I am celebrating with the following thread about the craziest & maybe most important thing going on right now on my favorite subject: PARKING

Seriously we're on the cusp of a potentially earth-shaking federal policy shift.

BUT

it needs your help

The headline is accurate.

When they were pulling all-nighters to get the Trump/Ryan tax reform passed, scouring the tax code for things to put taxes on so they could lower the overall corporate tax rate, GOP legislative aides found a line item worth $1.6 billion: "commuter benefits"

But you know and I know that by far the most expensive commuting fringe benefit many employers offer is FREE PARKING.

(Keep in mind that these are the same corporations that just got a massive tax cut from the federal government. They're not hurting.)

Every employer should charge for parking & then give everyone a raise so they can either pay for parking or pocket it (which is to say, spend it on other stuff ... like, say, housing that's closer to their work).

transitcenter.org/publications/w…

This piece of the tax reform might be a mistake, but it's very good.

"The days of free and unaccounted-for employee parking are coming to an end," says @Jpavllc, a longtime DC expert on commuting benefits policy.

Here's a rendering of the garage recently built by a Cupertino-based corporation you've heard of.

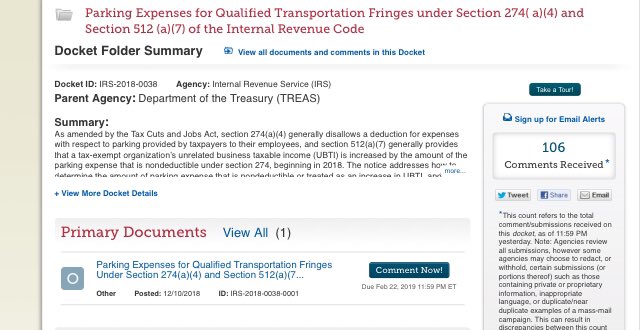

Comment deadline is Friday, Feb. 22. Here's the link: regulations.gov/docket?D=IRS-2…

So far, the population of the U.S. has submitted a total of 20 comments on this subject.

Here's the piece with full details & more advice on how to fix the IRS proposal.

sightline.org/2019/02/14/bel…

Dec 15-Feb 16: IRS gets 20 total public comments on potentially revolutionary change to commuting incentives

Last four days: 86 comments

Great work, America! Deadline is Friday. See the thread above for the bonkers backstory. regulations.gov/docket?D=IRS-2…