For the new tweeps and followers, I've disclosed how I invest and my holdings for many years on the blog...a reminder for context...

But it's useful to walk through as there is so much taboo around money and how people invest.

It's probably the most personal question you could ask someone, how exactly do you invest your money?

This may make them uncomfortable. Many would probably balk. Forget on TV or publicly...

via @RussKinnel

morningstar.com/products/pdf/M…

Half of portfolio is in private farmland in Kansas.

mebfaber.com/2018/10/01/why…

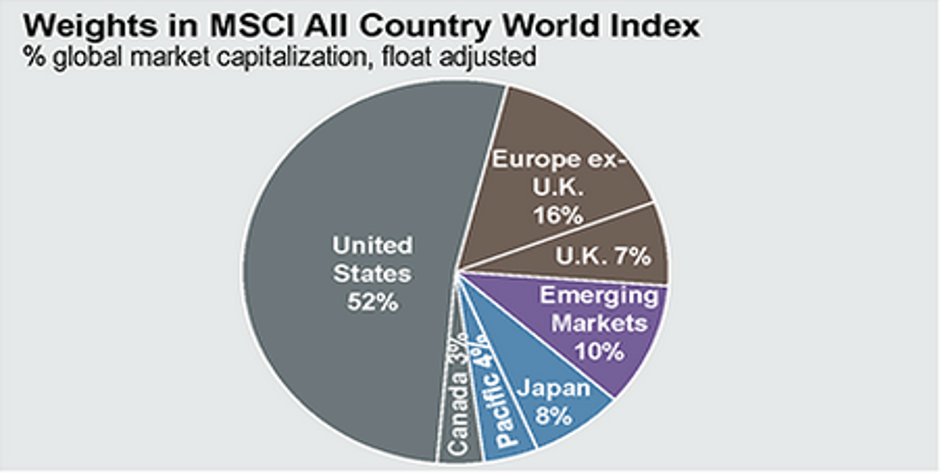

As a reminder, thats global allocations of stocks, bonds, real assets tilted to value and momentum. Half in buy and hold and half in trend.

cambriainvestments.com/wp-content/upl…

and some private and angel investment opportunities.

The angel investing we've talked a lot about on the podcast, and my journey there. I've invested in about 70 companies since 2014.

Power laws at work.

I plan on continuing to document the journey on the podcast, so for more in depth info you can tune in there...