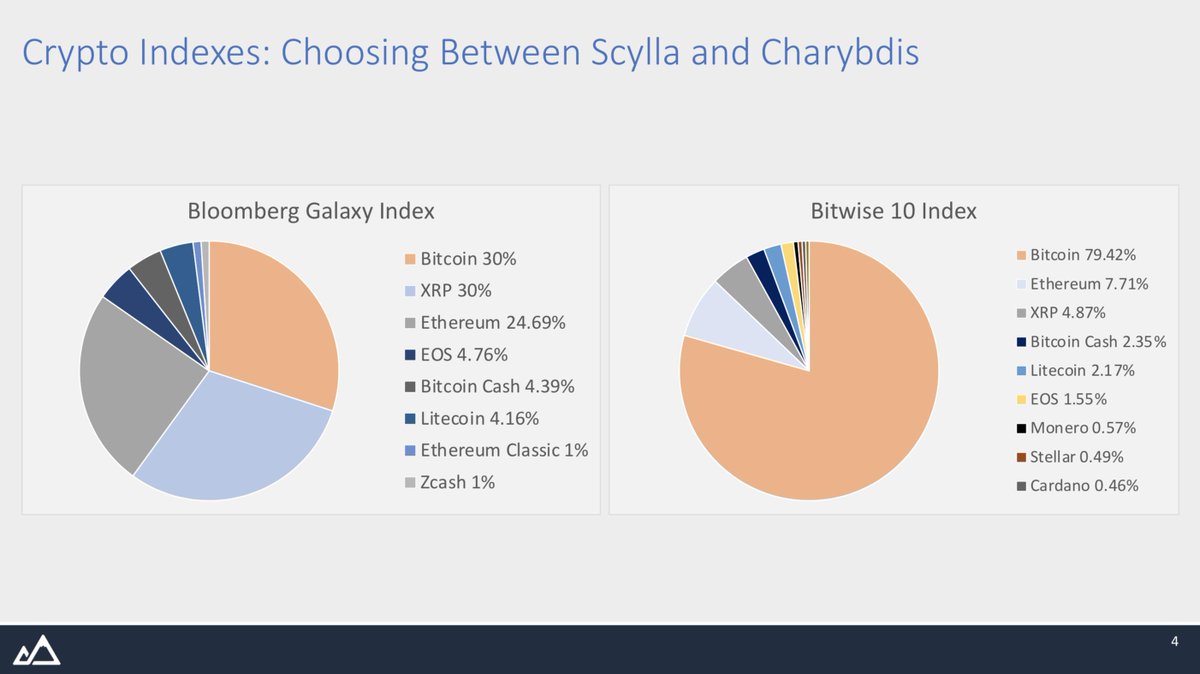

a) Current portfolio indices are flawed and won't stand the test of time

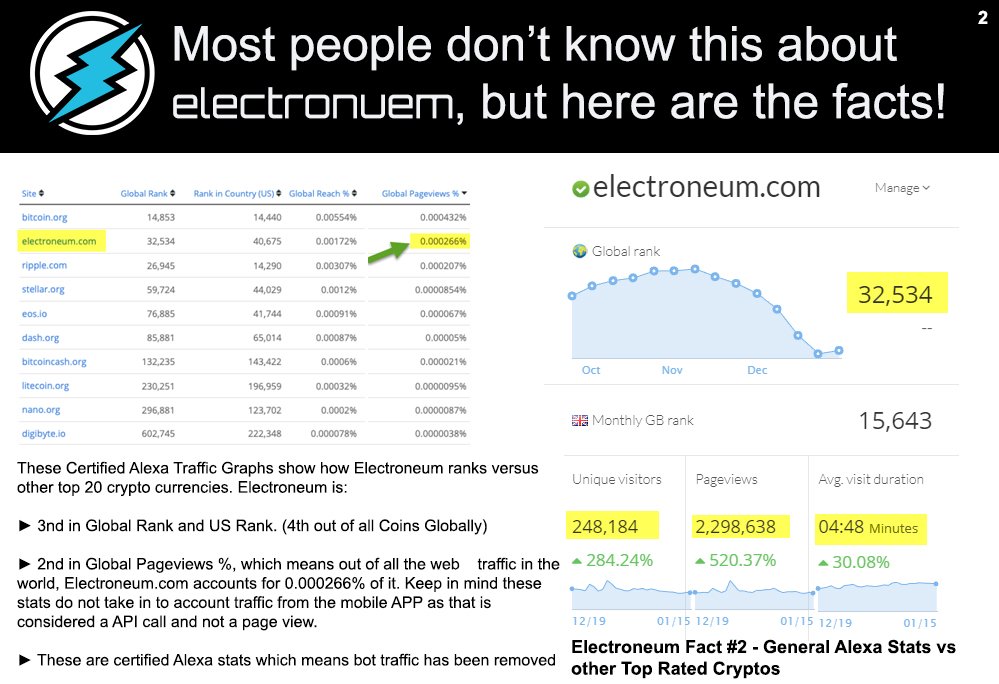

b) BTC is way ahead of its competition to become a monetary standard

c) It helps investors think in the right direction

"Diversification is a security against ignorance. It makes little sense if you know what you're doing" - Warren Buffett

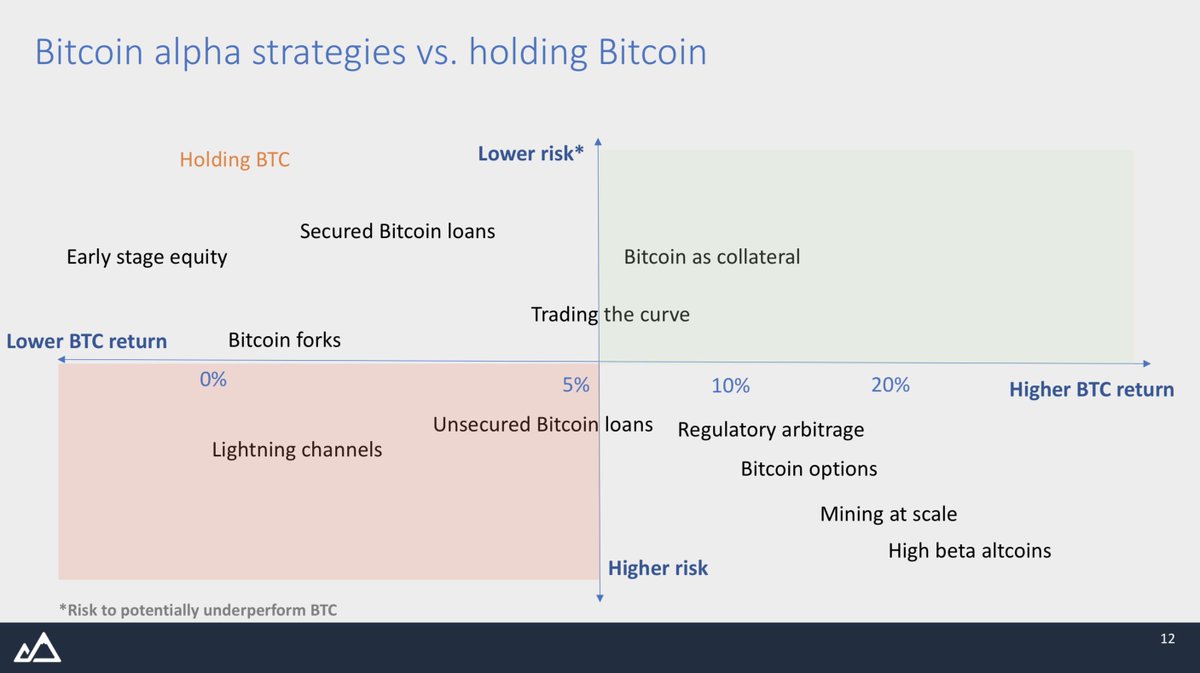

Here are a few frameworks that helped us think about Bitcoin alpha.

1) What is the performance benchmark?

2) How much is committed by the GP?

3) Does the strategy align with my outlook?

4) What was the performance?

5) How are the fees structured?

(1) BTC as a benchmark is the future of crypto asset mgmt and those who adopt it early will benefit.

(2) When pursuing BTC alpha, it's crucial to know how mature the market is, to know your skillset & ask the right questions.