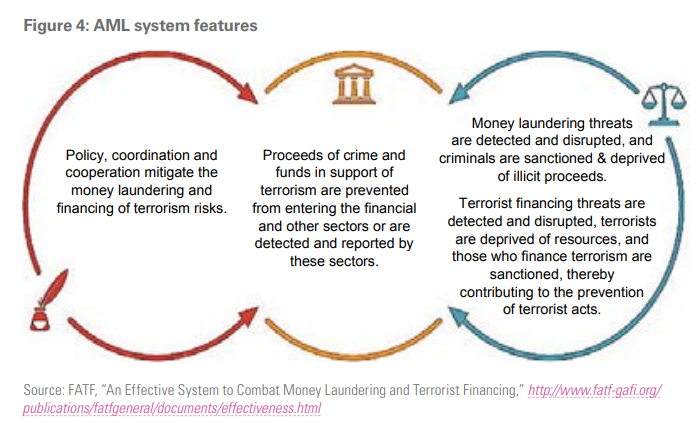

Its executive summary: BC cannot combat money laundering effectively on its own; it needs Canada's help, as coordination and cooperation are key. Anti-money laundering (AML) best practices are considered and gaps and opportunities identified.

Conclusion 2: The amount of money laundering is significant, but it is difficult to measure.

Makes sense, right? If 5% of our GDP roughly is laundered, 5% goes to RE.

Conclusion 6: BC's proposed beneficial ownership registry for land is a major step forward.

Conclusion 8: Unexplained Wealth Orders could add a caluable new anti-money laundering tool. (i.e. civil forfeiture)

Conclusion 10: Data sharing needs to be enhanced.

Conclusion 12: Money laundering should be addressed across Canada.

Long and complicated chapter, so I'll share just the summary. If you're further interested, read the report: www2.gov.bc.ca/assets/gov/hou…

This is what most people are looking for, probably, so I'll note that this chapter is pages 41-61 of the report www2.gov.bc.ca/assets/gov/hou…

Estimate of $7.4 billion of laundered money in BC in 2018.

Estimate of $5.3 billion of ML in real estate in BC in 2018.

Estimate of 3.7%-7.5% house price increase due to money laundering. /1

A complex set of (rather siloed) federal and provincial agencies and private sector actors makes up the broadly defined "regulatory/anti-money laundering system" in Canada.

There are quite a few developments relating to federal and provincial anti-money laundering and real estate regulatory and taxation activities.

2)Importance of beneficial ownership disclosure

3)Importance of clarity in AML mandate, investigative resources &data sharing

4)Cash Transactions

5)Supervision of AML Compliance

6)Regulation of Mortgage Brokers

7)Regulation of developers

The panel's recommendations: provincial regulatory improvements, changes to federal AML legislation and practice, improvements to the data-sharing framework, more effective investigation and collaboration, and involvement of other provinces

I might go into the other report if I see yet more misinformation going around on that one, but I hope this thread was useful.