$64.0 billion of revenue

$3.03 earnings per share (EPS)

My estimates were:

$64.4 billion of revenue

$3.00 EPS

$85.8B to $89.5B

My expectation: $88B to $91B

Consensus: $87B

Guidance is a tad light versus my expectation but slightly better than consensus.

Services revenue: $12.5B (my estimate: $12.2B)

Mac revenue: $7.0B (my estimate: $7.7B)

Wearables / Home revenue: $6.5B (my estimate: $5.9B)

iPad revenue: $4.7B (my estimate: $4.4B)

Wearables represent Apple's growth engine.

iPhone 11 is currently the best-selling iPhone model (no surprise there)

iPad is back, that's for sure.

Active installed base of iPhone grew to all-time highs in each geographical segment.

A big hole in the "iPhone users are switching to Huawei in China" narrative.

Net cash (excludes the debt) stands at $98B.

Tim Cook: It's early but iPhone 11 / 11 Pro trends look good. We are bullish.

Said another way, iPhone may return to revenue growth on a year-over-year basis next quarter.

Cook's comments sure seemed to suggest it's a limited time promotion. Some were wondering if Apple would keep the promotion going.

Three out of four Apple Watch buyers are new to Apple Watch (same as last quarter).

A subtle hint that AirPods Pro represent an expansion to the AirPods line and not the *new* AirPods.

When it comes to AirPods Pro, we are thinking the early buyers will be current AirPods owners looking for a second pair.

My reaction: Yes to both.

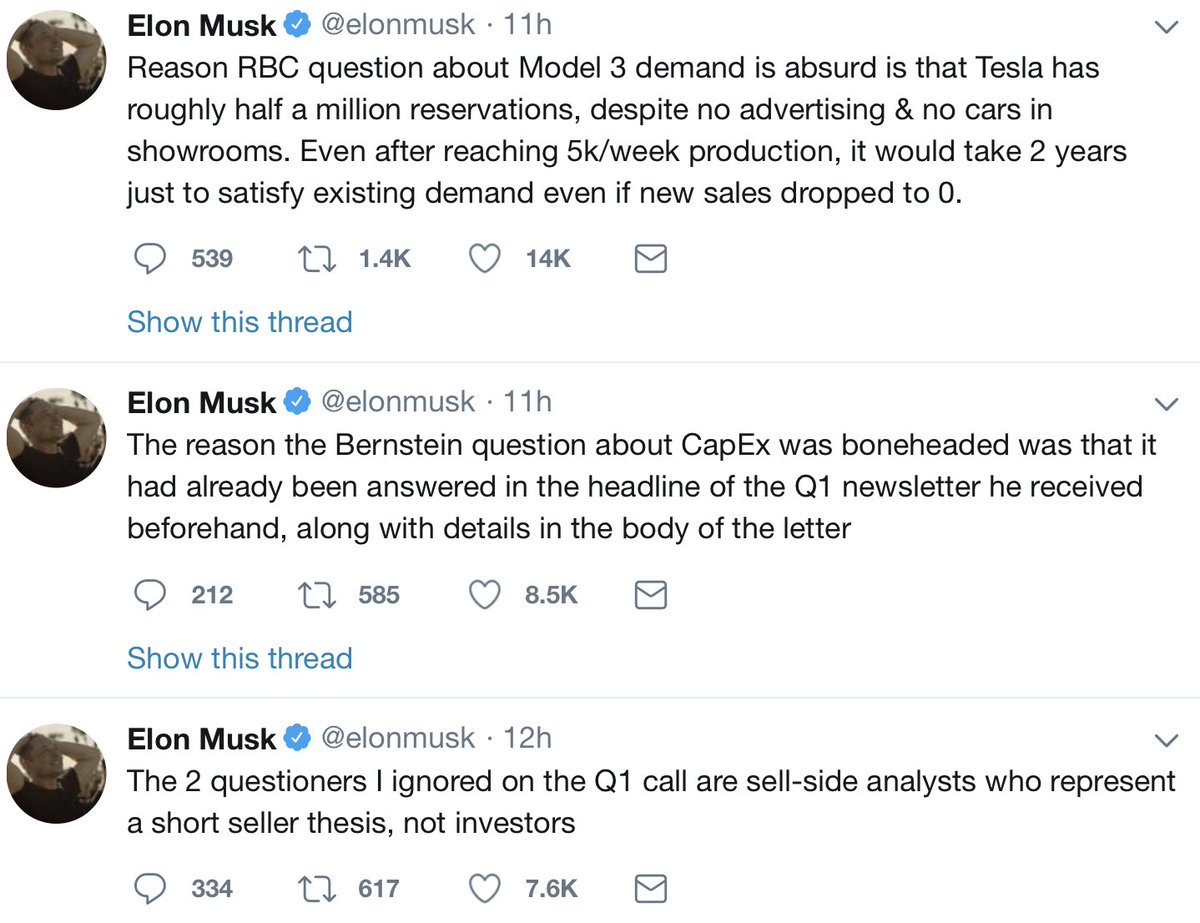

A transcript of these tweets will be available as long as Twitter exists.

To receive in your inbox, you can sign up here: aboveavalon.com/membership