The degree of VIX futures contango "has been shown to hold predictive power over volatility returns. This study proposes a conditional strategy which allocates to market and volatility risk."

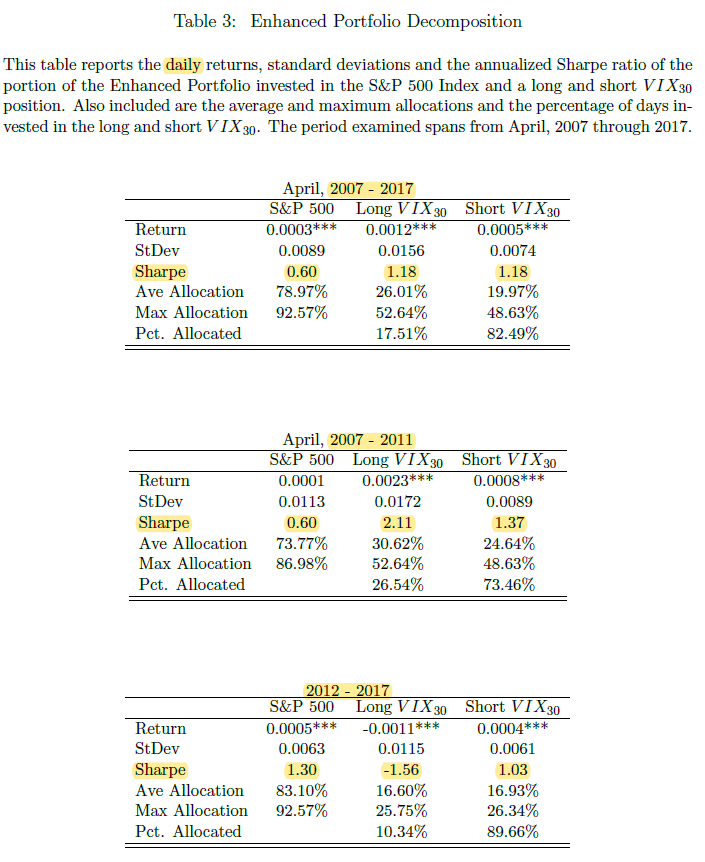

papers.ssrn.com/sol3/papers.cf…

(The expectation hypothesis fails for VIX futures as it does for bonds.)