As part of 226 slides presented to the SEC on our ETF filing, we did a first-of-its-kind analysis of *order book data* from all 81 exchanges reporting >$1M in BTC volume on CMC.

TLDR: 95% of reported volume is fake but LOTS of good news!

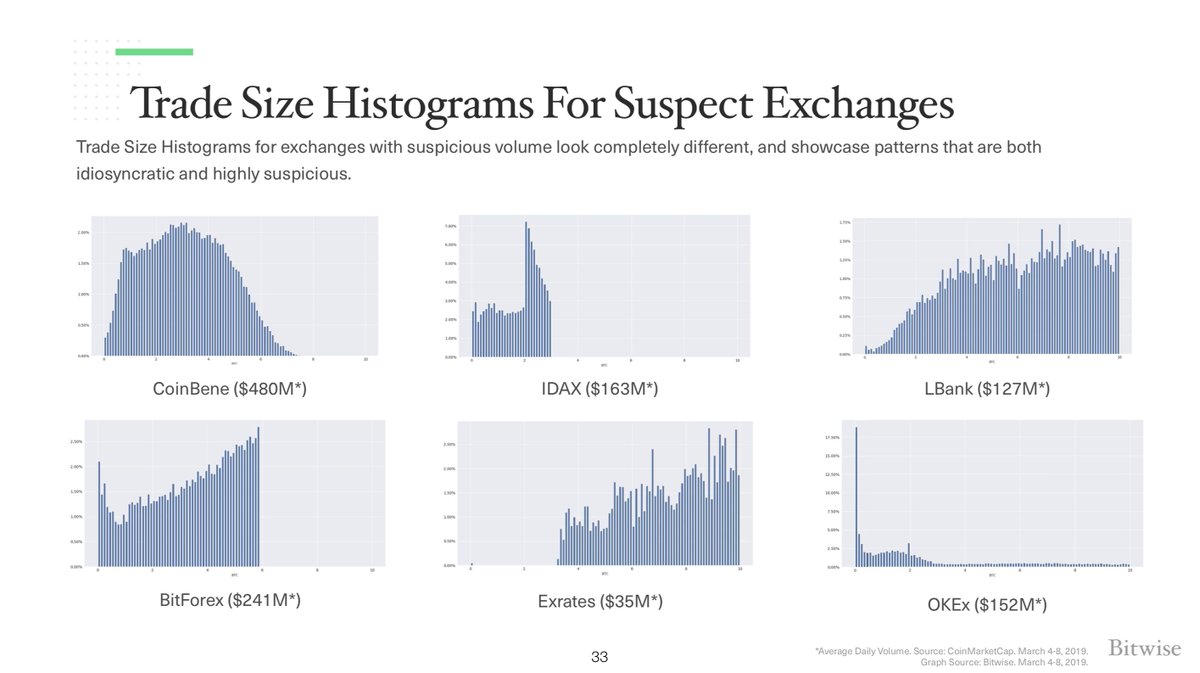

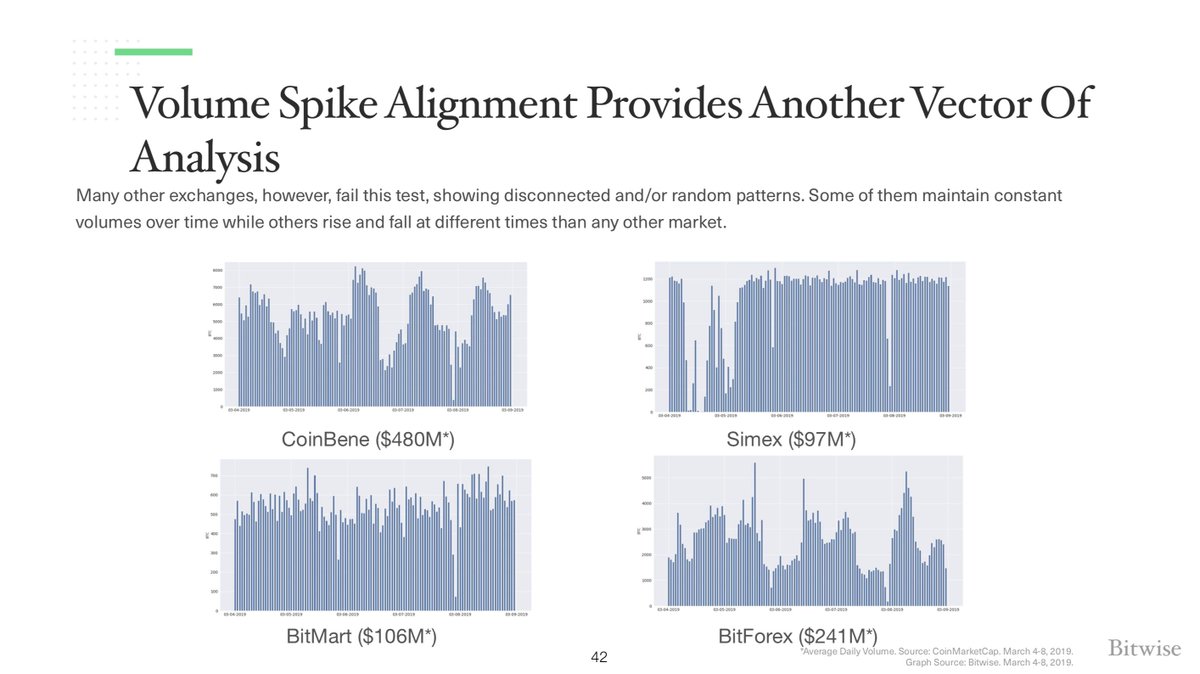

A. 95% of reported BTC spot volume is fake

B. Likely motive is listing fees (can be $1-3M)

C. Real daily spot volume is ~$270M

D. 10 exchanges make up almost all real trading

E. Most of the 10 are regulated

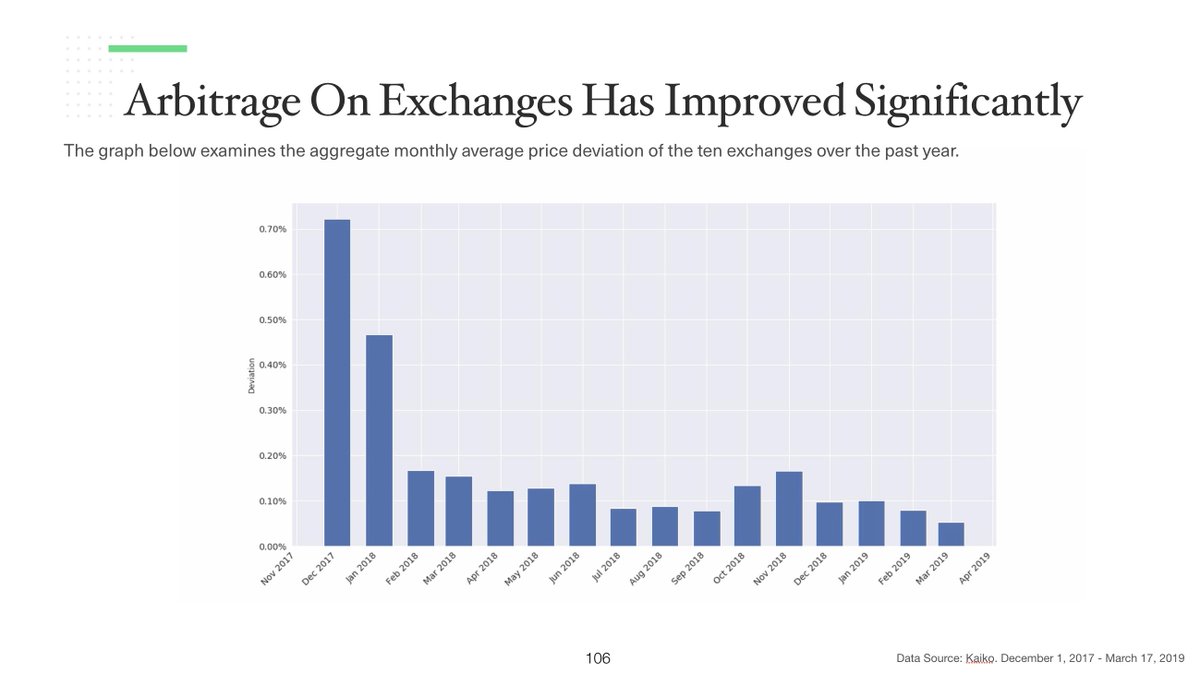

F. Spreads are <0.10%. Arb is super efficient

1. Full 226-slide presentation to the SEC: sec.gov/comments/sr-ny…

2. @paulvigna's writeup in the Wall Street Journal: wsj.com/articles/most-…

3. The total real daily BTC trade volume: bitcointradevolume.com

Now, a thread w/ highlights from the analysis.

You can see the daily BTC trade volume on these exchanges at: bitcointradevolume.com

More examples in the full analysis available on bitcointradevolume.com

To summarize: The bitcoin market is smaller, but more efficient and regulated, than reported, mitigating concerns around market manipulation.