My talk at @etherealsummit is now available on YouTube!

The article that this talk is based is now also on my Medium!

And all of this content is summarized in this thread

Ether: A New Model for Money

Ether, as an asset, is not well understood. The narrative around Ether, what it is and how it’s used, is constantly changing.

Ethereum is constantly changing as well, so this makes sense. This is an attempt to define Ether as an asset

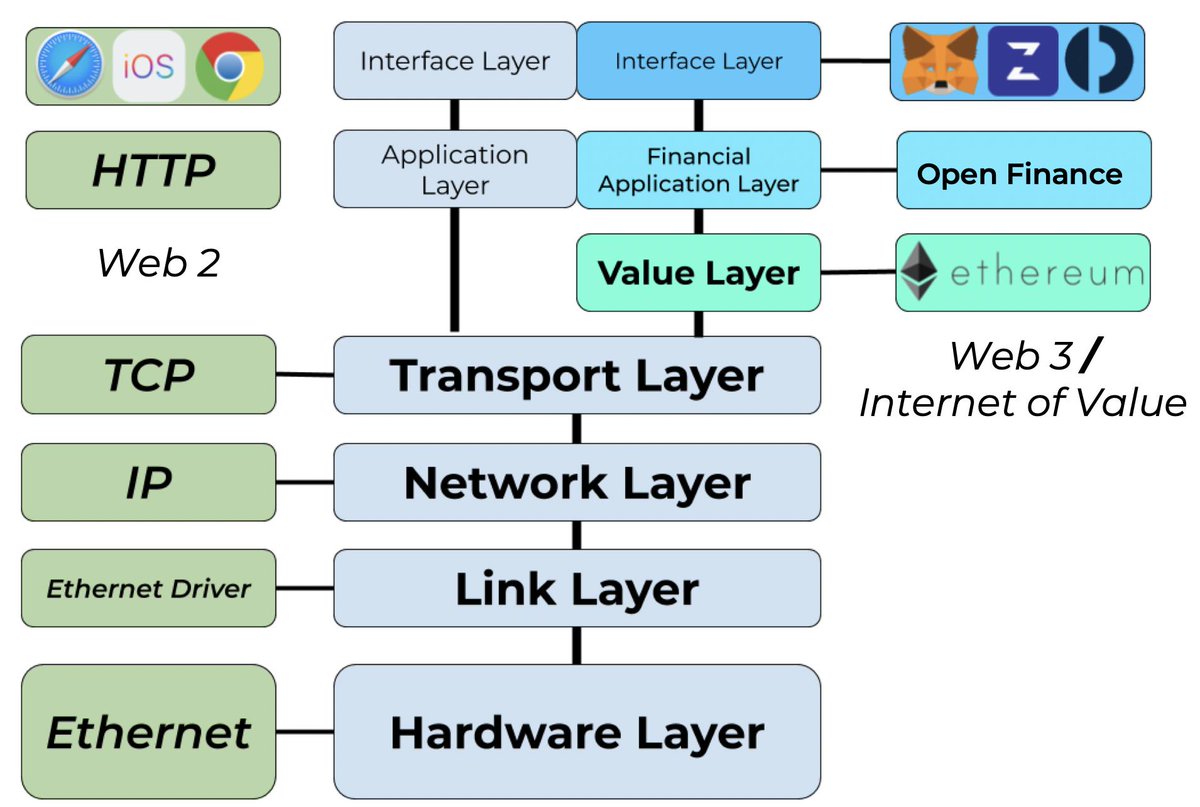

First, we must define Ethereum, as Ether lives inside of Ethereum.

But in order to define Ethereum, we must define the Internet, as Ethereum lives inside the internet.

While we could define the Internet as a global network of computers, with a standardized communication protocol, this isn’t helpful.

This does not help illustrate the things on the internet that meaningfully impact our lives.

Likewise, Ethereum will be defined by the applications that are found on top of it.

Ethereum’s value layer is a new fertile landscape for a new set of applications: applications that manage value rather than data.

Financial applications.

Gold is permissionless, and so is Bitcoin, but if the systems aren’t permissionless, then over time they will capture the asset and generate a permissioned system, which results in rent-seeking, corrupt incentives, and systemic inequality.

Here’s how I define Ethereum:

Ethereum is the internet of value. The internet-native global settlement layer for digital assets. A landscape of permissionless financial applications, which together support a permissionless economy.

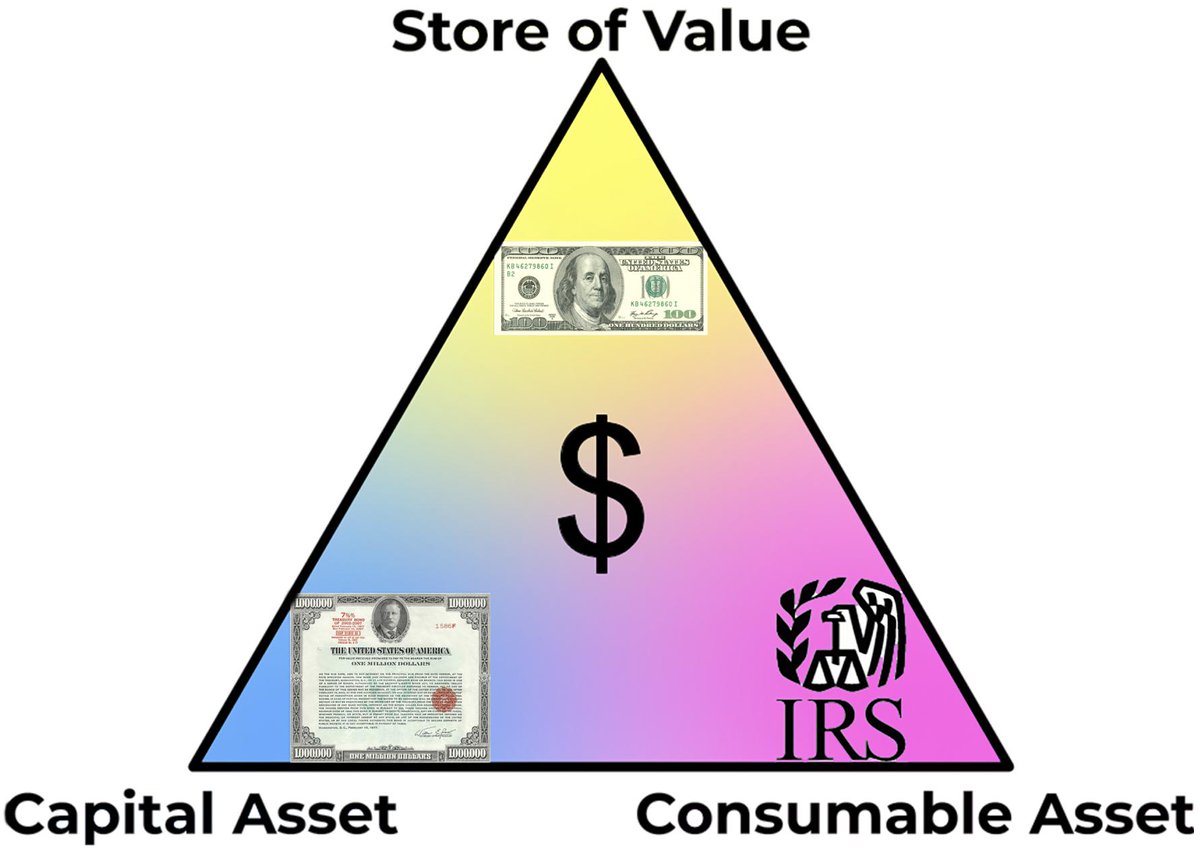

Capital Assets

- Assets that are productive

- Produce an ongoing source of value

- Generate value/money/cash-flow

Examples: equities, bonds, rentable real estate, or taxi medallions. Assets that, in some way, enable cash flow for the owner.

Transformable/Consumable Assets

- You can consume/burn it — one time use

- You can transform it into another asset

- Its consumption produces economic yield

One-time use assets, as a means to an end.

Commodities, energy, metals, oil, electricity.

Store-of-Value Assets

- Cannot be consumed

- Value persists across time / space

- Scarce

Examples include gold, currencies, real estate, art, or bitcoins. These assets MUST be scarce, and ubiquitously desirable globally.

You can blur the lines between these categories.

Real Estate is a good SoV, but also produces rent, making it a Capital Asset.

Gold is used in industry as a Consumable/Transformable, but it’s also a great SoV.

Ether is the first asset to transcend all three asset classes

- Ether is a Capital Asset (staking)

- Ether is a C/T Asset (Tx fees)

- Ether is a SoV Asset (Collateral in Applications)

Ether is a Capital Asset.

Ether is equity in Ethereum. Ethereum collects fees, and those fees are paid to Ether holders. If you want to work for Ethereum, and collect fees, you must hold Ether to do so.

Ether is A Consumable-Transformable Asset

Ether is the Economic Substrate for the Internet.

Anytime

- An asset is moved

- A loan is generated

- An exchange is made

- A DAO is started

Ether is consumed to produce economic yield. Ether is internet energy.

Ether is a SoV Asset

Ether is the collateral behind other internet Assets. Assets that have Ether backing them borrow from Ether’s permissionlessness.

Ether is used as the programmable permissionless reserve currency for programmable permissionless financial applications.

Ex. 1:

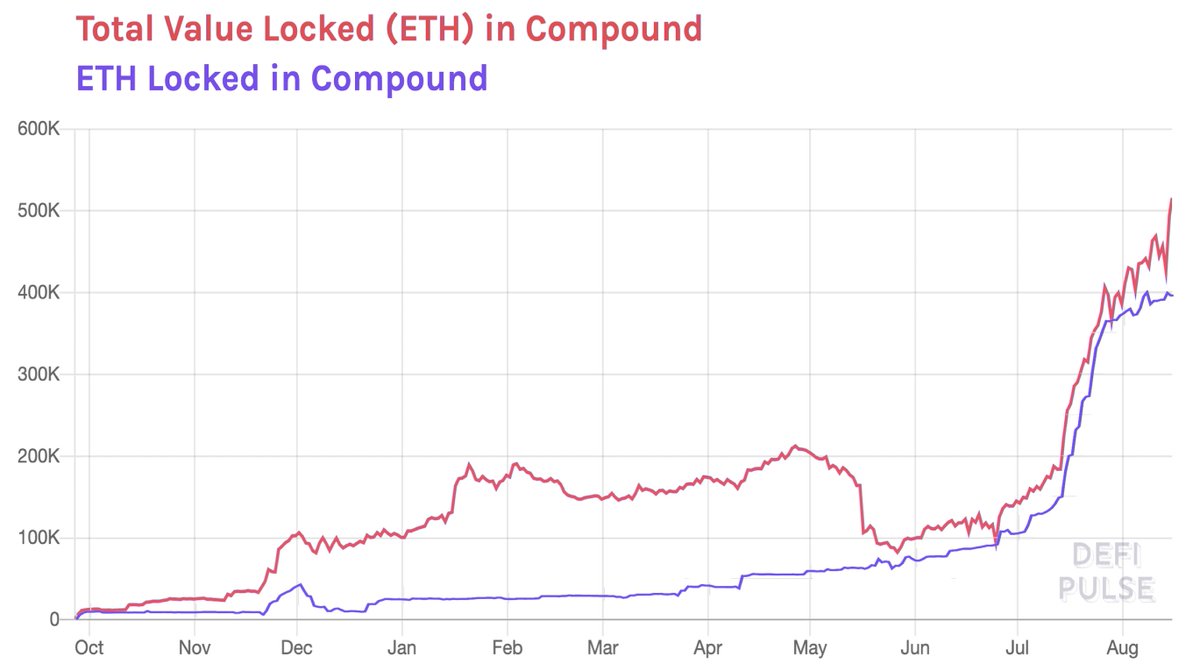

@Compound is trustless because of collateral.

In this chart, RED is the total value of all collateral locked in Compound, denominated in ETH. Purple, the total number of ETH locked as collateral.

Compound’s collateral is 80% ETH

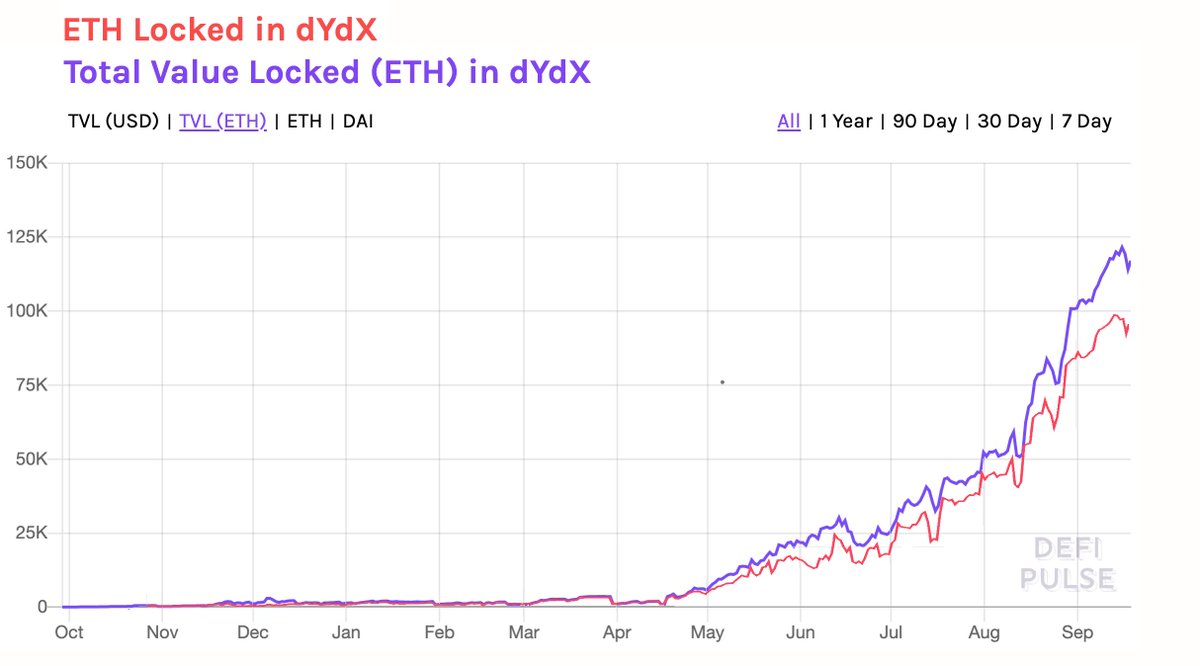

Ex. 2: @dydxprotocol

You can see that demand inside of dYdX is 94% Ether or Dai. And remember, Dai is just a token that represents collateralized Ether.

Store-of-Value Ether makes dYdX permissionless and trustless

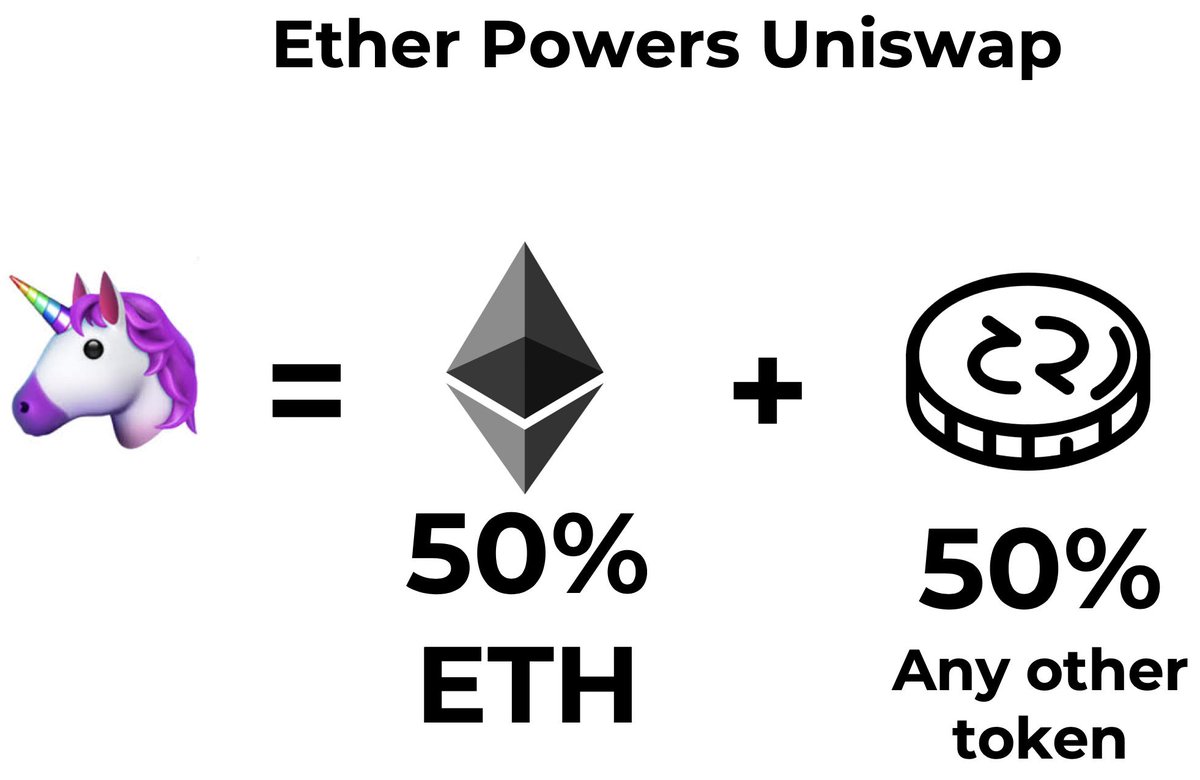

Ex. 3: @Uniswap

All trading pairs on Uniswap are 1-part ETH, and 1-part any other token.

In V2 of Uniswap, this will change to AnyToken-AnyToken, and I’m willing to bet that the next most-used collateral will be Dai.

Now that we have this new economy, we need a new money to run inside of it.

The only trustless and permissionless asset in Ethereum is Ether.

Next, (and last!) we define Ether’s role in Ethereum

Ether is bandwidth for Permissionlessness

@makerdao: Using 1.35% of all Ether

@compoundfinance : Using 0.43% of al Ether

@dydxprotocol: using 0.1% of all Ether

@UniswapExchange: Using .05% of all Ether

Total Ethereum DeFi: 2.1% of Permissionless bandwidth used.

So we’re not using much of the Internet of Value’s bandwidth. There’s room for applications to grow capture ETH

- If we want more DAI

- more permissionless synthetic assets

- More liquidity inside Uniswap

They will need more USD-valued ETH

Ethereum as an economy leaves much to be desired. If we want Ethereum to be

- The global financial platform for the internet

the internet of value

- The global settlement layer for all digital assets

then we need Ether to scale to larger numbers

If we continue to build DeFi applications that lock-up ETH, then there’s less ETH staking, and therefore generating higher returns for stakers, pulling MORE ETH off the secondary market.

The U.S. Dollar price doesn’t stand a chance in this fight.

Thanks for reading. If you’ve made it this far, you should probably just read the entire article:

medium.com/@TrustlessStat…

Or watch the youtube video: