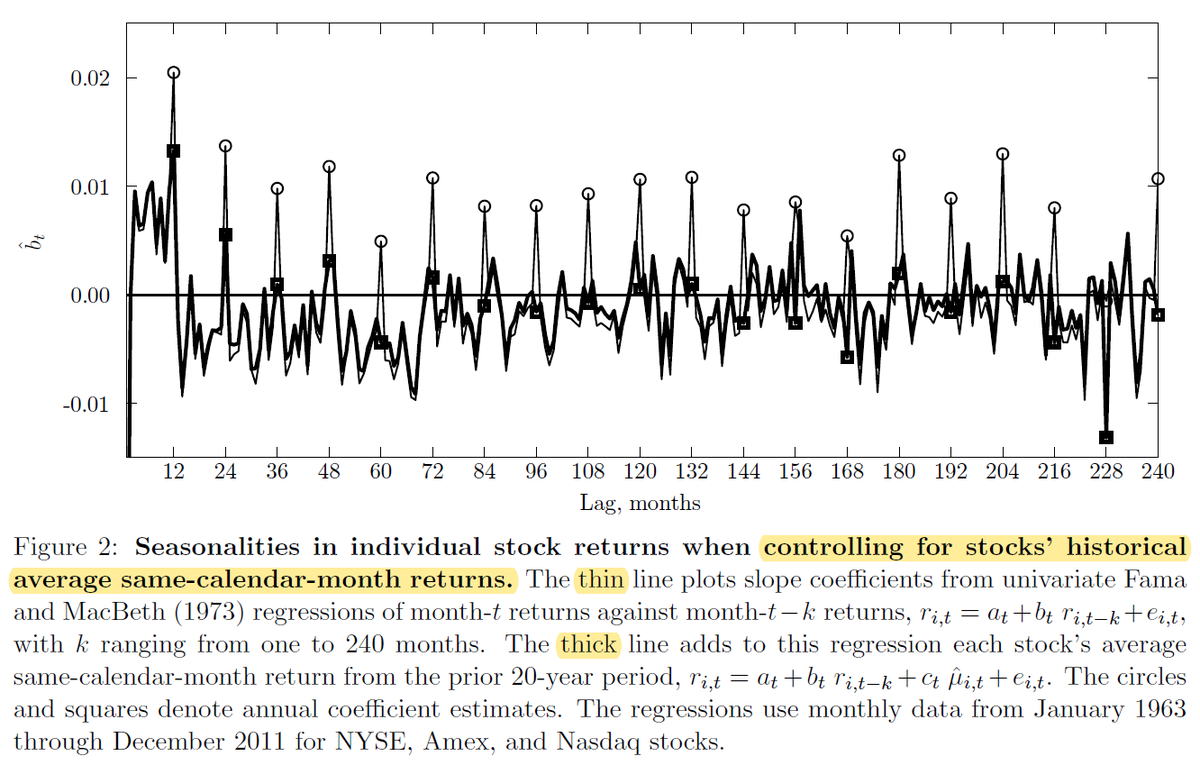

Return autocorrelations (individual stocks)

D’Souza, Srichanachaichok, Wang, Yao

Moskowitz, Ooi, Pedersen

(Goyal and Saretto)

Harvey, Hoyle, Korgaonkar, Rattray, Sargaison, and Hemert

Babu, Levine, Ooi, Pedersen, and Stamelos

Gupta and Kelly

"The monthly AR(1) coefficient for the excess market return is 0.07 during our sample.

"The average for our factors is 0.11, and 50 of them have a larger AR(1) coefficient than the market."