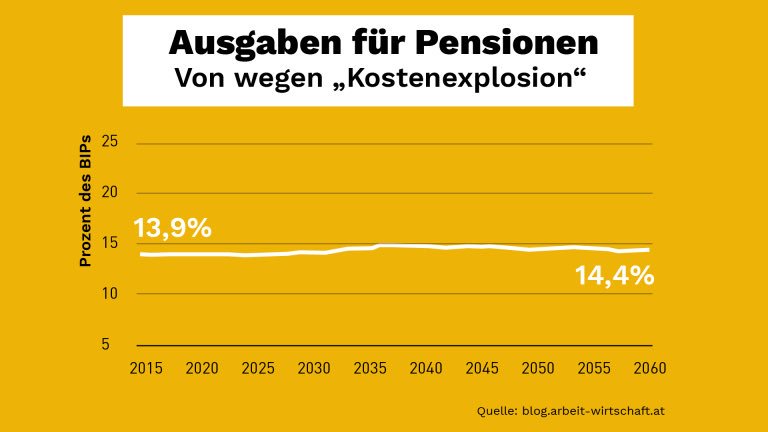

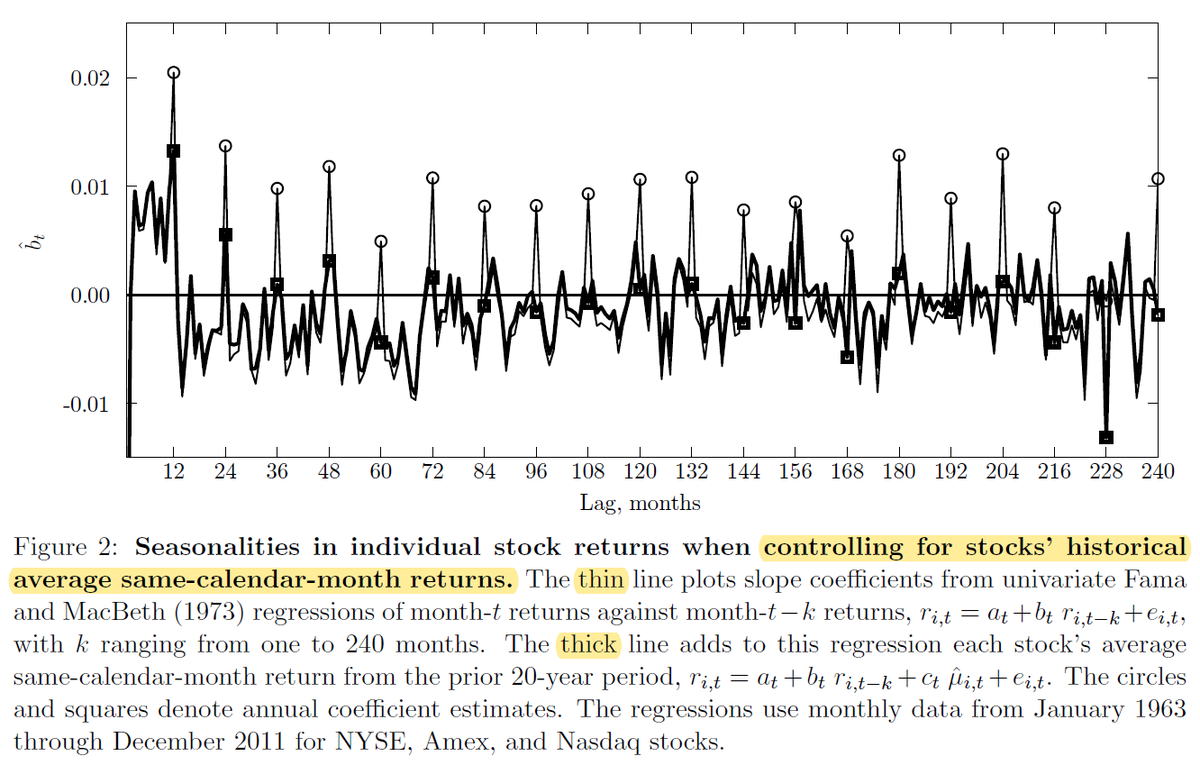

* Stocks, L/S factors, commodities, and country indices have seasonality

* Factor seasonalities are comparable in size to factors themselves

* Stock seasonality may originate from factor seasonality

papers.ssrn.com/sol3/papers.cf…

Thinking of stocks as bundles of factor exposures might lead to other interesting findings as well.

Factor momentum also brings size back to life:

Quality does it too:

So the death of size may not be an open-and-shut case.

Goyal and Jegadeesh examine similar questions for TS and CS momentum: