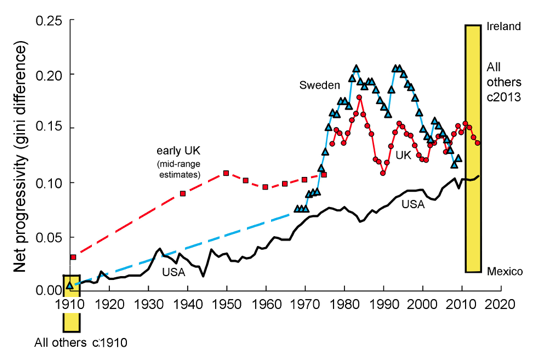

Once you count government transfers, our fiscal system is actually pretty progressive, and has been getting steadily more so over the years (unlike, say, Sweden).

voxeu.org/article/rise-a…

brookings.edu/bpea-articles/…

For example, Bill Gates and Warren Buffett.

cnbc.com/2019/02/25/war…

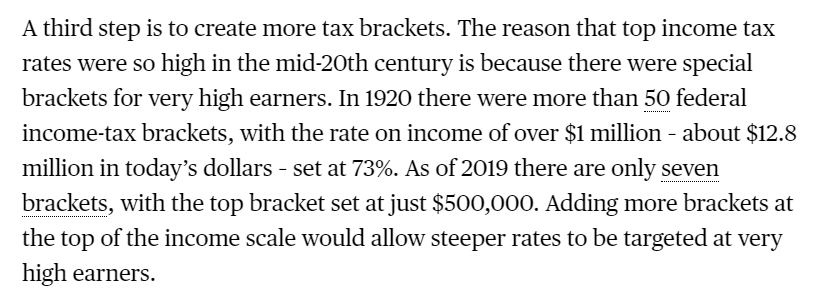

First of all, it will provide some revenue. Maybe not as much as people think, but definitely some. Especially if top taxes are raised in a variety of ways.

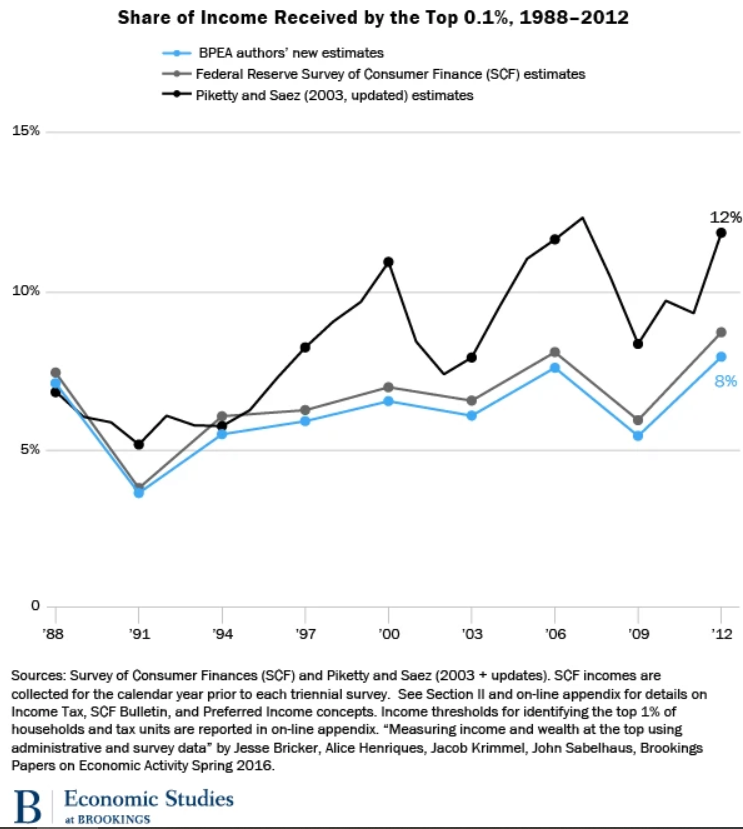

davidsplinter.com/AutenSplinter-…

That might just make companies hold more cash, but it might increase business investment. And that would be good!

bloomberg.com/opinion/articl…

That's part of what I might call "democracy".

(end)

bloomberg.com/opinion/articl…