Let me explain, with some help from @bridgewater, why that is a horrible, and easily avoidable mistake.

I wrote a book on stock market valuations (free here: cambriainvestments.com/investing-insi… …), and used to give speeches and ask people the same question.

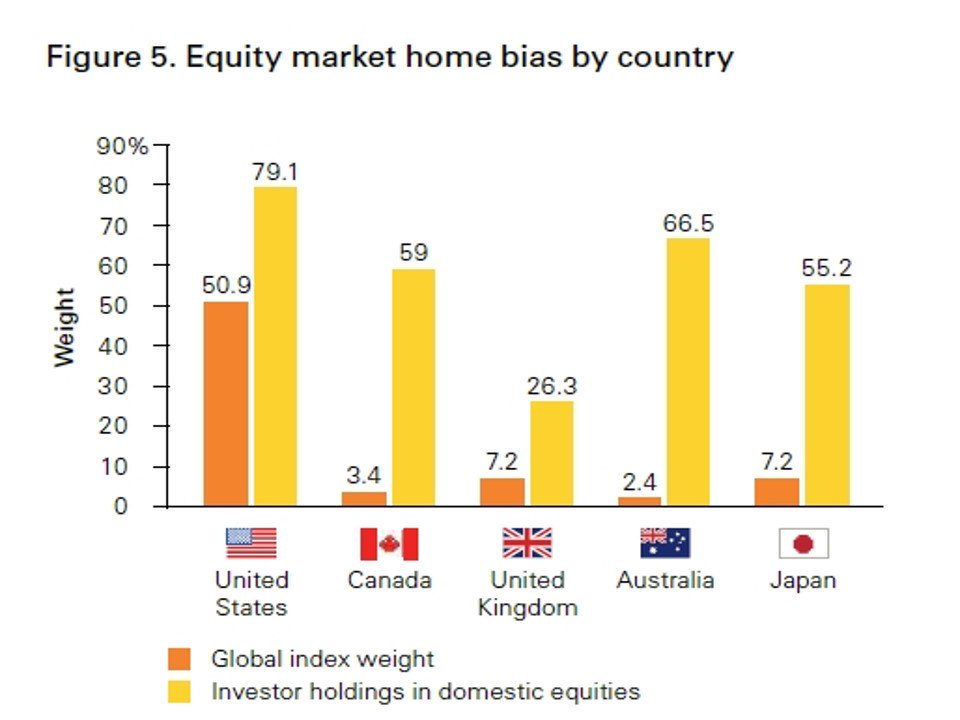

We'd collect the responses and the answer was always ~80%. Our Twitter poll said the same.

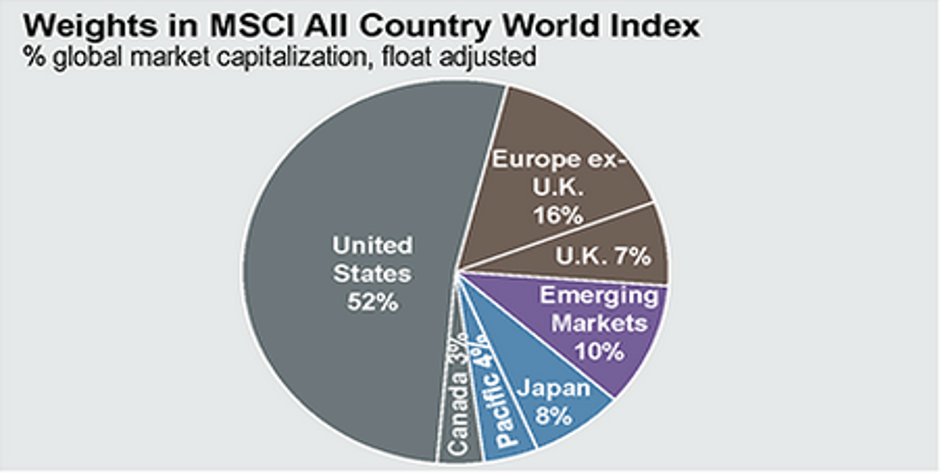

via @jpmorgan

This happens all around the world and is even more egregious elsewhere since most countries have a much smaller % of total market cap.

via @Vanguard_Group

(Pat yourself on the back if you've been lucky and done this the past 10 years)

Bad idea - let me explain.

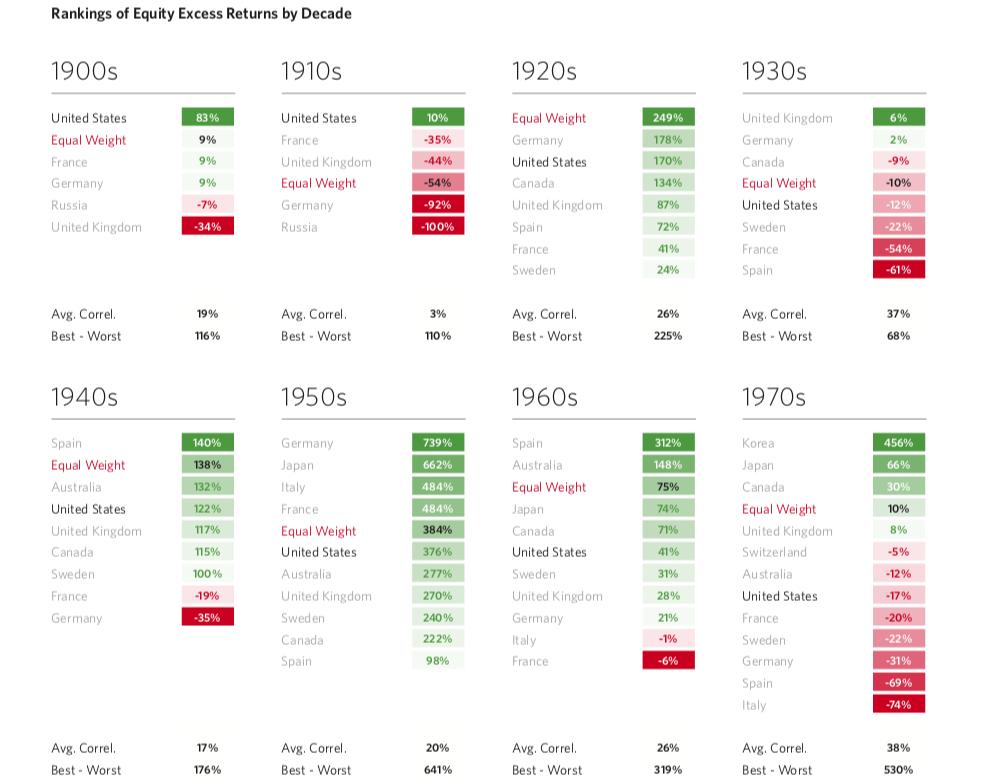

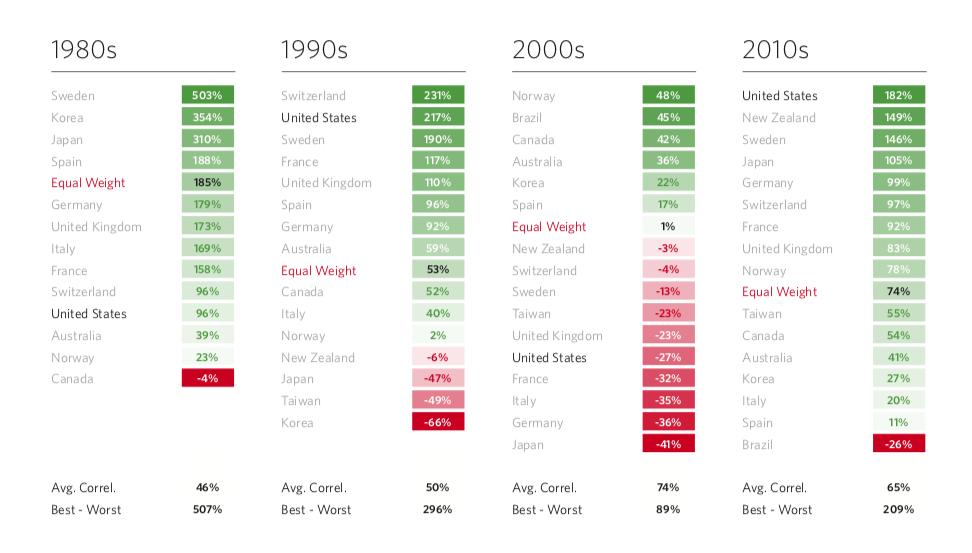

$10k invested in US stocks in 1950 turned into $14 million vs. only $8m in foreign stocks.

Want to know how much of that outperformance has come since 2009?

All of it

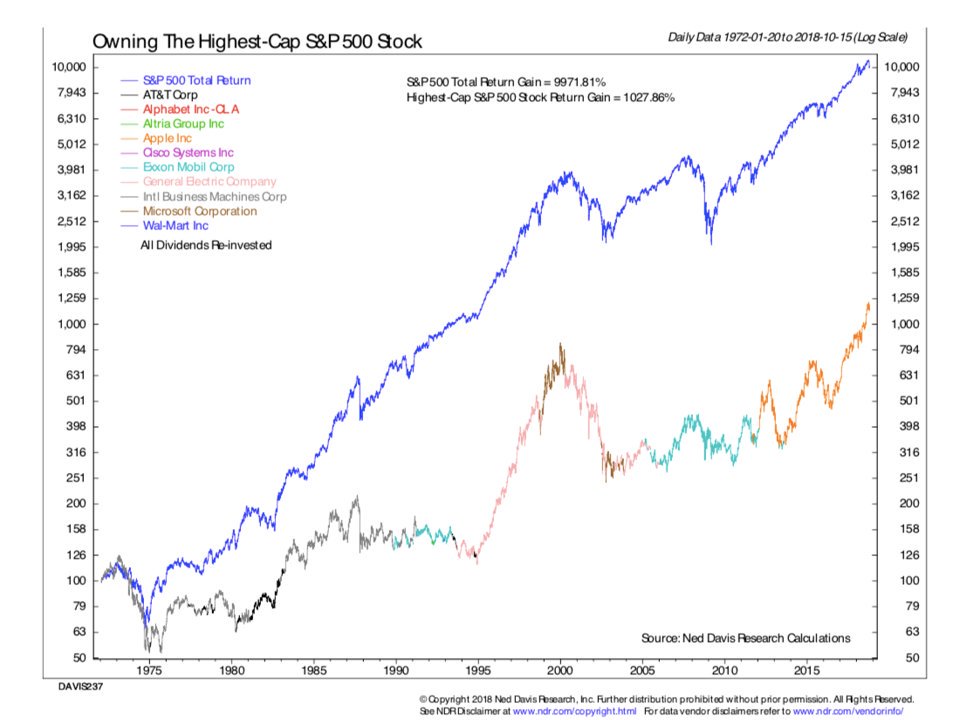

The culprit is market cap weighting. This is "the market" according to the TRUE passive investor.

But why is market cap weighting sub-optimal?

It's a laundry list of the top American companies like @walmart, @IBM, @Google, and @Microsoft.

And it's a HORRIBLE idea.

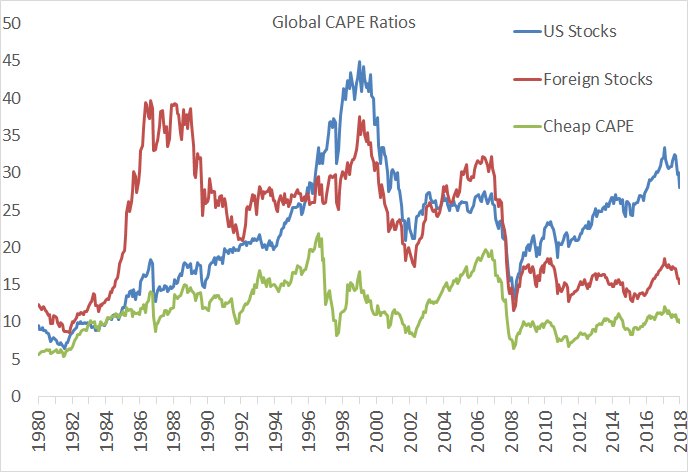

But there's also a flaw with market cap weighting in that there is no tether to fundamentals.

So a market cap index often overweights expensive stocks.

mebfaber.com/2016/09/07/epi…

This matters ESPECIALLY right now as the US stock market is expensive.

bridgewater.com/research-libra…

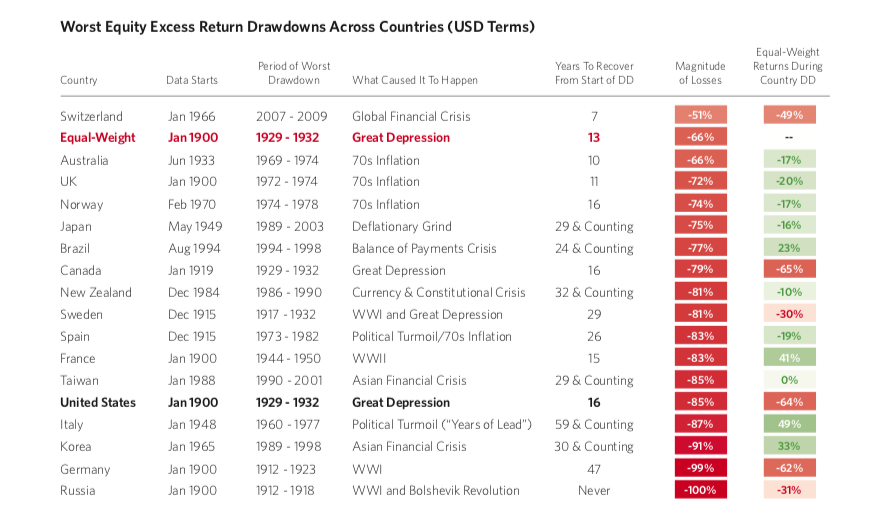

Meb: China also went to zero.

Let that sink in if you plan on extrapolating recent outperformance....

The US opportunity set is poor

Diversifying globally can save your butt

Investors should move to 50% US / 50% Foreign stock

Consider adding value or other tilts like equal weight

(This is uncomfortable for some)

Relax and sleep tight