Short thread to outline our main findings 1/9

imf.org/en/Publication…

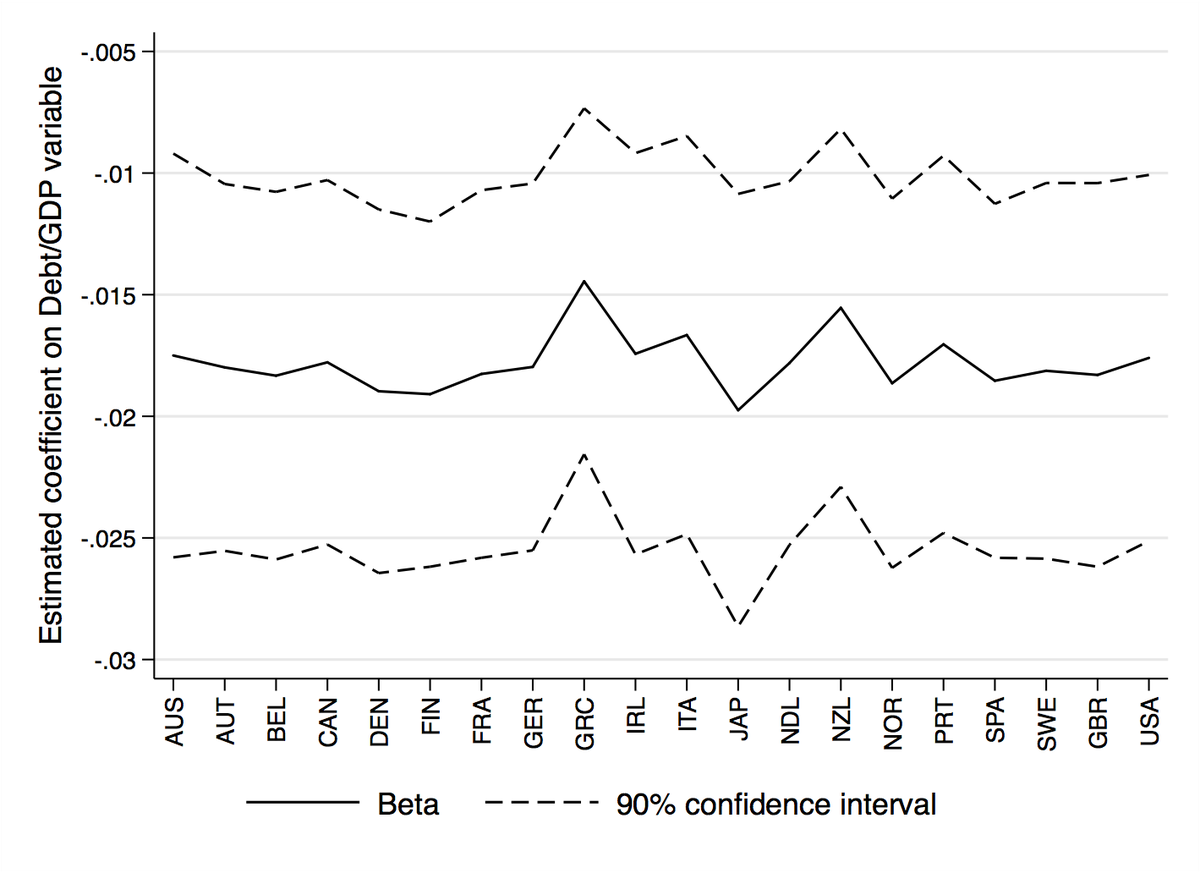

1. in a low rates environment, the transmission of monetary policy becomes weaker

2. the ZLB is an important constraint (@krogoff)

3. beyond a “reversal” rate, lower rates could be contractionary (@MarkusEconomist) 2/9

1. How does negative interest rate policy (NIRP) affect credit supply and the real

economy?

2. Through which channel does NIRP operate?

3. How does NIRP differ from other conventional and unconventional policies? 3/9

1. the ECB’s introduction of NIRP in June 2014

2. the Italian credit register matched with firm- and bank-level balance sheets 4/9

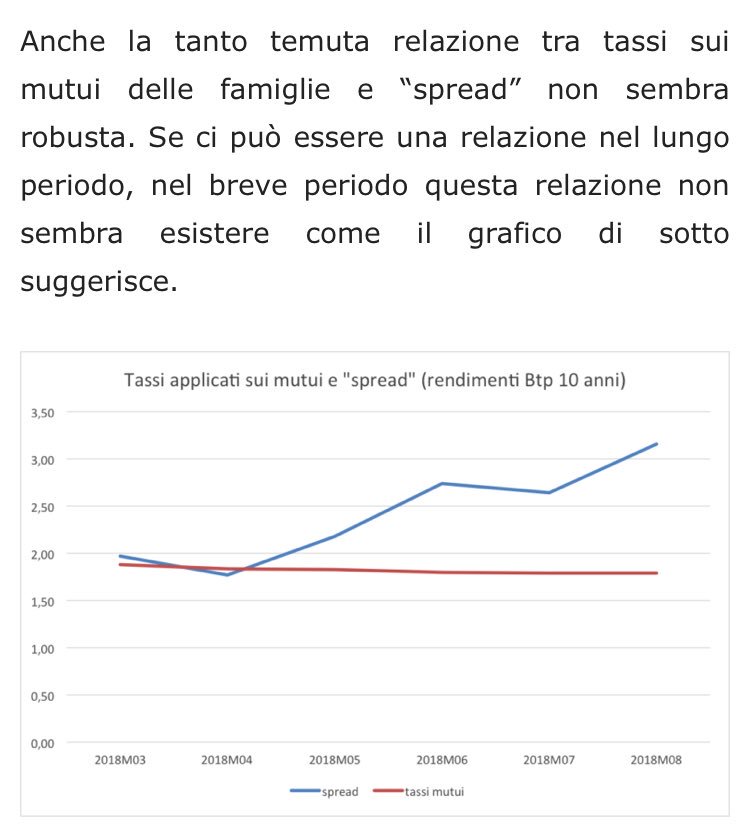

Retail deposits channel: as banks are reluctant to pass negative rates to depositors, NIRP may reduce banks profits and erode capital. Thus, NIRP could lead to risk-taking & lower lending (@gschepen @GautiEggertsson @LHSummers) 5/9

1. Reduce their net holdings of liquid assets

2. Expand credit supply, especially to ex-ante riskier firms (with no higher ex-post NPLs)

3. Reduce lending rates

4. There are real effects on firm activities 8/9

Unlike previous cuts just above the ZLB and forward guidance, this channel was activated as NIRP shifted downward and flattened the yield curve. We find similar results for QE

9/9