stock prices to line their own pockets.

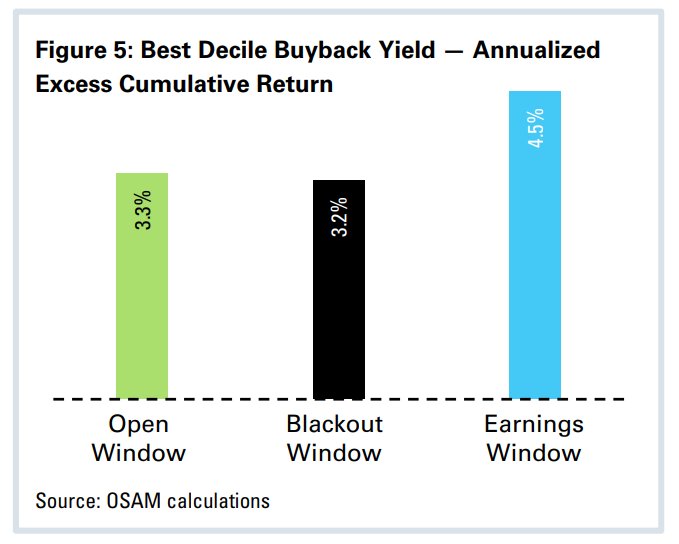

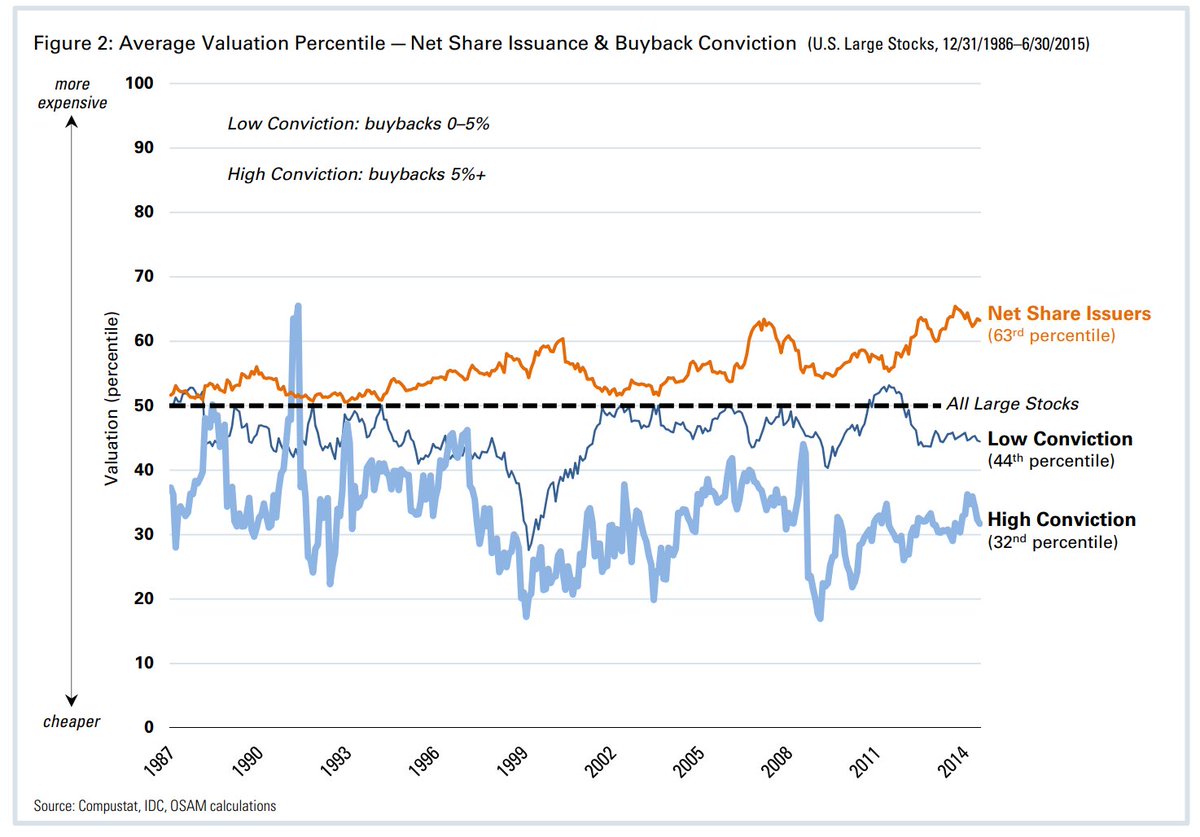

on average generate long-term excess returns for shareholders, driven by the earnings of the companies. It does

not mean every buyback program is done for the same reason...

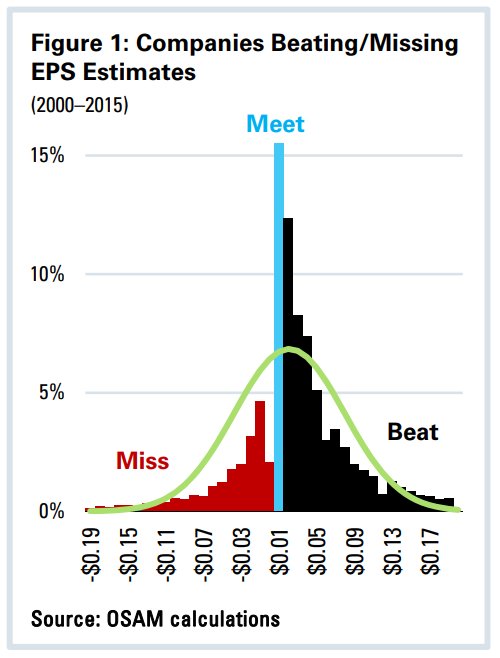

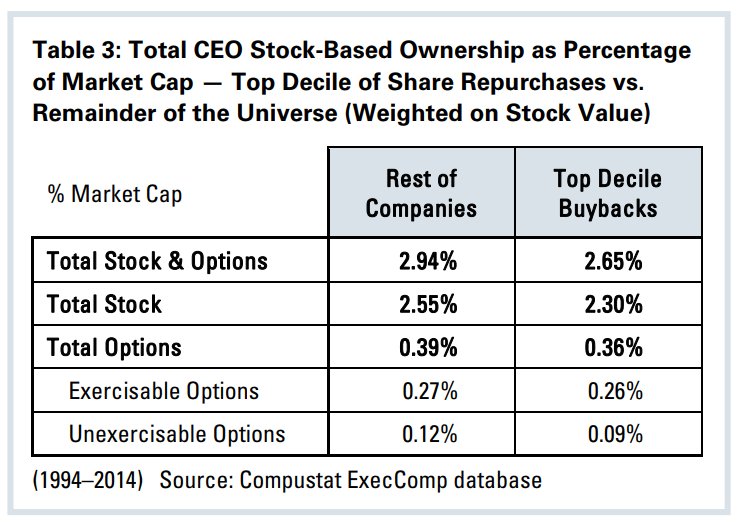

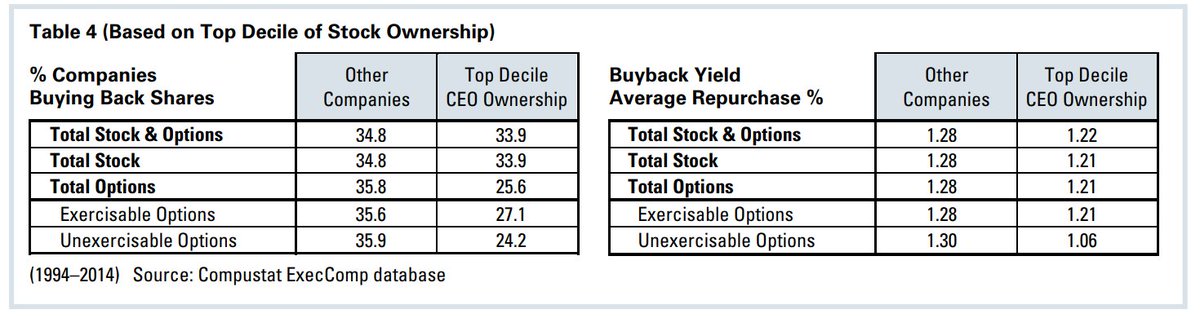

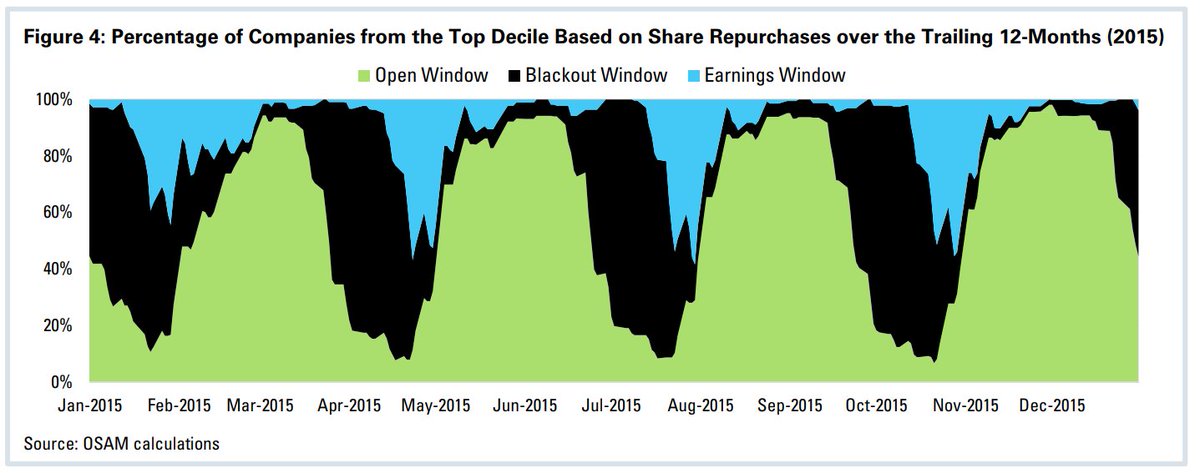

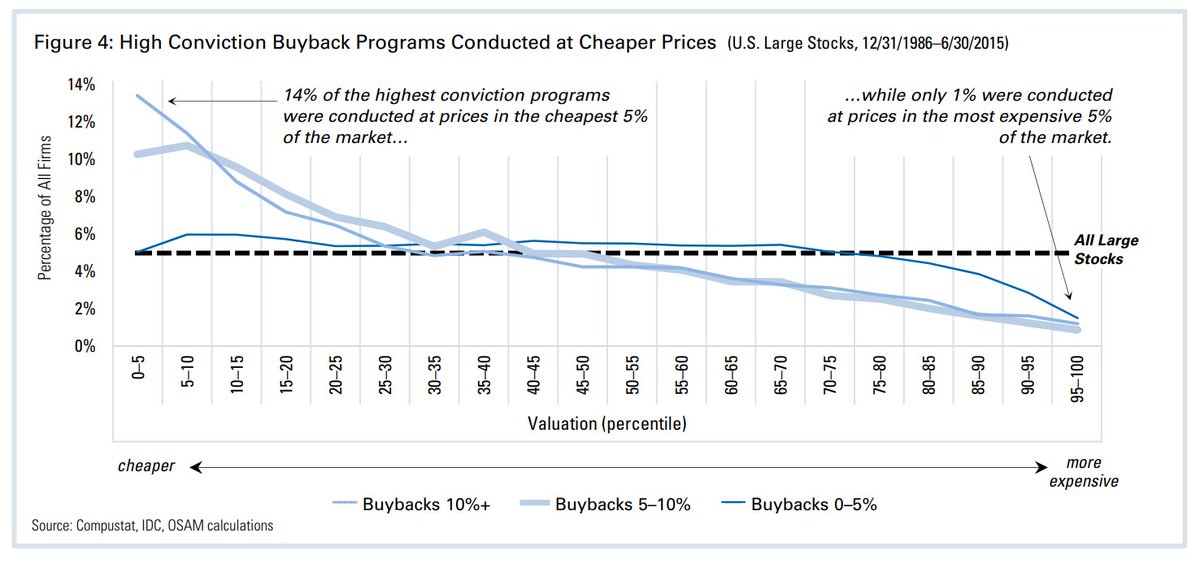

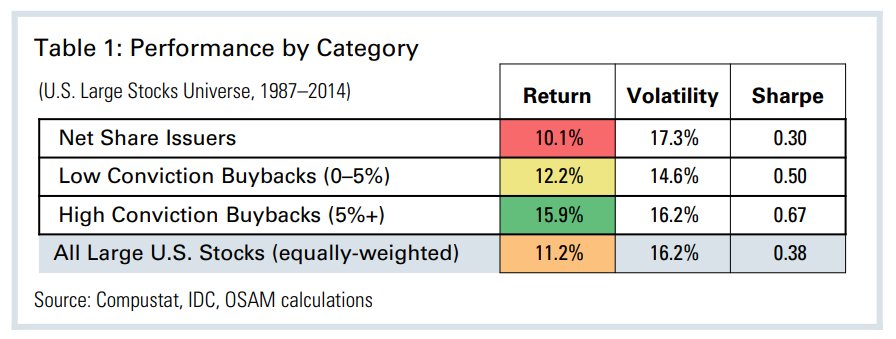

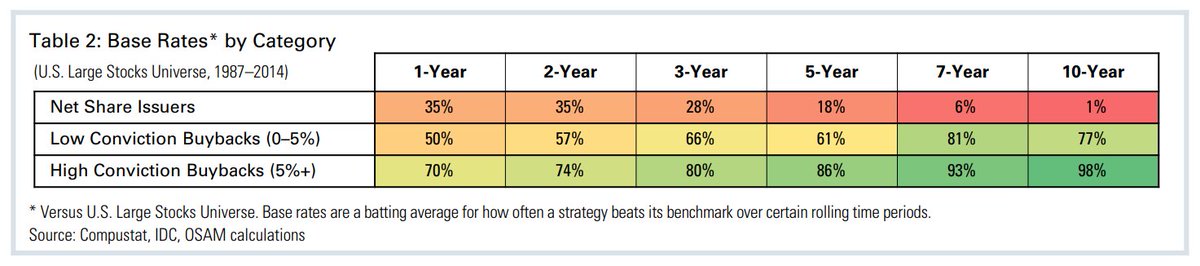

Some charts...

Disciplined capital allocation...often showing up as large buybacks...has been great for shareholders.

They are not evil.