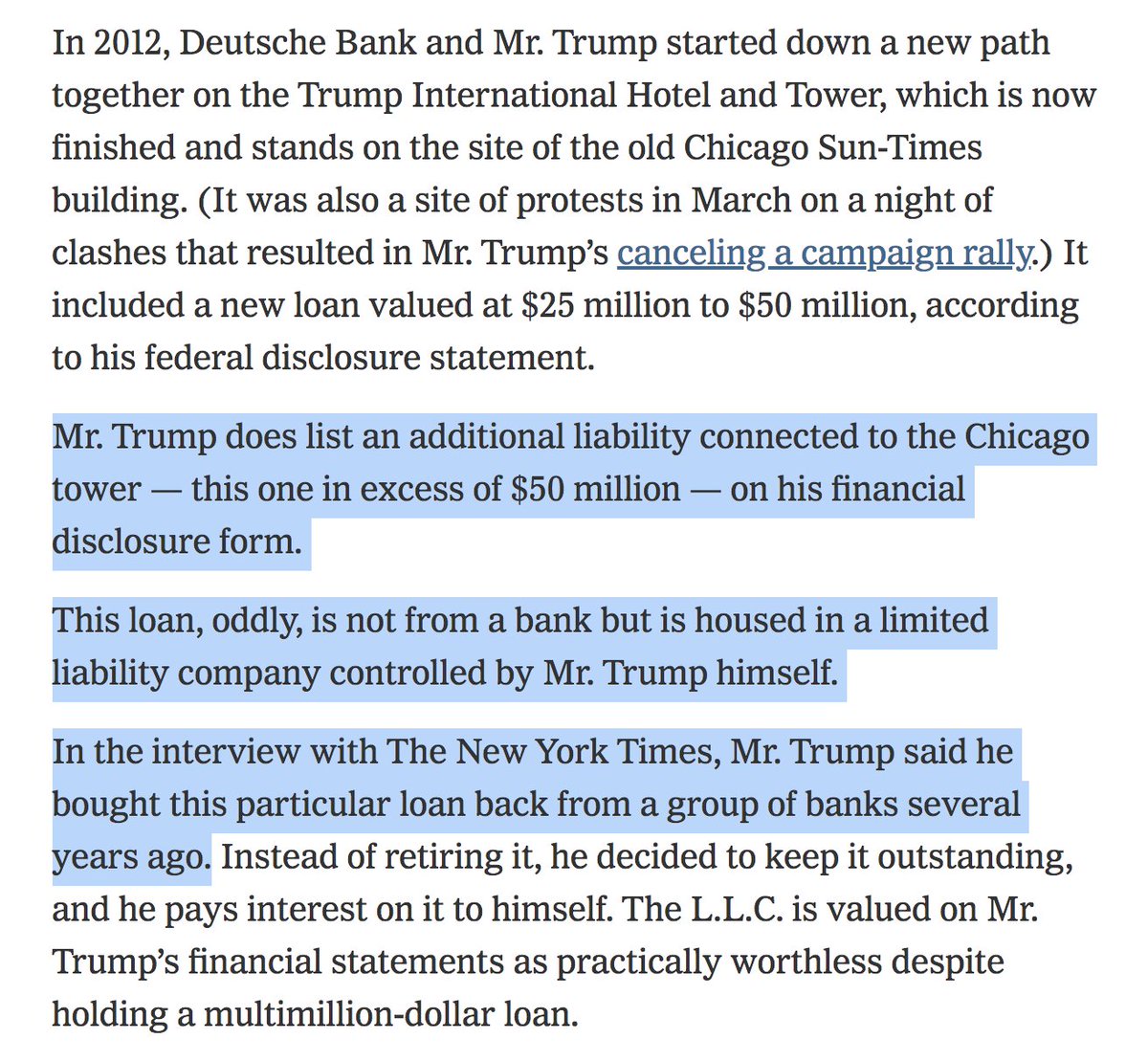

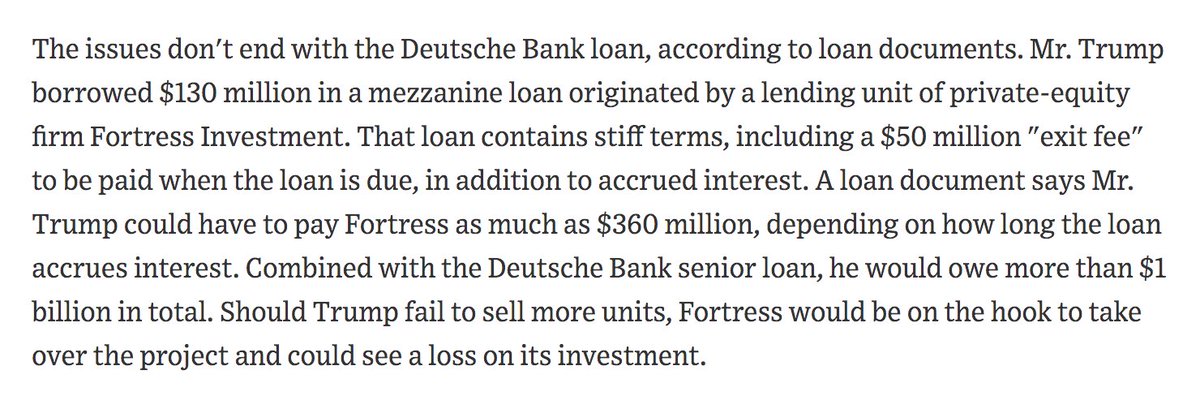

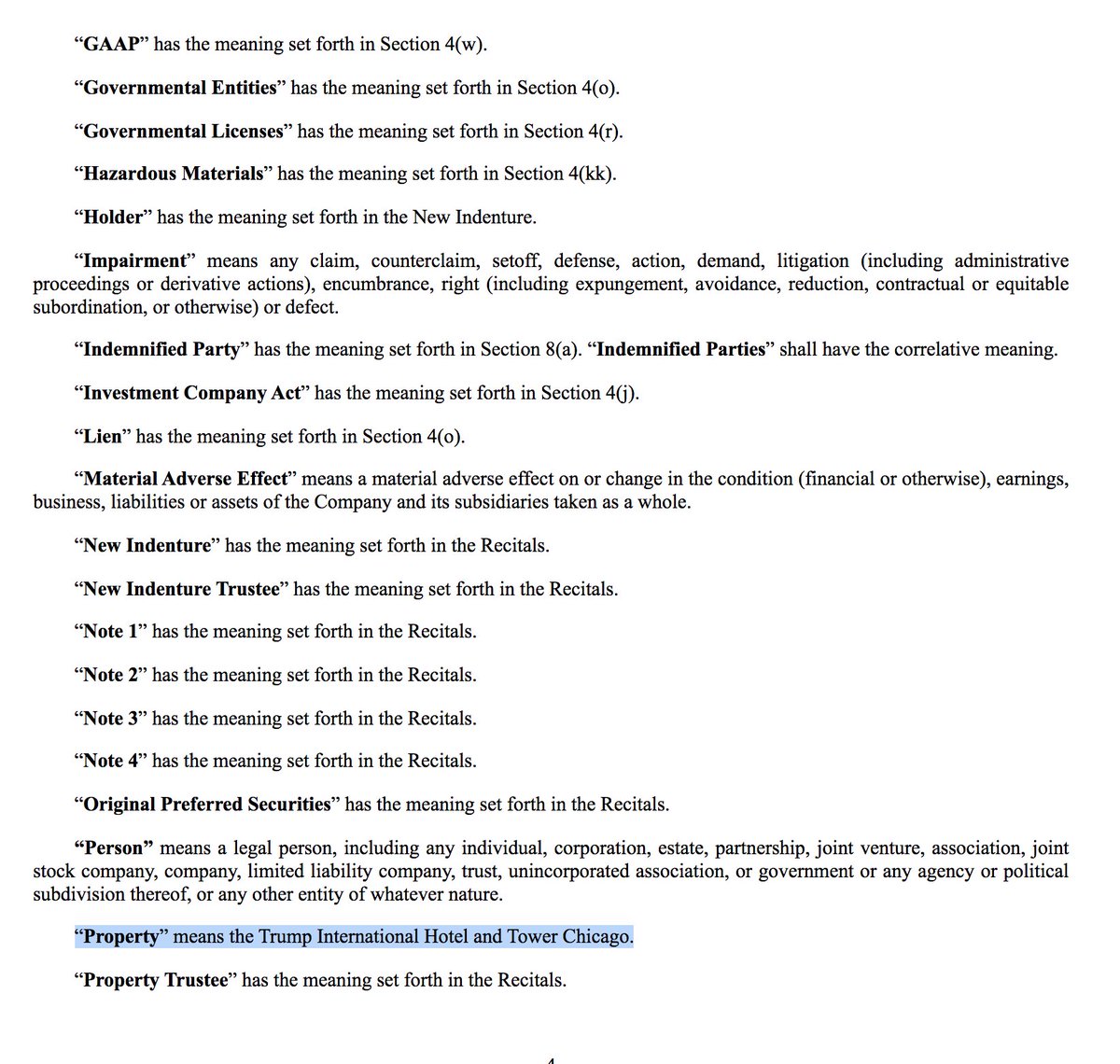

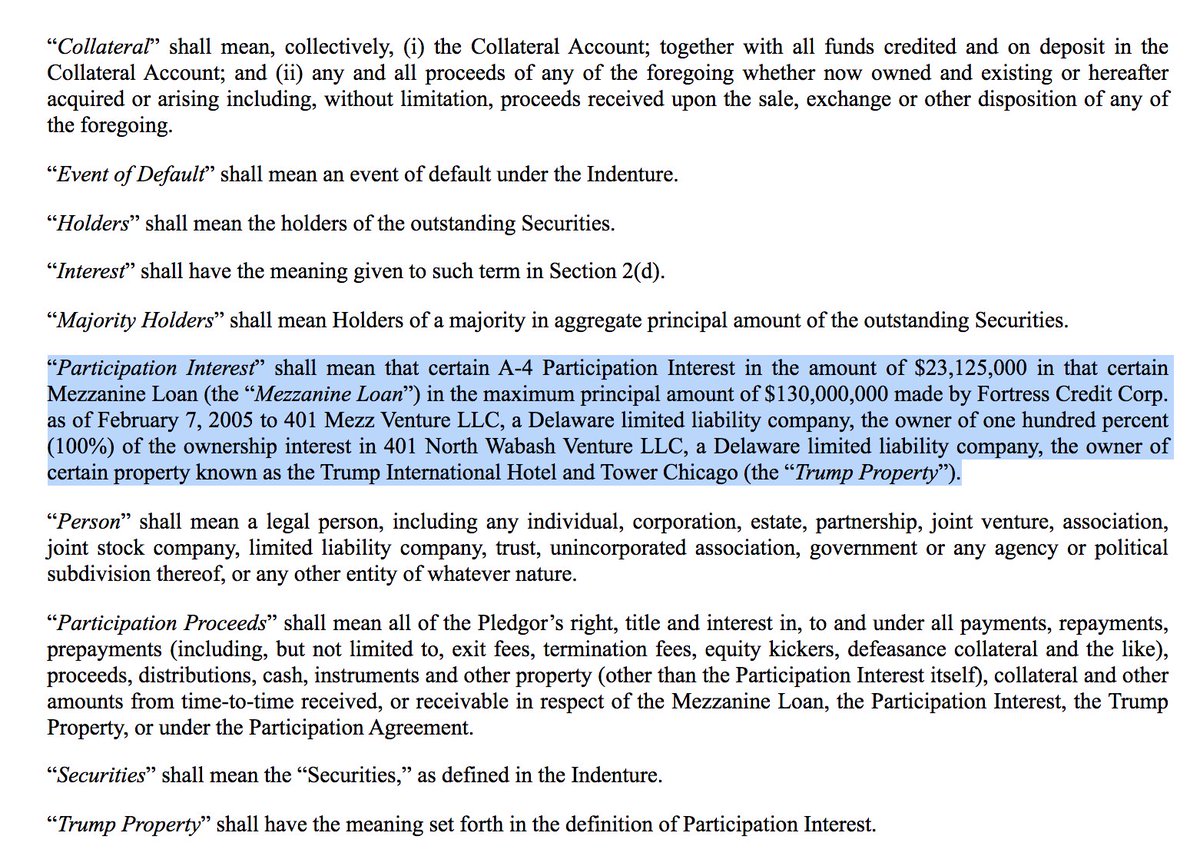

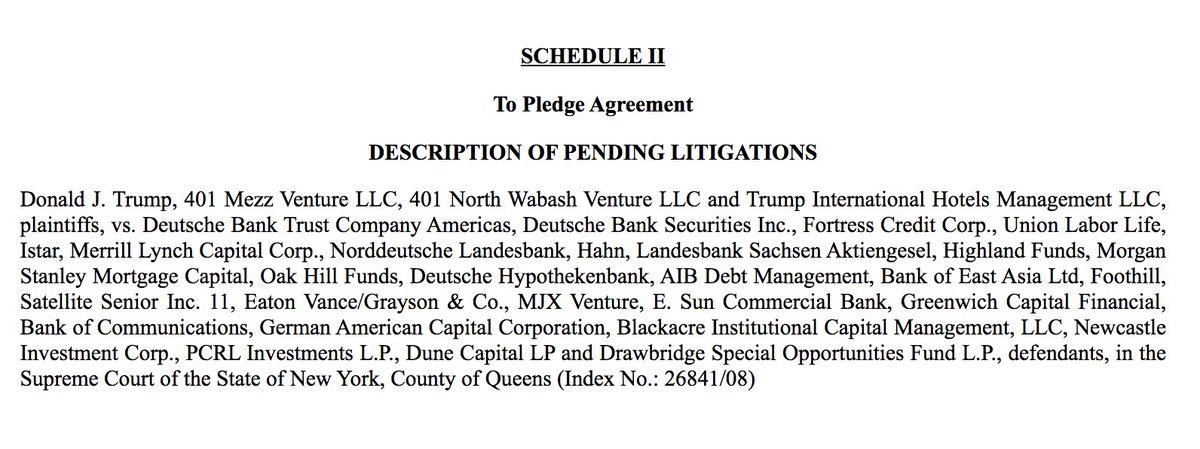

I found SEC filings related to $130mil mezzanine loan on TIHT Chicago from before loan was paid off that may shed light on the loan (but may not tie to $50mil debt mystery) /thread

@susannecraig reported that Trump said the $ was a loan he purchased back from several banks

nytimes.com/2016/05/24/bus…

wsj.com/articles/SB122…

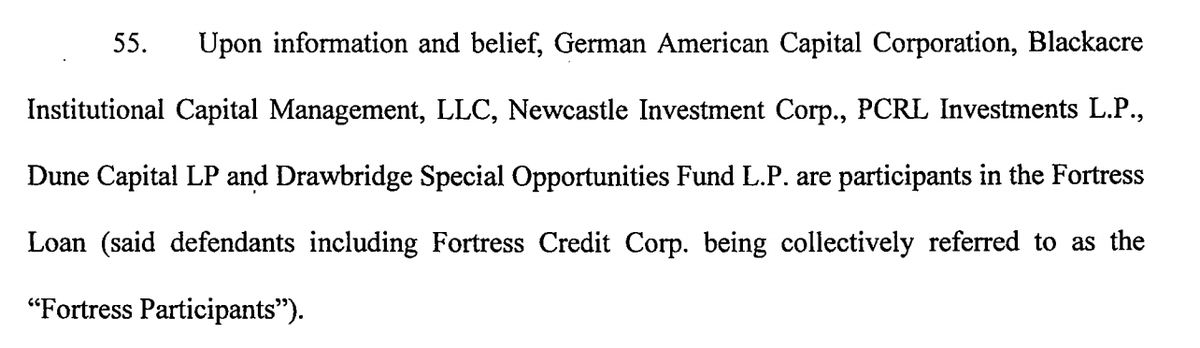

Fortress Credit Corp

German American Capital Corp

Blackacre Institutional Capital Mgmt

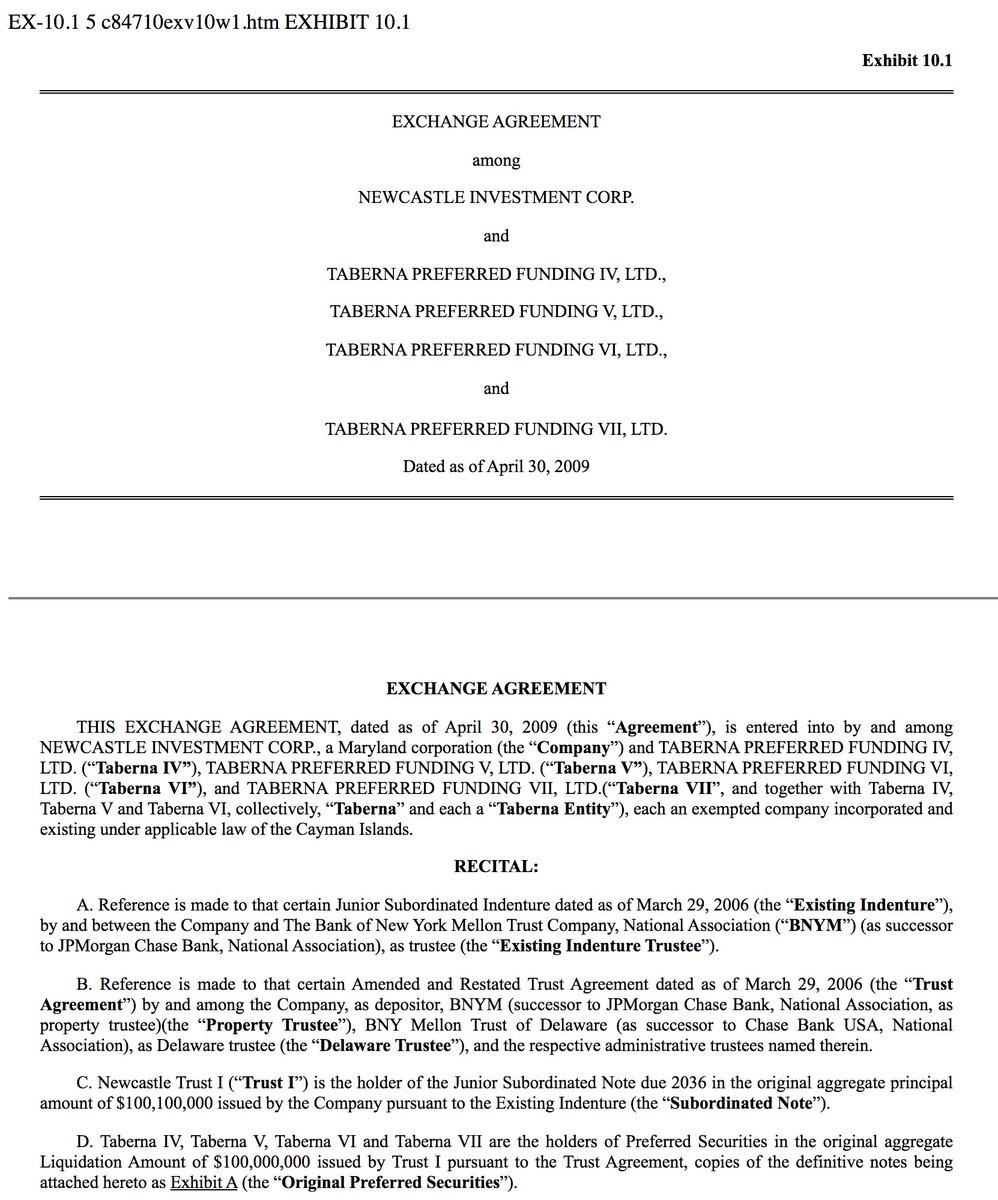

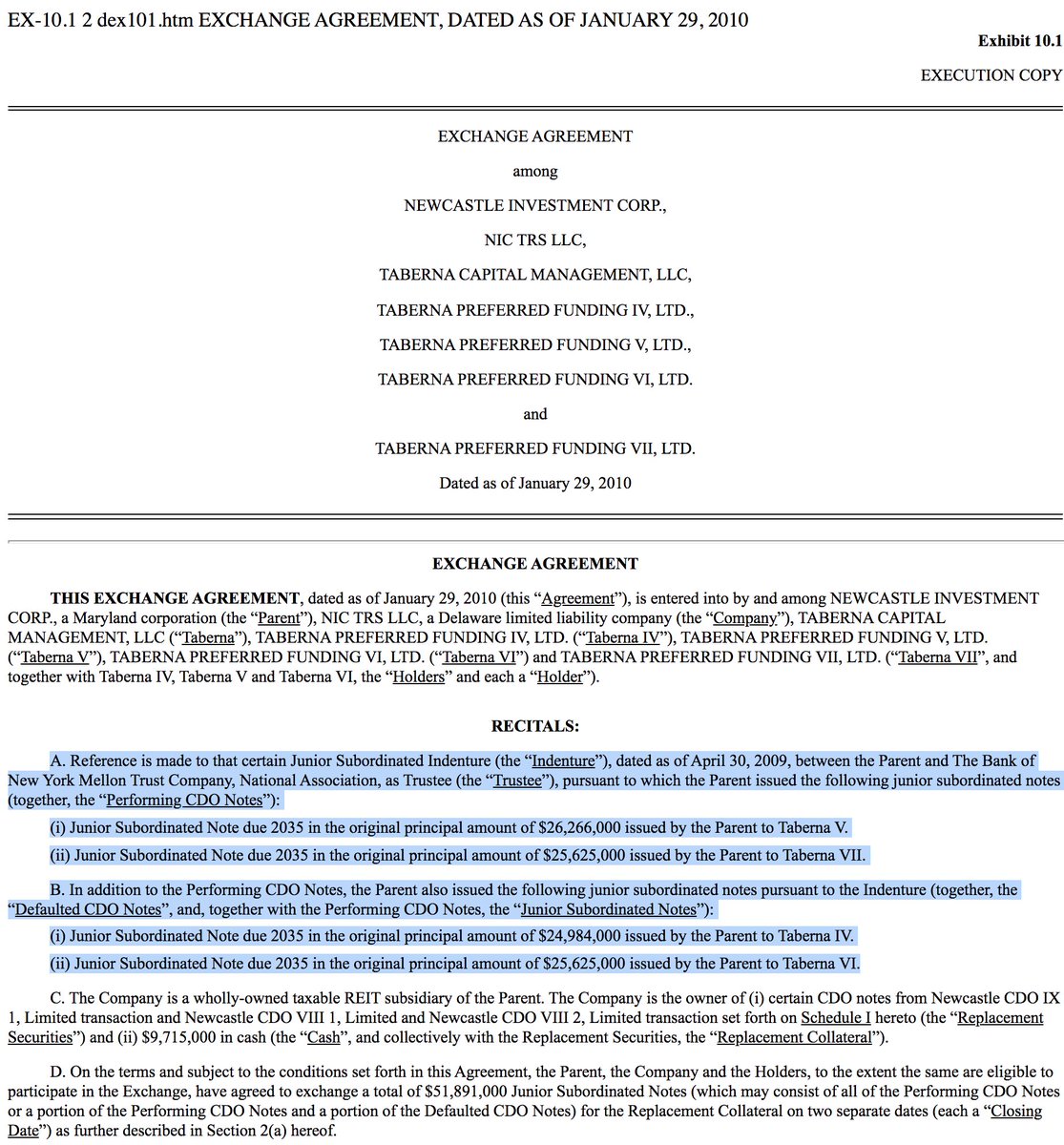

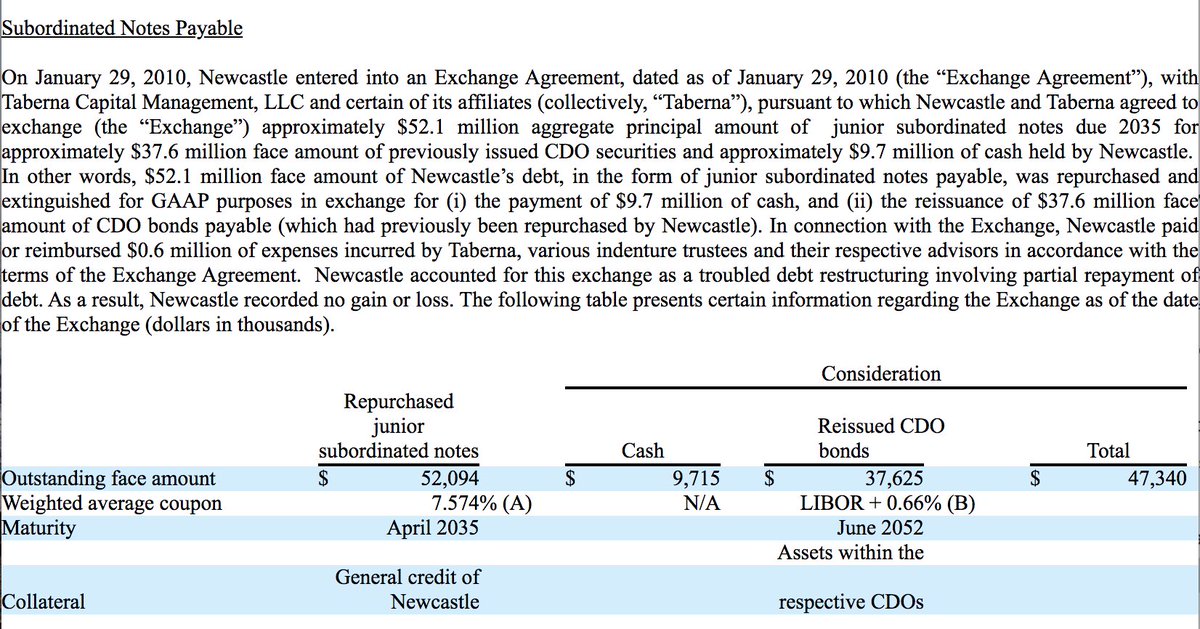

Newcastle Investment

PCRL Investments

Dune Capital (Mnuchin’s co)

Drawbridge Special Opportunities Fund

documentcloud.org/documents/6194…

sec.gov/Archives/edgar…

sec.gov/Archives/edgar…

sec.gov/Archives/edgar…

sec.gov/Archives/edgar…

sec.gov/Archives/edgar…

reuters.com/article/us-sec…

Based on SEC filings above, it's possible debt was transferred & reduced prior to 2012

Are these loans tax avoidance structures? or financed opaquely by other people?