I'm always worried. Sometimes less, sometimes more. However, that doesn't stop me from investing.

Today I want to go through some of the more important worries for me. Let's start.

When those worries disappear for the most part and the majority is celebrating usually marks a sign a major top is near.

These are going to be more contrarian in nature, where one is potentially anticipating — but not necessary bearish & betting on a turn of events.

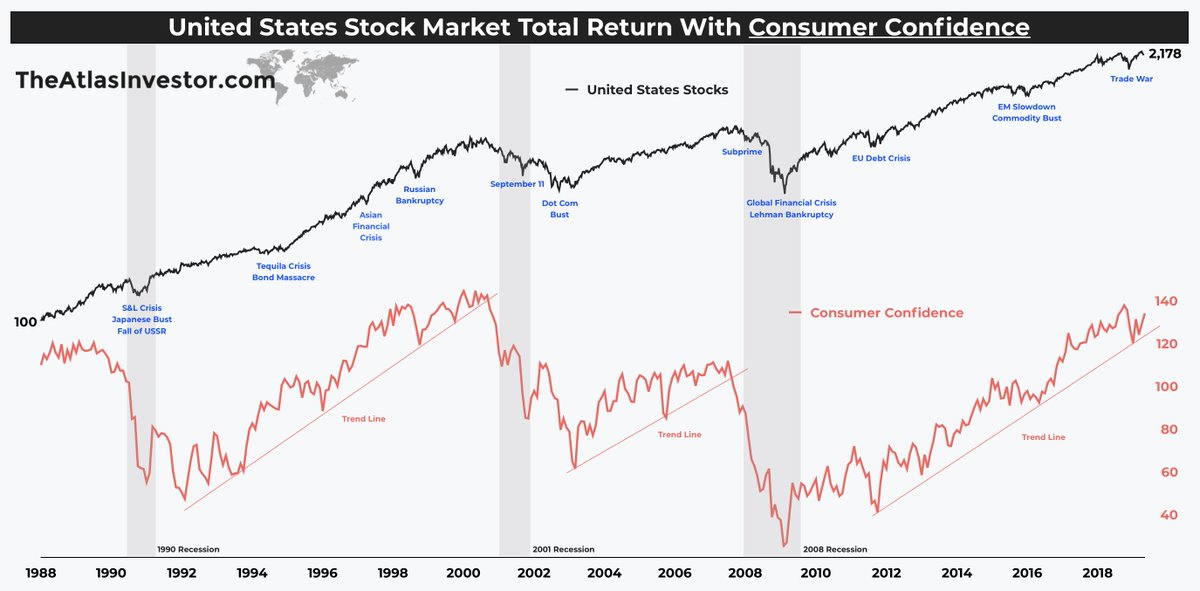

1. Sky high US consumer confidence

2. Beginnings of the inverted yield curve

3. Rock bottom claims & unemployment rate

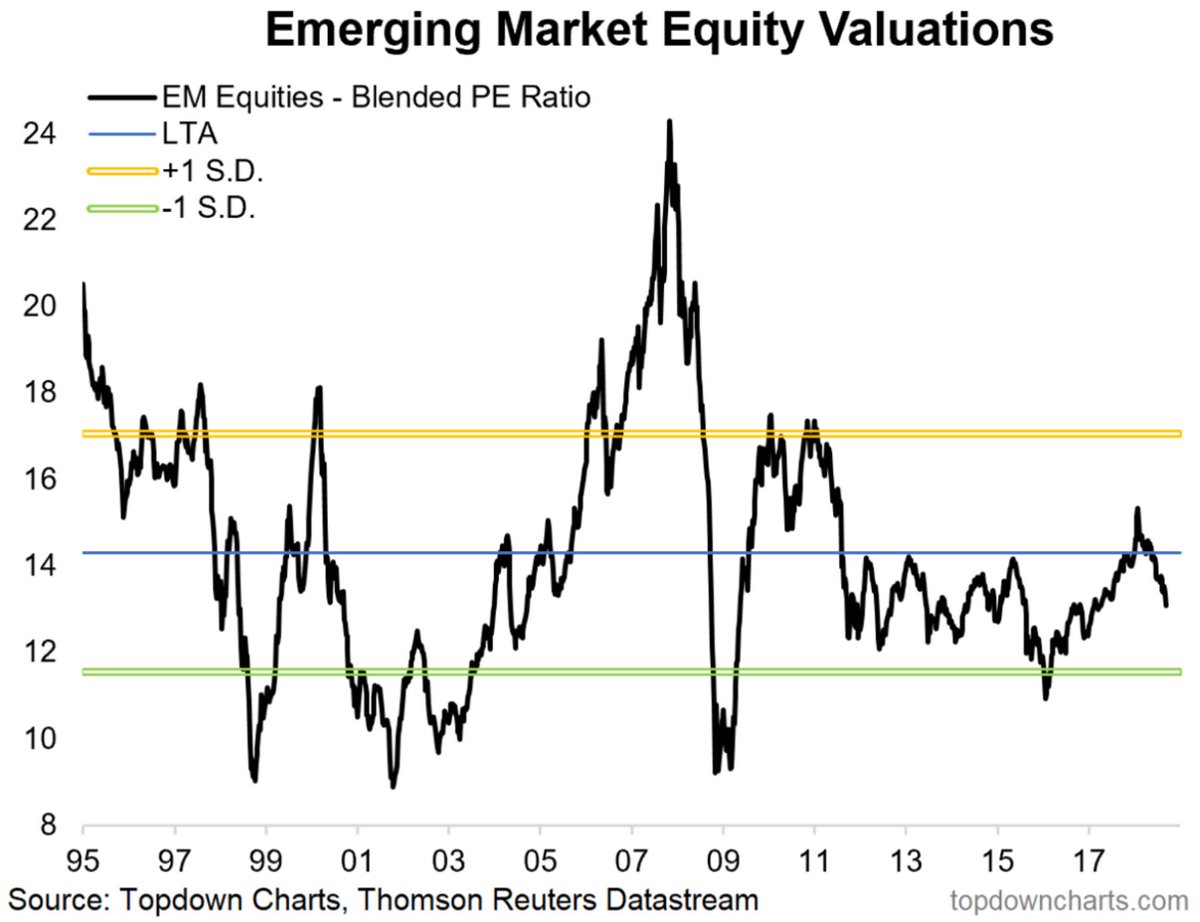

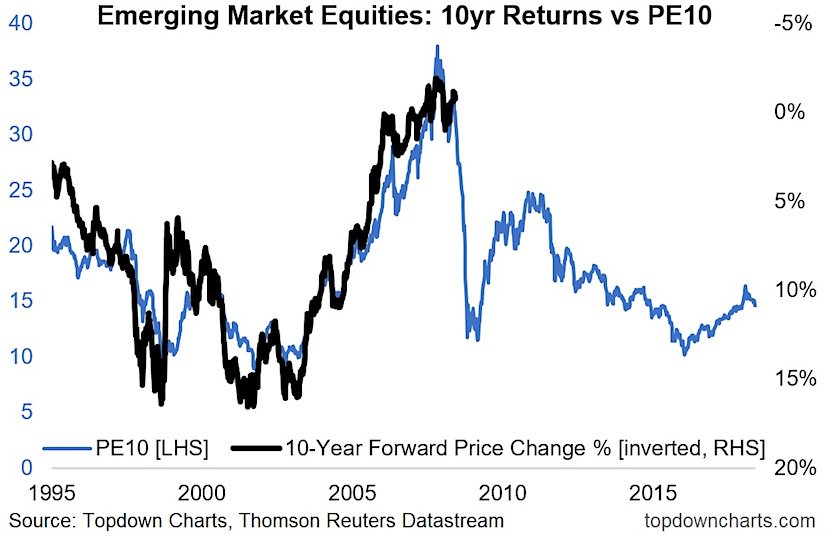

4. Low future expected return probabilities

5. Prolonged period without a serious asset decline

After all, that is the definition of dumb money.

Sentiment also went sky high during the tech bubble of the late 90s, and stocks had an awful performance from 1998-2012 (or 2000-12).

However, whenever the public is this euphoric, from a contrary perspective —I'm extremely worried.

It's that simple for me.

The party tends to continue (for a while).

Who's to say that the yield curve signal won't end up being a false alarm, or that central banks pull a "helicopter money" bunny out of the hat!

What do I mean by that?

These two periods, where the consumer confidence was off the charts and employment conditions as good as they get, have at least some parallels to the present data.

And that worries me.

Low expected returns, high valuations, lack of major declines, prolonged bull market length, etc, etc, etc...

I'm not here to blow wind up my a$$ (as we say in Australia) nor to show off but to say that apart from a few depressed pockets there are no major opportunities I see to make a SCORE!

That worked well and 2016/17 for — the majority of us was a great year or two.

I've now almost exited everything successfully!

As I said right here, apart from a few pockets of value (riskier EM jurisdictions like Russia, Greece, Turkey, Nigeria) there is just nothing of interest where I would bet a ranch on it.

But when it does, it will "feel" a lot different than 2011, 2015 & 2018 — what you guys call a bear market.

When the big drawdown starts & things get bad FIRE people, retires, high flying millennials will all be hurting.

But when the consumer confidence is sky high, when the yield curve begins inverting, employment conditions cannot get too much better, the expansion is long in the tooth & set to break all records...

Today, a little bit more than normal.

I think it's justified.

You asked me what I’m worried about and I merely answered the worries that would keep me up at night if I was 100%, or even 60% long US equities.