openknowledge.worldbank.org/bitstream/hand…

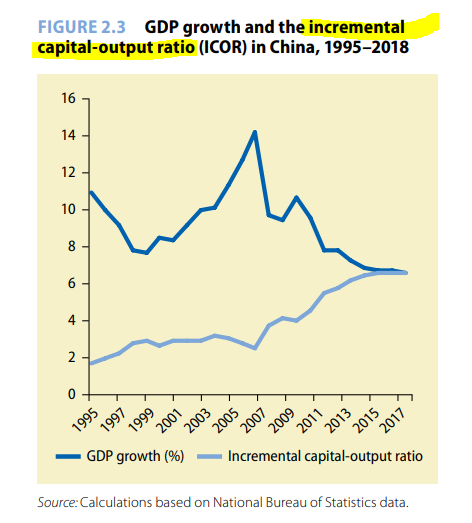

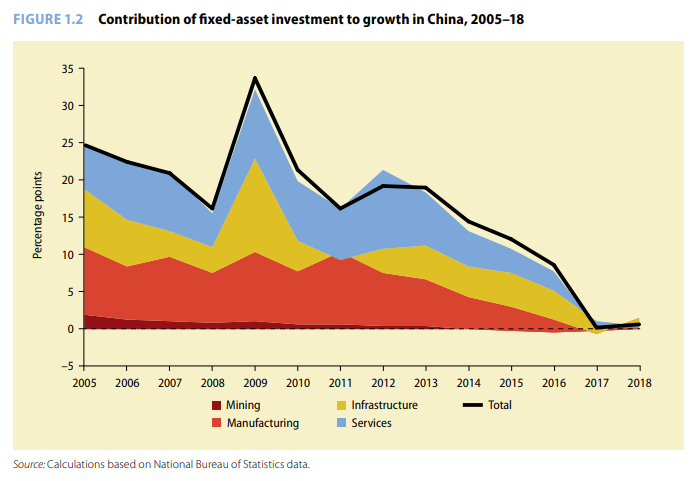

13*2.5 = 33trn of debt * .05 = 1.6trn of interest expense or ~12-13% of GDP.

Nominal growth needs to exceed this or rates have to fall over time.

Loan prime rate fell 5bps for 1yr but the 5y, which is a benchmark for loans etc, didn't fall.

Question is when...