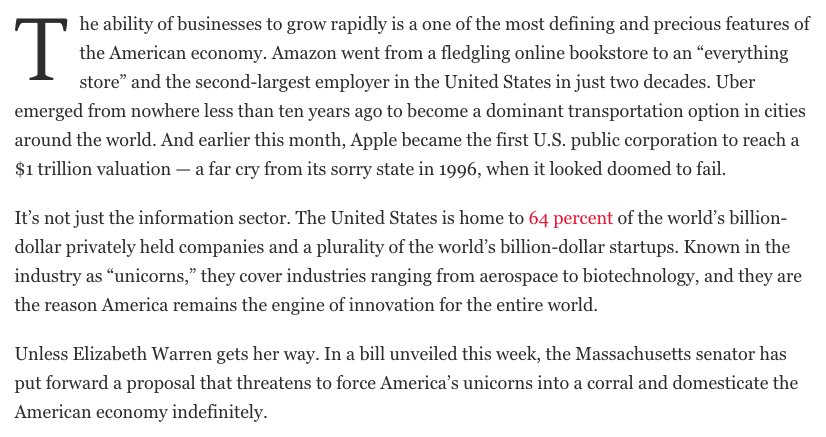

1 Across the board

2 Short squeeze

3 FAANG market cap driven

#1 is real

#2, #3 can only be detected by breadth indicators's divergence:

a. most shorted stocks rally

b Equal-Weigh vs Market cap

c Tons of breadth indicators

See Below

1/7

2/7

Great read:

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate Market Direction and Strength

by Gregory Morris (Author), Tom McClellan (Foreword)

Others I have to implement myself.

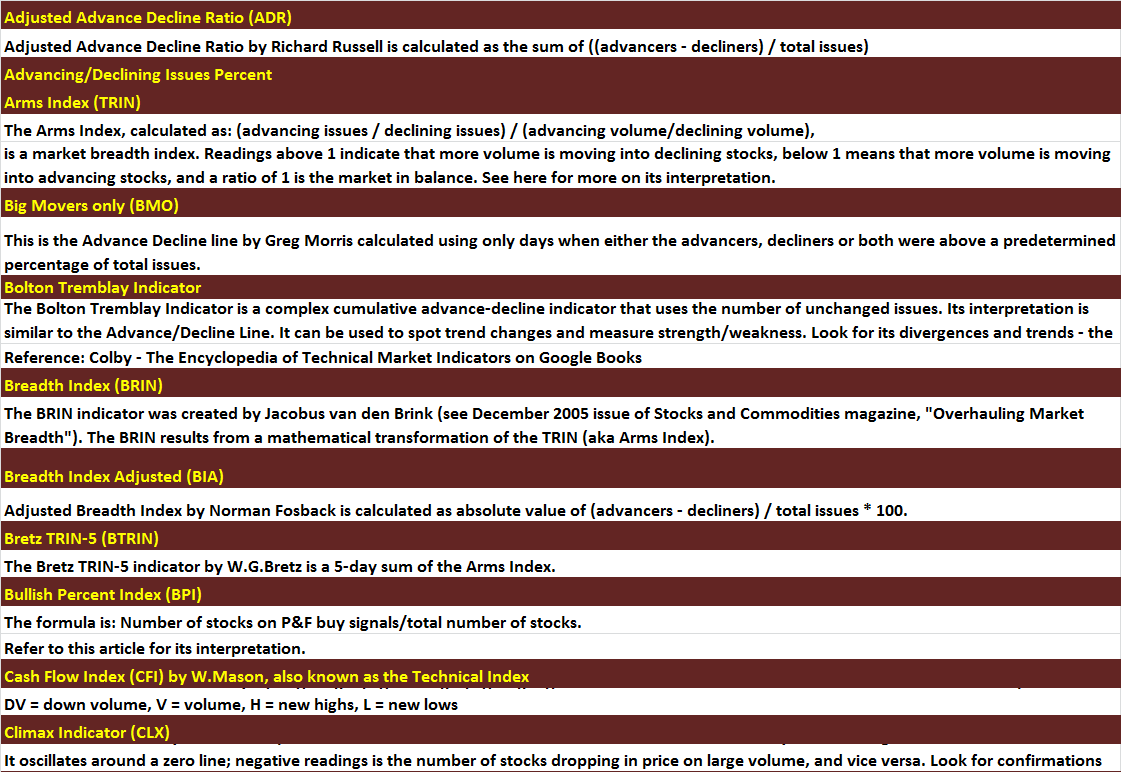

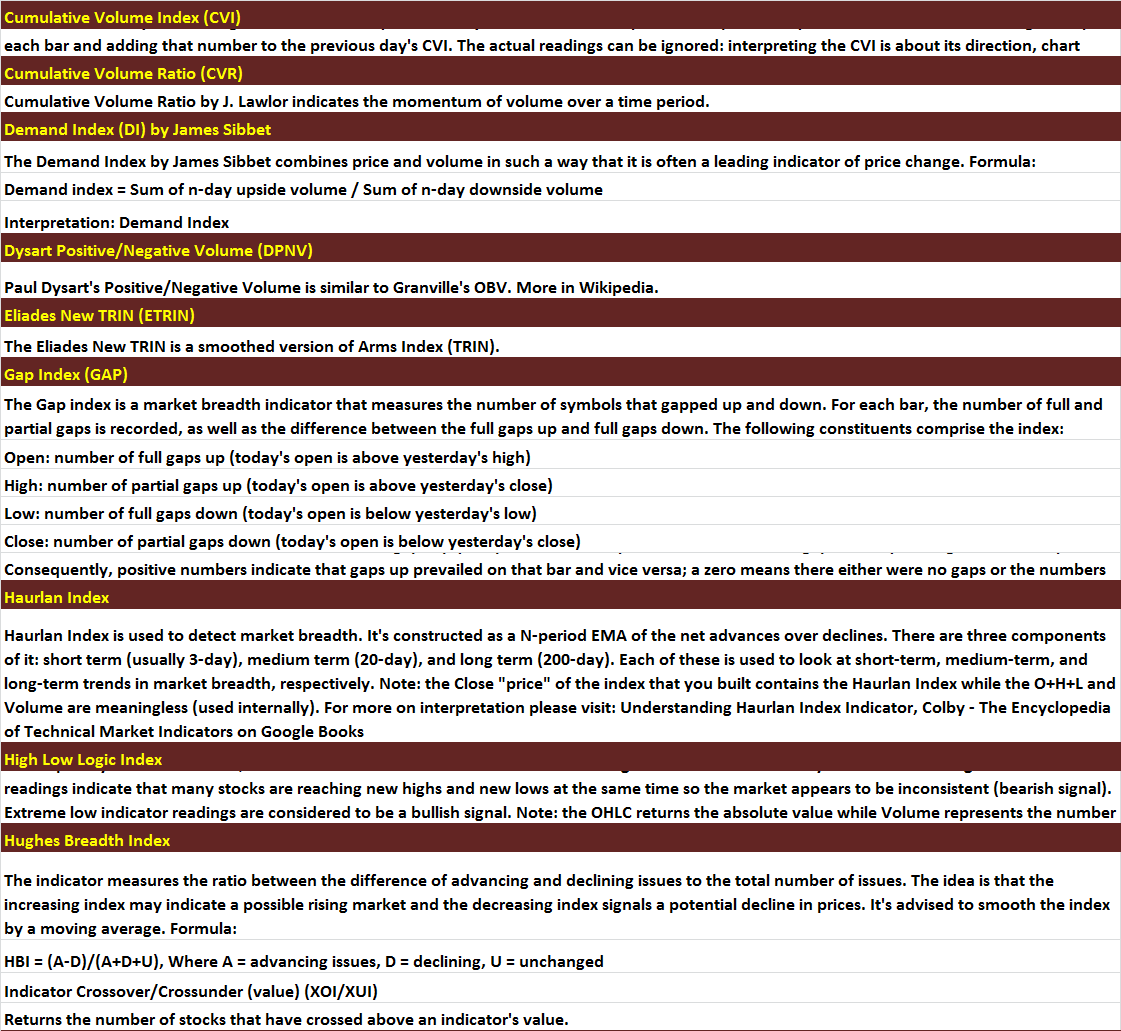

The goal is to estimate and predict the breadth of all major Indexes and Sectors using all these indicators for market strength and weakness measurement; hence the divergence and convergence, etc

All these breadth indicators can be implemented in such a way that it can be applied to a group of stocks (like SPY, RUT, NDX, MID, XLK, XLY, XLP components stocks), so as to measure the breadth strength & weakness from different perspective for major indexes and sectors.

Greg Morris implemented hundreds of his breadth indicators described in his book with MetaStock charting and testing software.

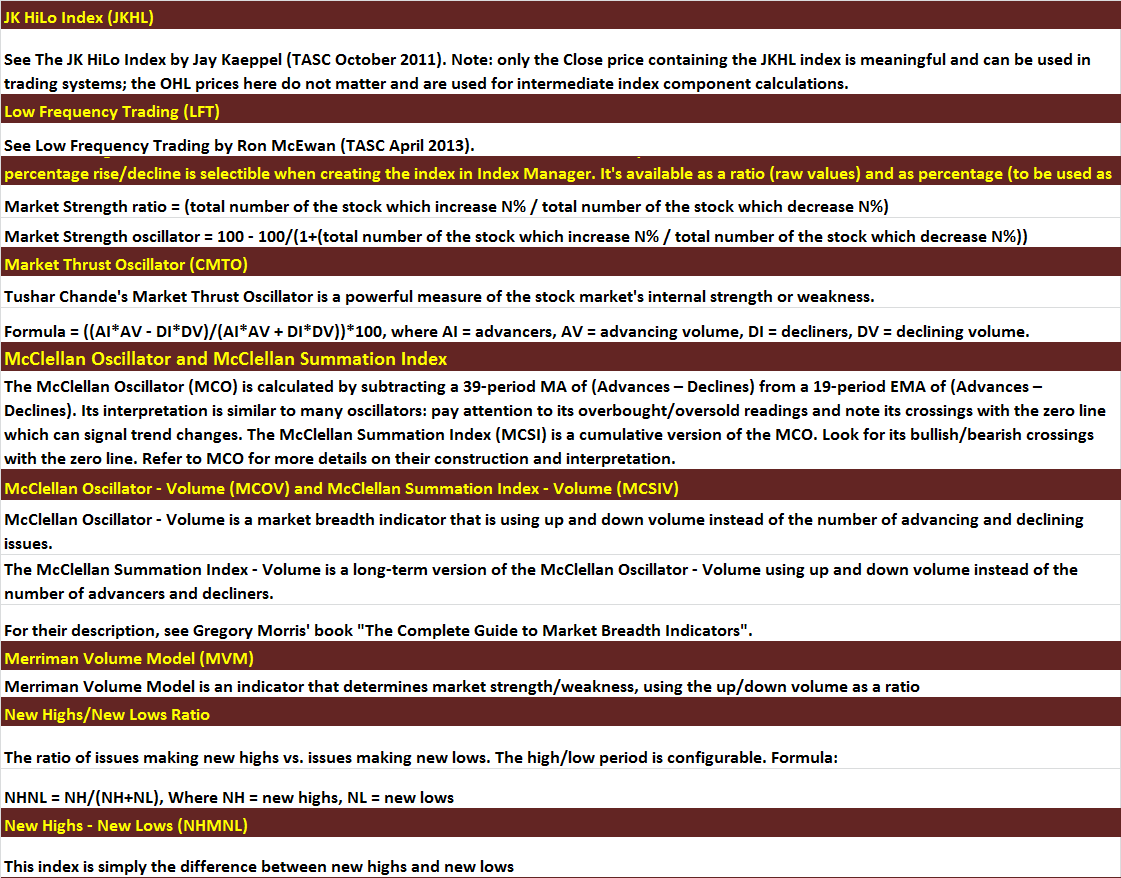

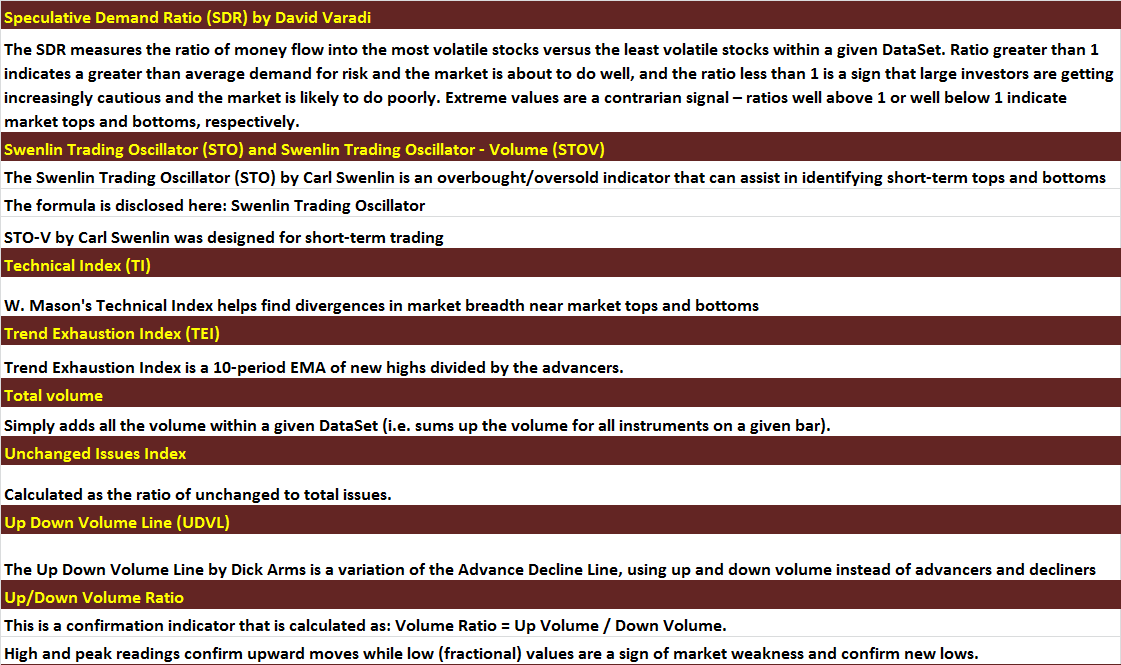

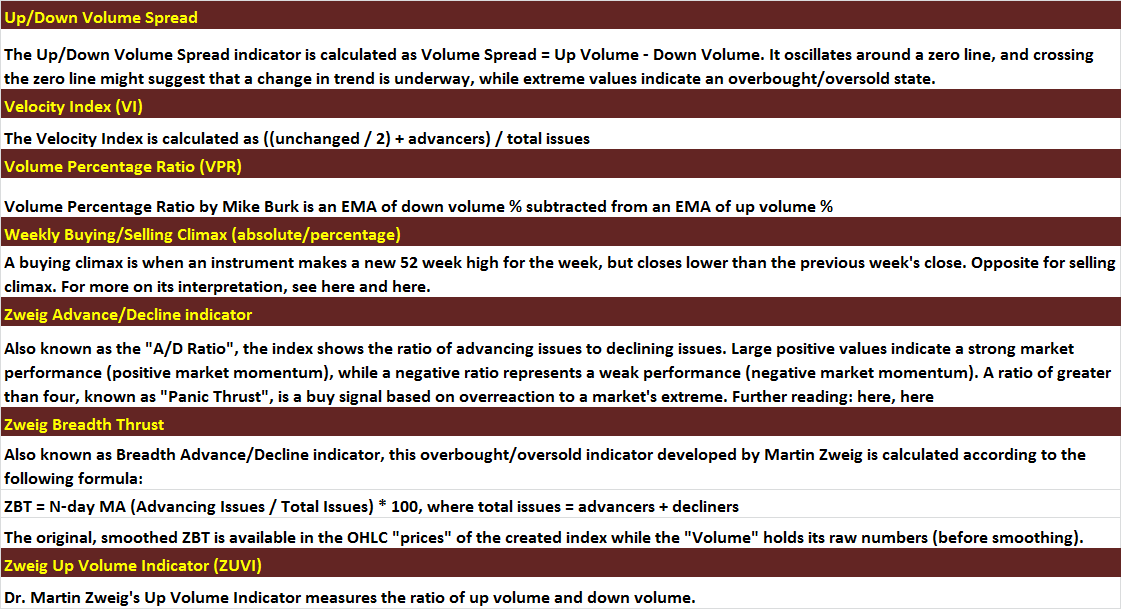

Quite a collection of breadth indicators. You can see from my list

He is also the author of some popular "Candlesticks" chart patterns books.