Most of the hyper-growth companies in my portfolio either have (a) no earnings or (b) they are trading at triple digit PE ratios.

Before dismissing these businesses as potential investments,...

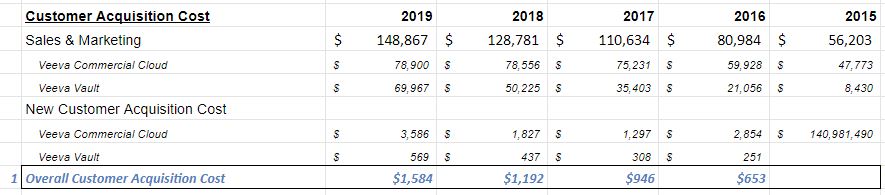

The reality is that these businesses are currently spending 30-40% of their revenues on Sales & Marketing...

So, they are spending cash hand over fist (and why not?) to grab as many customers as they possibly can...

This will make them profitable right now but given the large TAMs and long growth runways, this...

Whether it is e commerce, fintech/payments or SaaS, these industries are very sticky (due to network effects, scale etc) so it makes perfect sense that the leading companies in this space are currently spending a lot of money to lock-in as many...

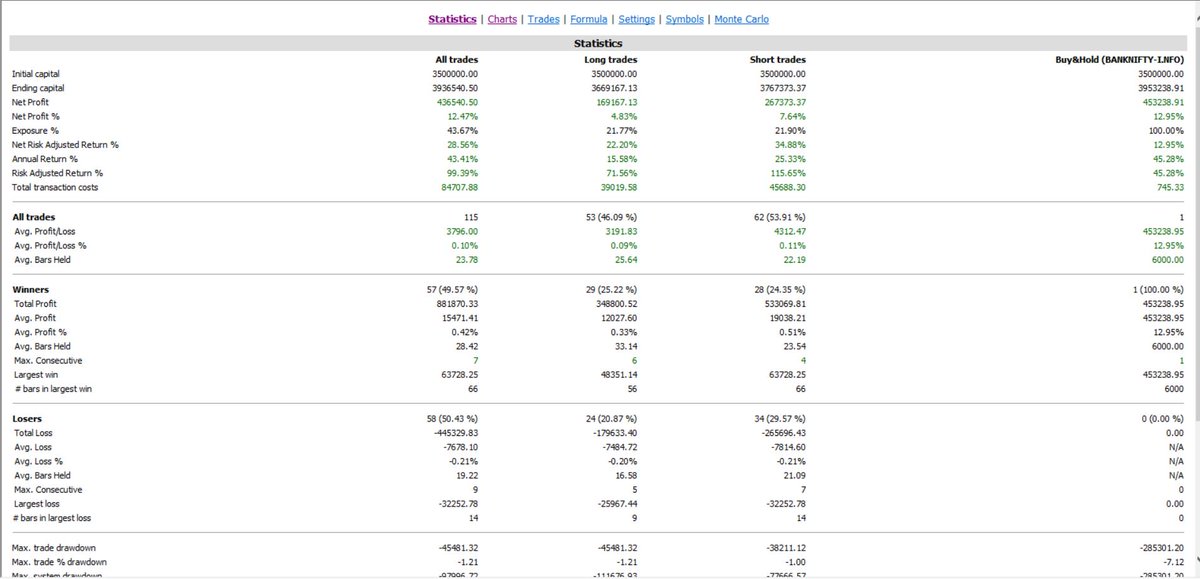

As long as the gross margins stay stable, these businesses demonstrate operating leverage (losses shrinking as % of revenue) and they are near FCF breakeven or FCF +ve, near-term lack of profitability isn't a concern IMHO.

After all, these industries aren't relying on new demand creation,...

Given their unheard of growth rates, it is hardly surprising that these companies..

As an investor in these companies, I'm comfortable with the current heavy cash outlays + losses so long as these businesses don't rely on the kindness of strangers

(external capital).