Lets come on first AFL, FP+1- here is the link of the explorer. (2/n)

#from_swing_ka_sultan

drive.google.com/file/d/11czZtU…

Now coming on explorer, first column is stock names, second mentions stocks breaks in which direction. We've to (4/n)

Now, I'm sharing few thoughts on FP+1. When a breakout happens, either of 2 things can happen- either prices will be accepted above breakout (6/n)

I love to read Price Action at BO level. If we mix candlesticks & supply demand zone, we'll make a killing out of it by.. (8/n)

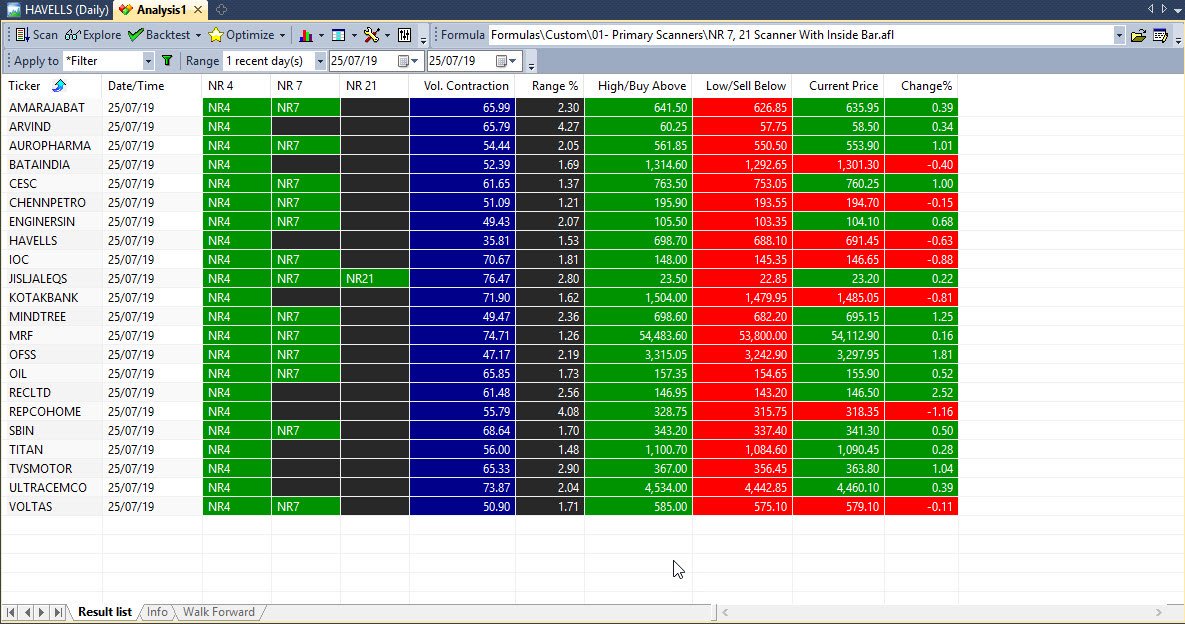

Now, I am sharing other scanner, NR4+IB. Here is the link of it & the screenshot-

drive.google.com/file/d/11gQy4Q…

Range% shows the width in % terms of NR candle, and also (12/n)

Further there are two columns, Buy Above & Sell Below. These are levels where you should put your buy orders. When it fills one side, second (13/n)

Apart from scanning, if you drag it on a price chart, it will show arrows on candles which are NR7 (14/n).

As I said, I'll share further explorers on setup shared by @Stockengg team. I believe this will be helpful for everyone by reducing their homework.

One more announcement, everyday I get several requests for my "Close to EMA" plotter. That plotter has been (15/n)

I request that this thread should be shared further for everyone's benefit. (17/17)

@CAtLarge