Data was OK out of the US but weak elsewhere & so USD strong despite cut!

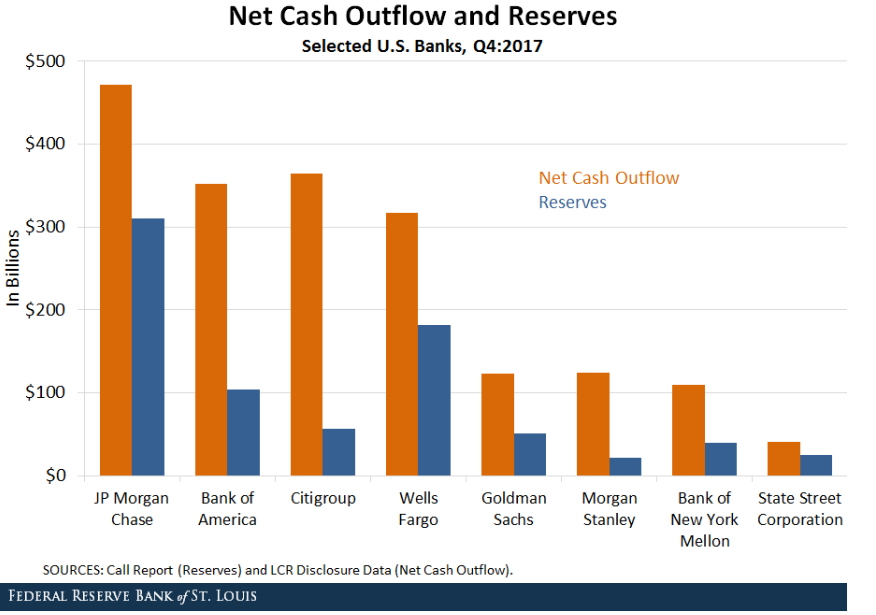

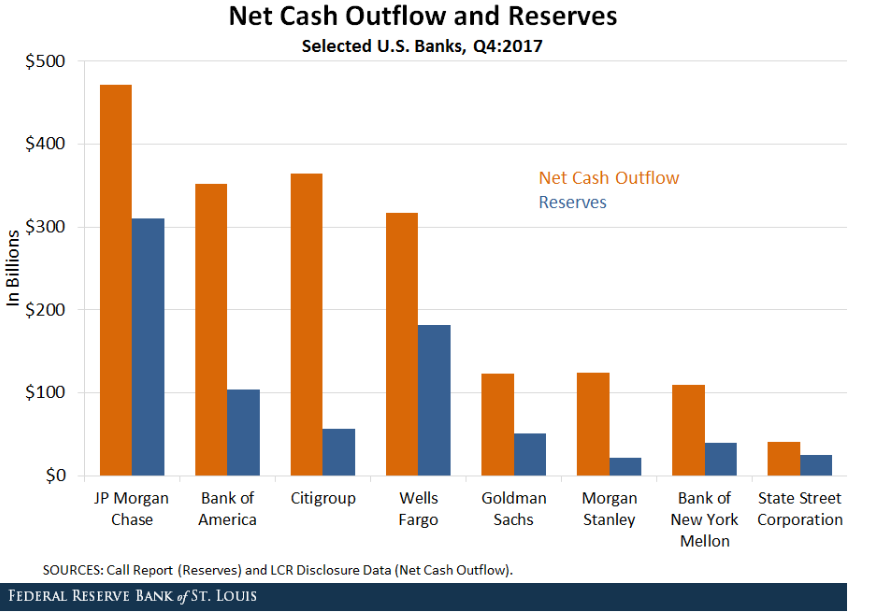

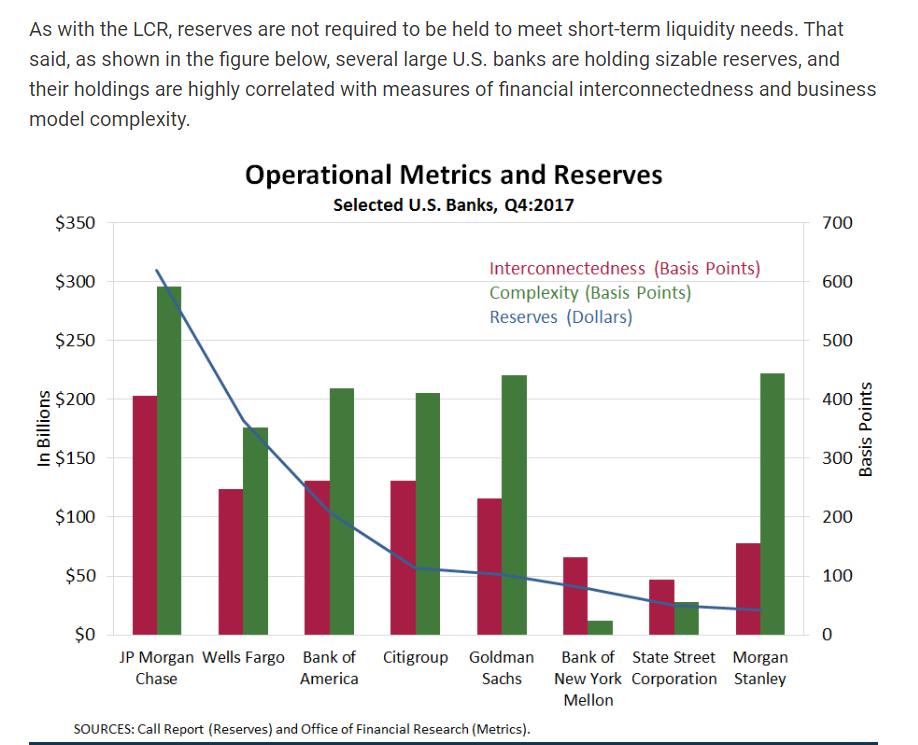

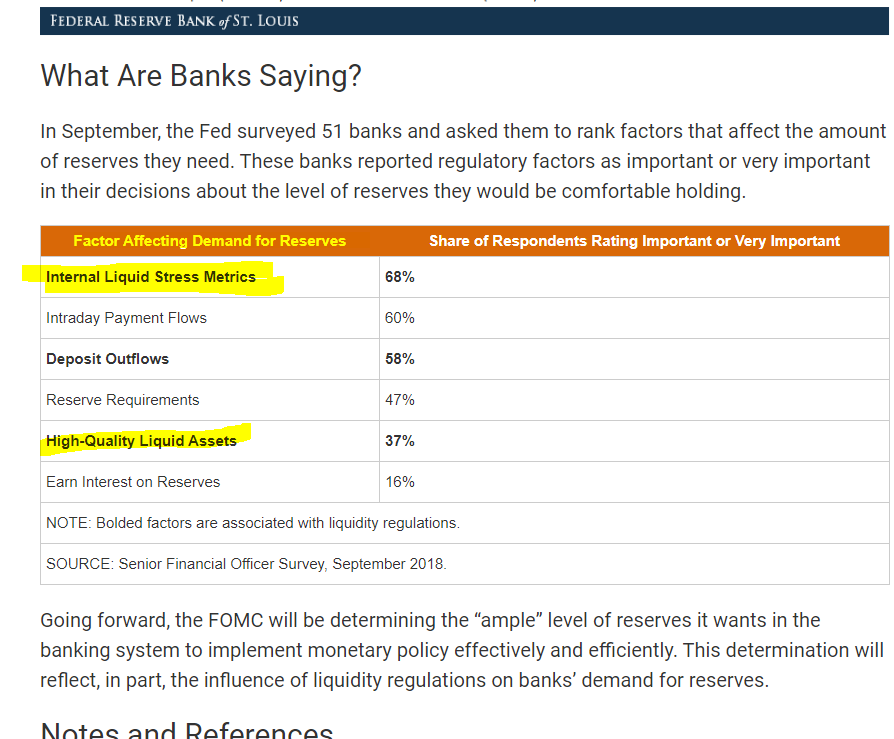

*Reserves >1trn & much more than pre 2008 (~20bn) but Basell III & Dodd-Frank regulations cause a large demand for high-quality liquid assets (HQLA)

*SRF helps convert treasuries to reserves to help overnight repo

stlouisfed.org/on-the-economy…

stlouisfed.org/on-the-economy…

Standardized min daily liquidity requirement for large & internationally active banking orgs. Formula-based metric of liquidity that requires a bank’s HQLA to be larger than its projected net cash outflows over a 30-day stress period 👇🏻.

Known as living wills to ensure large banks can rapidly &orderly resolve in the event of material financial distress. To ensure banks have enough short-term liquidity to cover demands from stakeholders and counterparties during such an event.

👇🏻👇🏻

Internal liquidity stress metrics!!! (basically preparing for the worst b/c of regulatory demand of such prep)

All about Basel III: The Liquidity Coverage Ratio and

liquidity risk monitoring tools

Fun fun fun 🥳

bis.org/publ/bcbs238.p…

What you can say (although coming off w/ a bit of occupational hazard esp if u'r a treasury person):

In times of significant stress, you are the HQLA, allowing me to survive 30 days🤓😉🥳