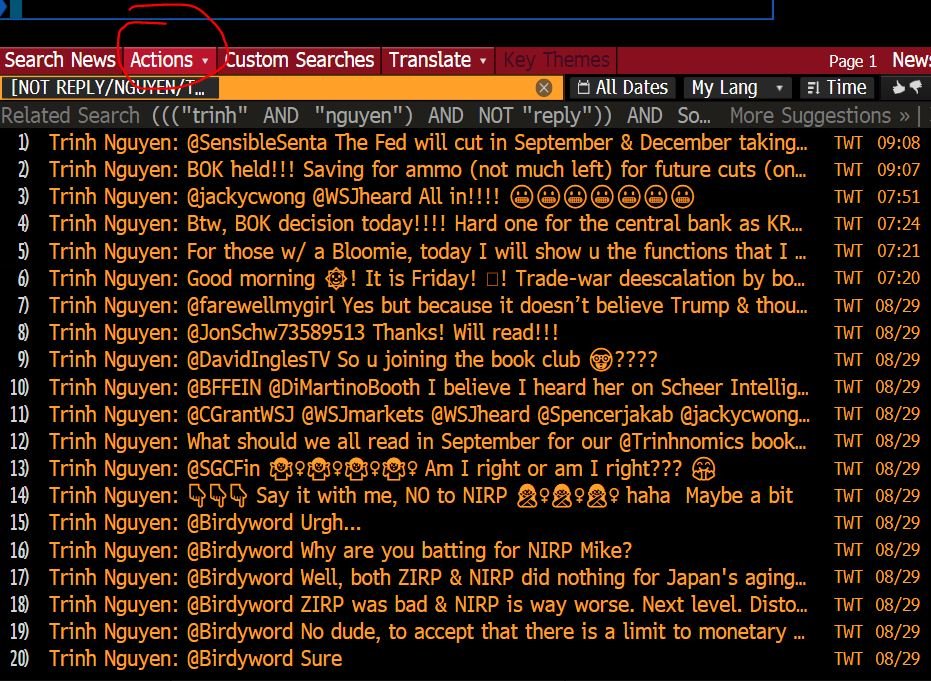

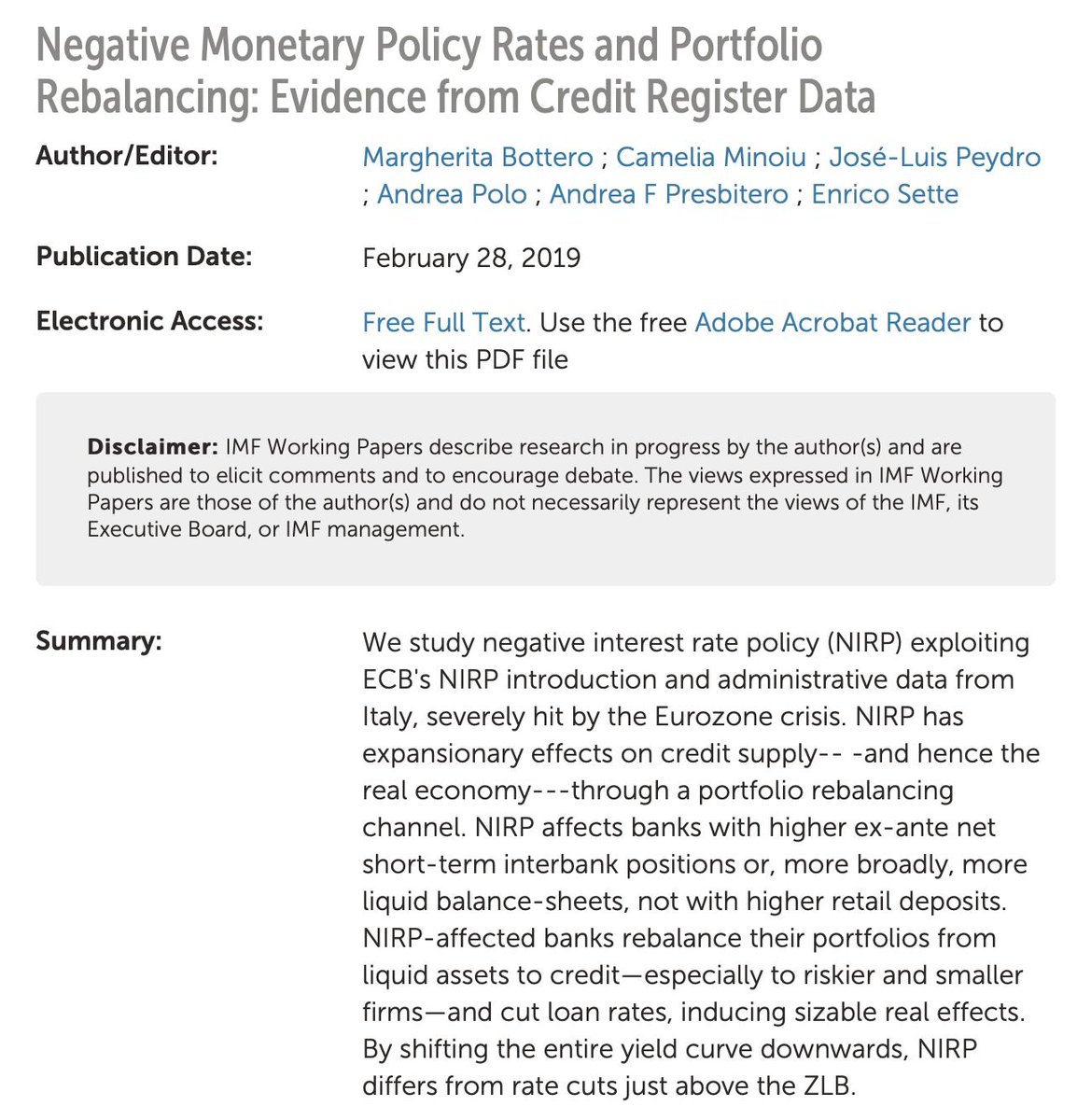

Negative interest rate policy (NIRP) is a TAX ON SAVERS to the benefit of BORROWERS. The only way to benefit is to be able to BORROW CHEAPLY (access to capital) or have tons of DEBT @ low rates.

So what?

Governments = NEGATIVE RATES (will go deeper negative)

Firms = ~2%

Households 5-7%

the CURRENT ACCOUNT SURPLUS (SAVINGS OF PEOPLE) channeled to HELP GOV DEBT👈🏻

Say the rate is -1%, then that means that the gov can borrow for 100 & magically after 1 yr owe only 99👈🏻.

U ask, from whom does the gov borrow from? SAVERS.

*Introduce tiering to OFFSET THE NEGATIVE IMPACT OF ITS NIRP🙄

*DOUBLE DOWN ON NIRP by lowering it to -0.5%

*Change rules to buy more BONDS!

THE WANT TO REWARD U TO BORROW. HAVE DEBT. BORROW!!!!!!!

What do u do?

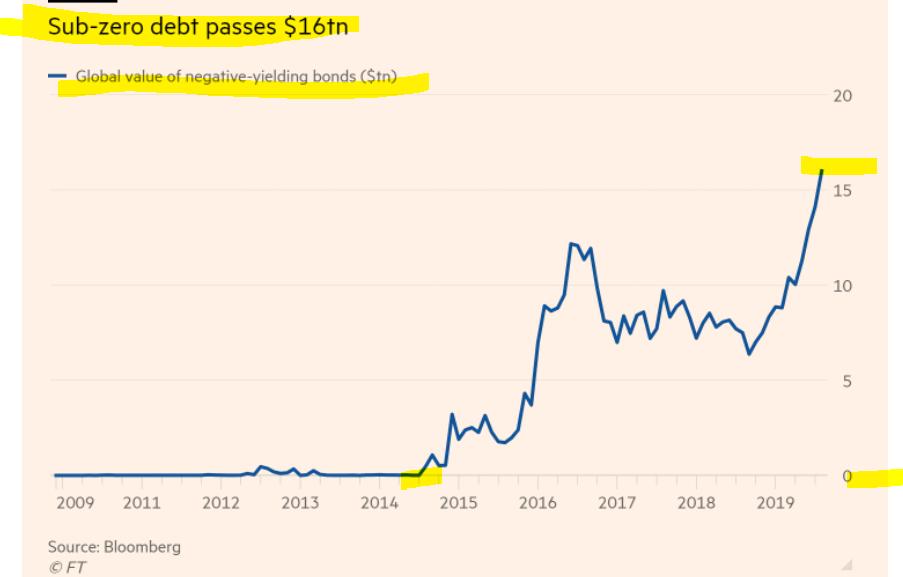

So it's like a VIRUS, spreading FAST!

But for the rest, they save more b/c they know their pension won't be enough w/ NIRP so they must save more!!!