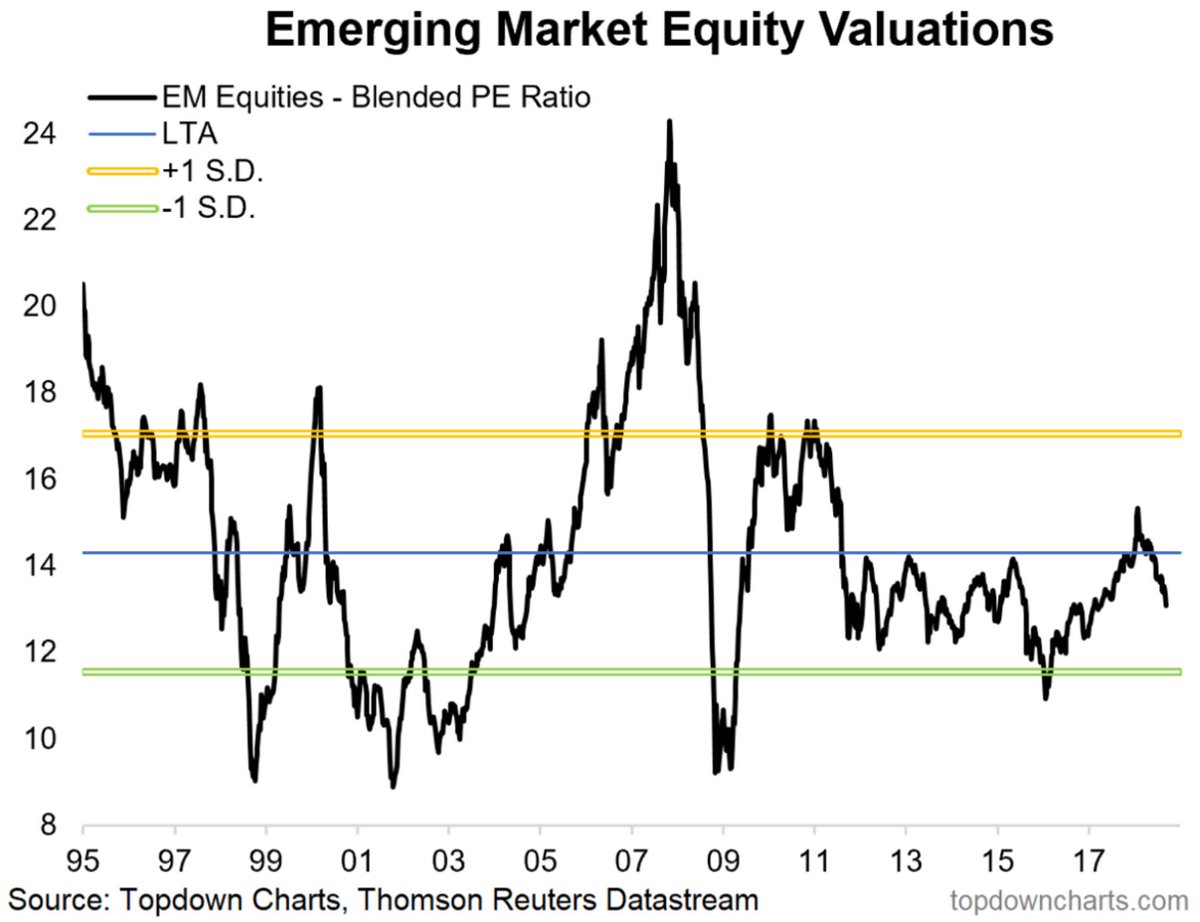

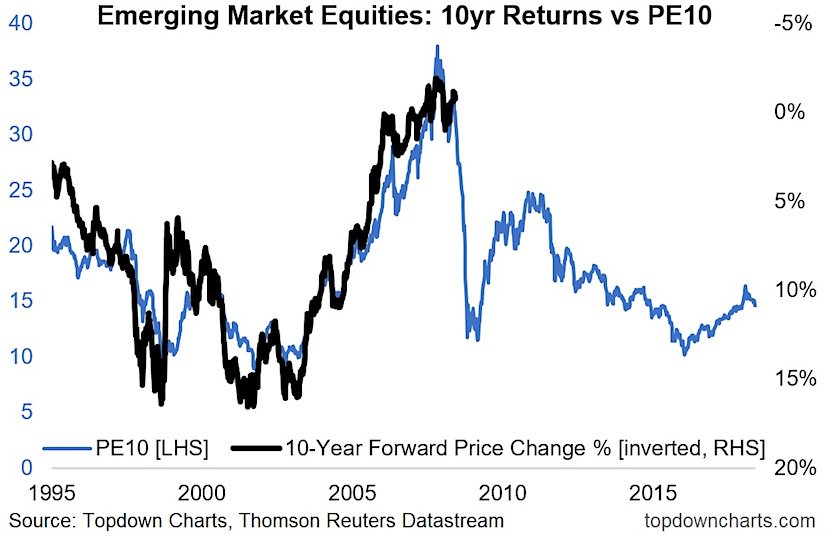

Both charts thanks to @Callum_Thomas and @topdowncharts

Many investors out there, including some I personally know who are extremely successful for decades, think it is just ludicrous to group countries like Brazil together with China, and India with Poland (as an example).

I will be using long term MSCI data together with recent ETF data, dating back as far as possible. I want to focus on the major index weights.

It is an understatement to say that these three economies are highly correlated and very much linked to each other — especially in terms of trade.

Firstly, major exports include semiconductors, petrochemicals, machinery, automobiles, ships, steel, LCD and wireless communication devices.

While not as cheap as China, South Korea or Taiwan on a valuation basis, India will be the key growth engine of the future!

With a weighting of 11.5% — which is poised to grow if the bull keeps running — this could be the ace in the sleeve for EM equities.

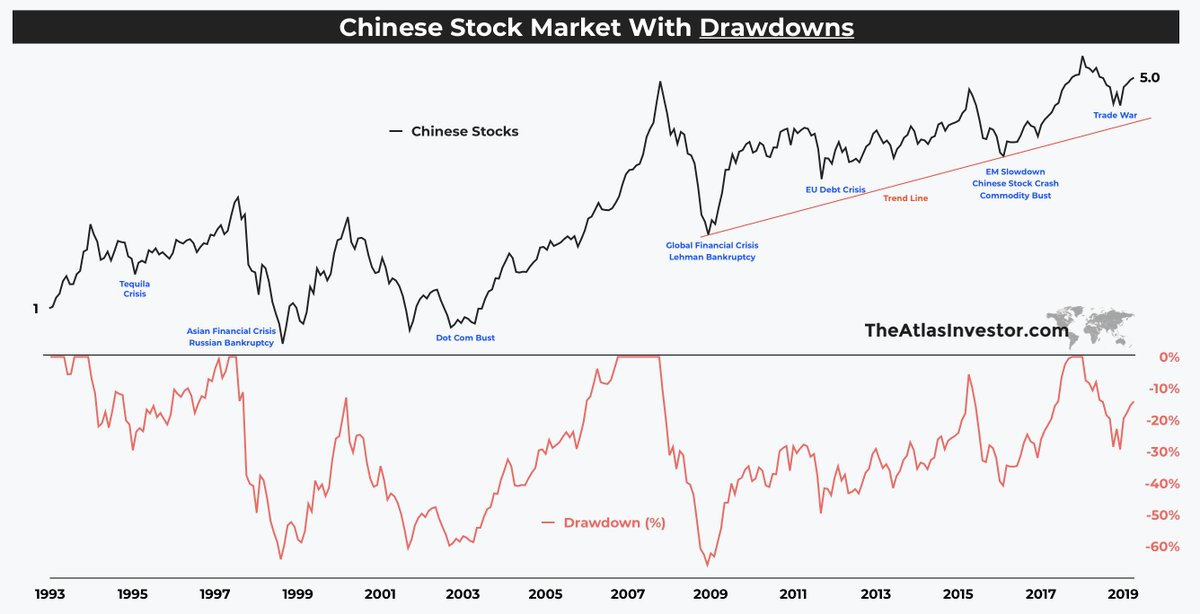

It goes to show what can be achieved when you buy outright panic during the depths of the Asian Financial Crisis.

A passive approach of just exposing some of your portfolio capital towards attractively priced EM index, especially emerging Asia?

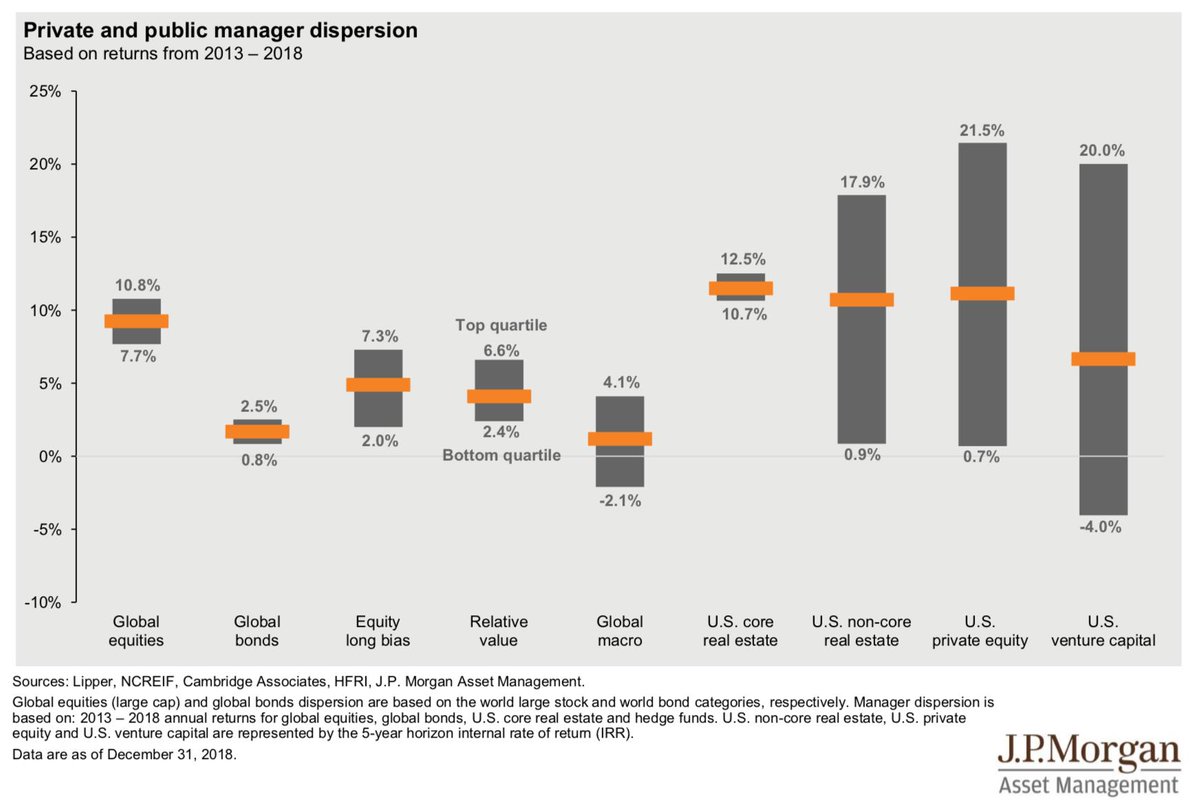

Or a more active approach by picking those jurisdictions and countries which stand to outperform?

It's rather boring.

As George Soros said, investing should be just that. If it's is exciting to you, you're probably doing it wrong.

With that in mind, my way to play the bull market in EM economies would be via a basic, cheap index.

"...over the 15-year investment horizon, 92.33% of large-cap managers, 94.81% of mid-cap managers, and 95.73% of small-cap managers failed to outperform on a relative basis."