This depends mainly on:

-Growth

-ROIC

-Cost of capital

Outperformance requires anticipating revisions to cash flow estimates. If high returns (& growth) are maintained, there are likely to be revisions higher

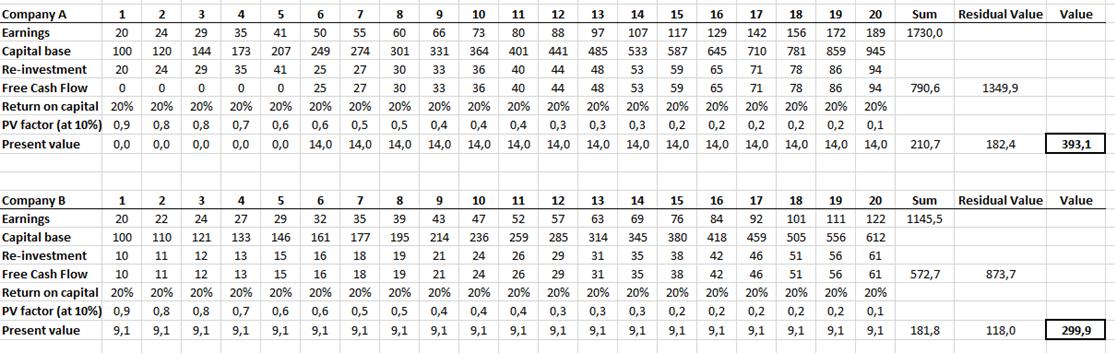

Growth=ROIC x Investment Rate

Cash Flow=Earnings x (1–Reinvestment rate)

Rearranged, Investment rate=Growth/ROIC

Cash flow=earnings x (1–Growth/ROIC)

Imagine if a company has very attractive growth opportunities over a 5 year period. Say it can grow at 20% annually. But this growth requires quite a bit of investment (in working capital and capex for instance)

Because its growth is more consistent (and is expected to continue to be consistent…for example a consumer staples company), and it’s more cash generative

That’ll be for another thread