@McKinsey_MGI has put out an interesting report in their 'Future of #Asia' series titled; 'Corporate Asia: A capital paradox.' Here are a few take aways..(1/8) 43% of the world's largest firms by revenue are based in Asia...#GlobalTrends

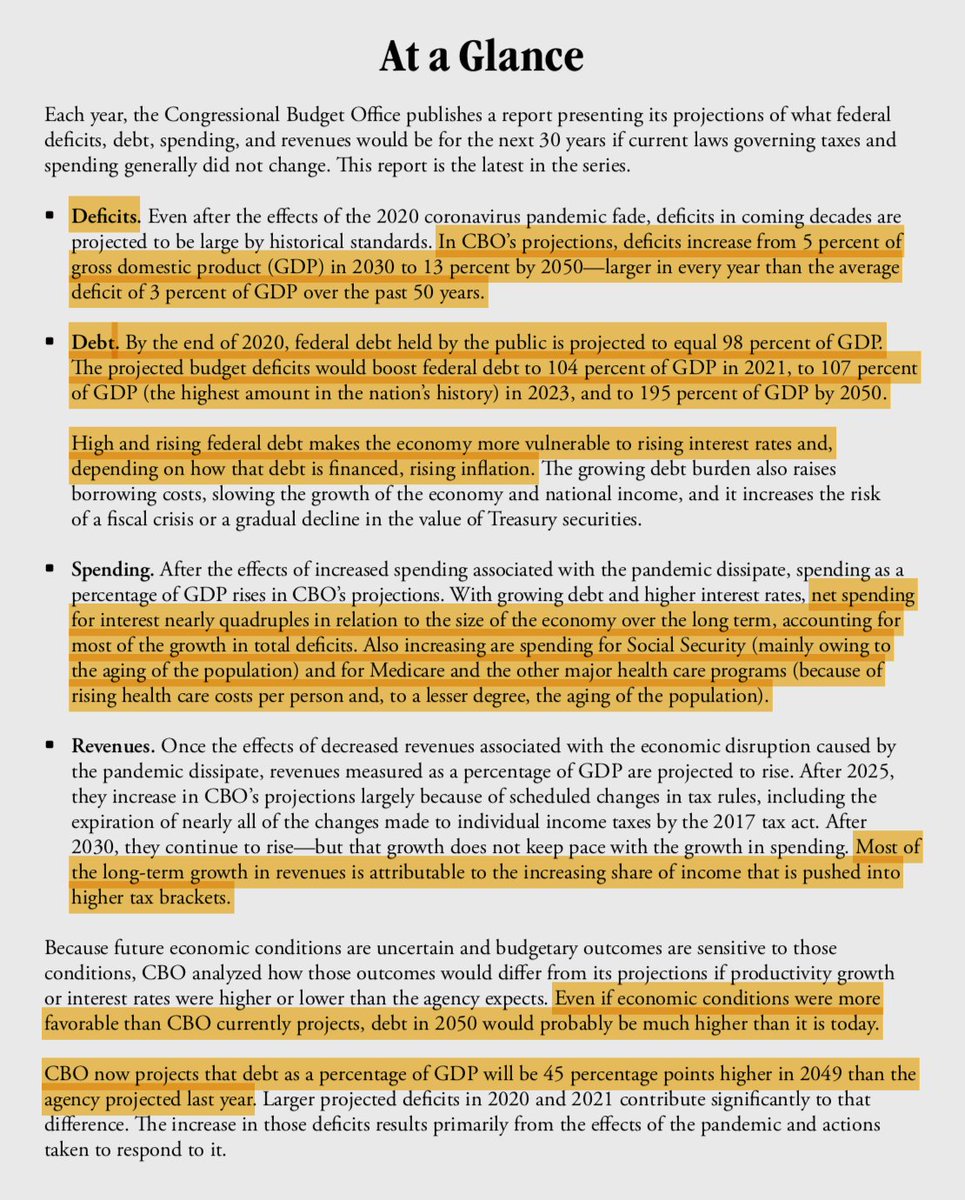

2/8 However 'Economic profitability has declined around the world over the past decade' (Not something that is reflecting in stock market indexes), with #Asia accounting for about half of the decline...#GlobalTrends #Macro #Risk Side note: It's good have a tech/IP focused econ...

3/8 A rough ROIC - "..implying that, u would have needed $0.80 of invested capital to earn $1 of rev. 10 years ago. Today, u need almost $1.10 of invested cap. 2 earn that $1 of revenue."...Good thing corp sector has not levered up big time...#GlobalTrends #Macro #Risks

4/8 What sectors/regions has been destroying profits during the last decade? Tough times in '#Energy & Materials' European financials & #China's (strategic?) allocations to "value-destroying" sectors...#GlobalTrends #Macro #Risks

5/8 "Increased capital intensity of the #Energy & Materials sector has been a prime factor in recent economic profitability losses"...cyclical or structural? And what does it mean for the #commodity exporting nations going forward? #GlobalTrends #Macro #Risks

6/8 Another capital sinkhole of the last decade - #European #financials..2009: 8 of the world's top 30 banks by market cap was in the #UK & Western #Europe. 2019: 3 was left in that top 30. #GlobalTrends #Macro #Risks

7/8 #China's economic loss has been due to domestic services and capital-goods sectors (Bring manufacturing back?) as well as energy & materials...#GlobalTrends #Macro #Risks

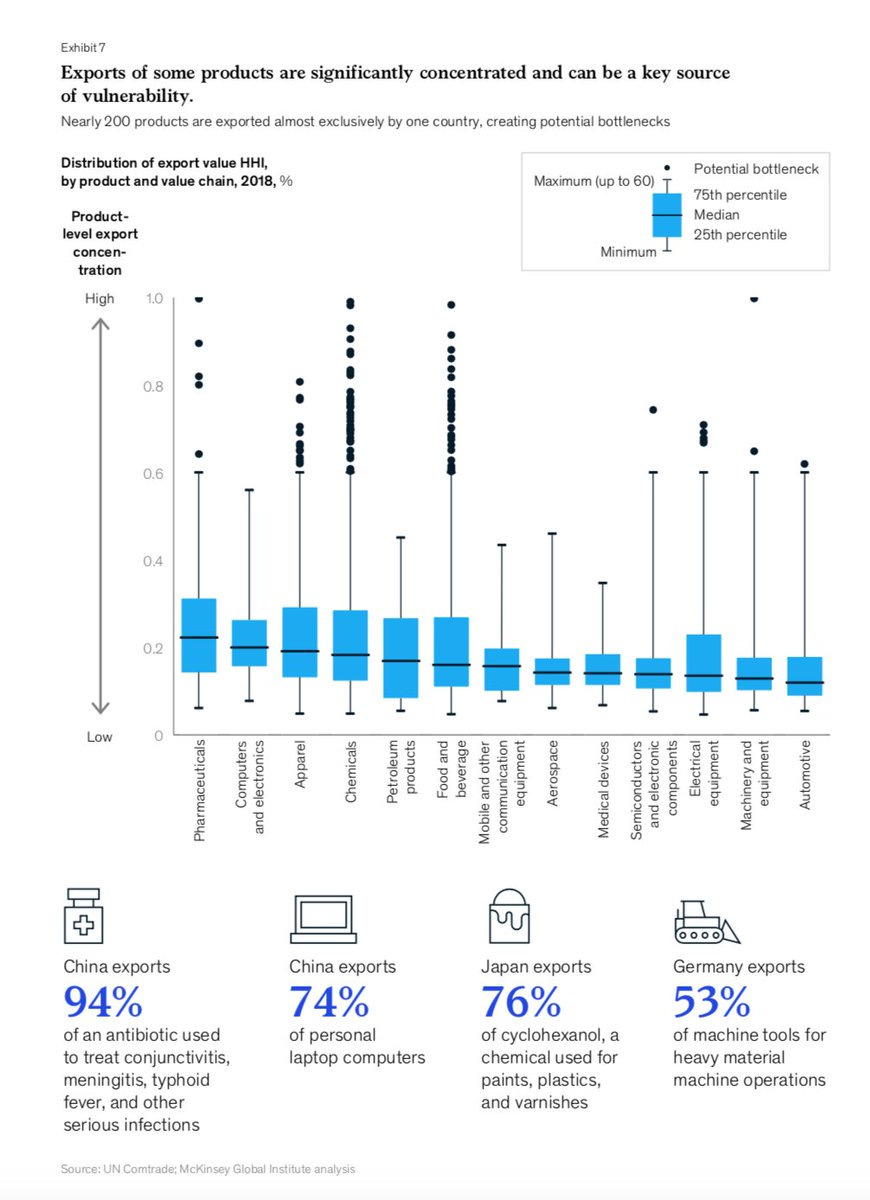

8/8 However there are "pockets of excellence in #Asia" 4 investors...The deepest pockets r in '#Tech-driven (IT & PMP), a space dominated by the #US so far...U can kind of understand why #China is keen 2 keep their China 2025 plan rolling.. #PowerOfInnovation #SoftwareAteTheWorld

• • •

Missing some Tweet in this thread? You can try to

force a refresh