Here are 20 slides of charts & goodies about the latest in BTC & crypto!

As we debate whether we're still in a bear market or have moved to bull @DiarNewsletter has been tracking the record CME futures volumes. diar.co/volume-3-issue…

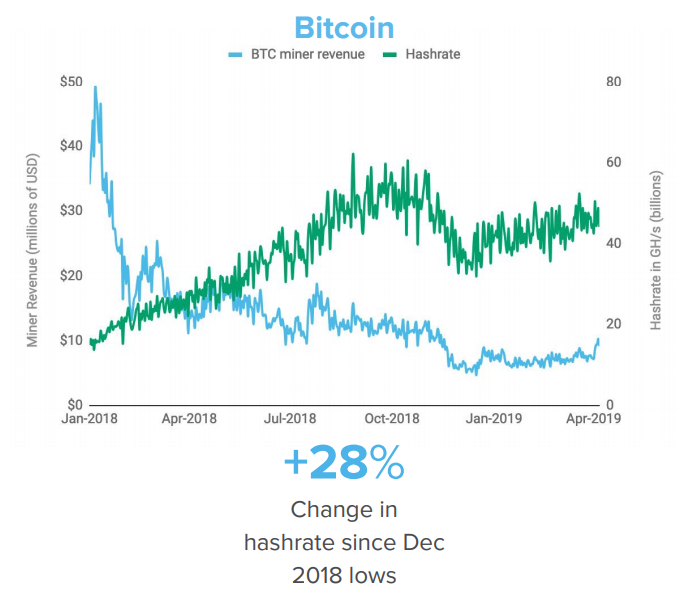

In their Q1 report, @ResearchCircle shows a 28% increase in hashrate since the Dec 2018 lows. research.circle.com/wp-content/upl…

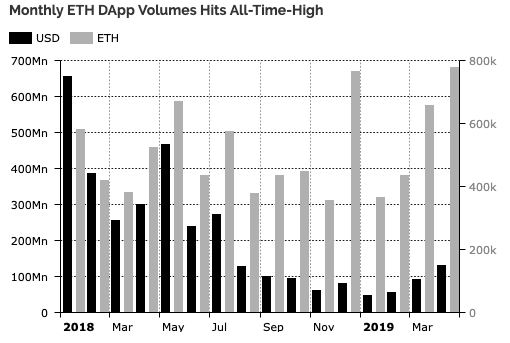

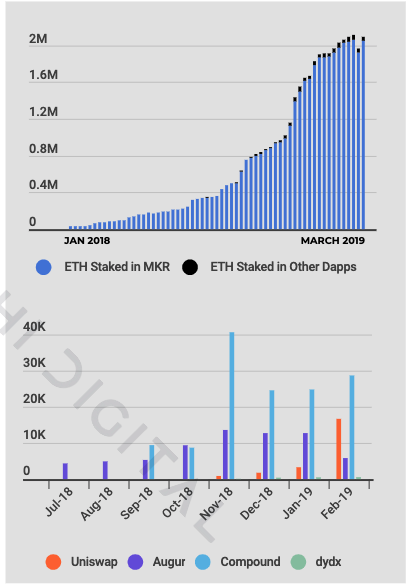

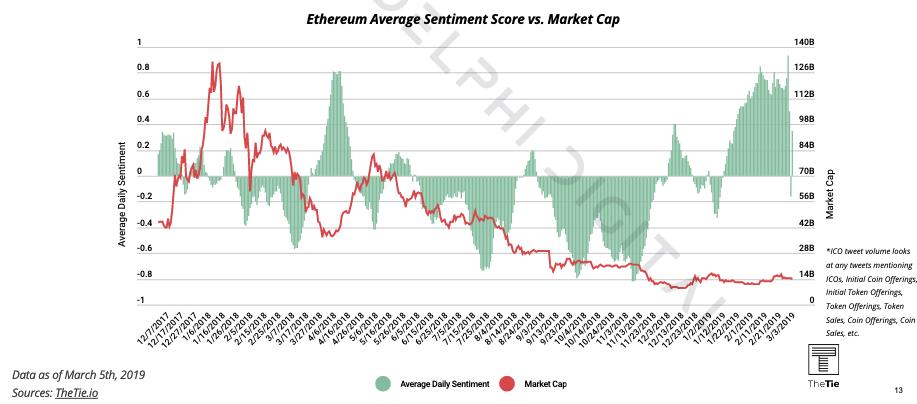

delphidigital.io/ethereum

1. Crypto - with so much on-chain information - is one of the data richest technological and financial spaces in history

2. It is full of incredible analysts and researchers who make the story of that data accessible to the rest of us

We get a basically unlimited amount data, on demand, at any time, with a huge number of brilliant and highly public interpreters.

I think we're doing it.