I present the DTF 😏(Discounted Transaction Fundamentals) model.

Vo = Dt/(1+r)^t

Per @Awe_andWonder's log trend, bitcoin is curently returning about 5% per month or 80% per year. So depending on how far in the future you are forecasting, 60-80% discount rate seems safe

medium.com/coinmonks/bitc…

Say we believe bitcoin will transact $1 billion per day in one year.

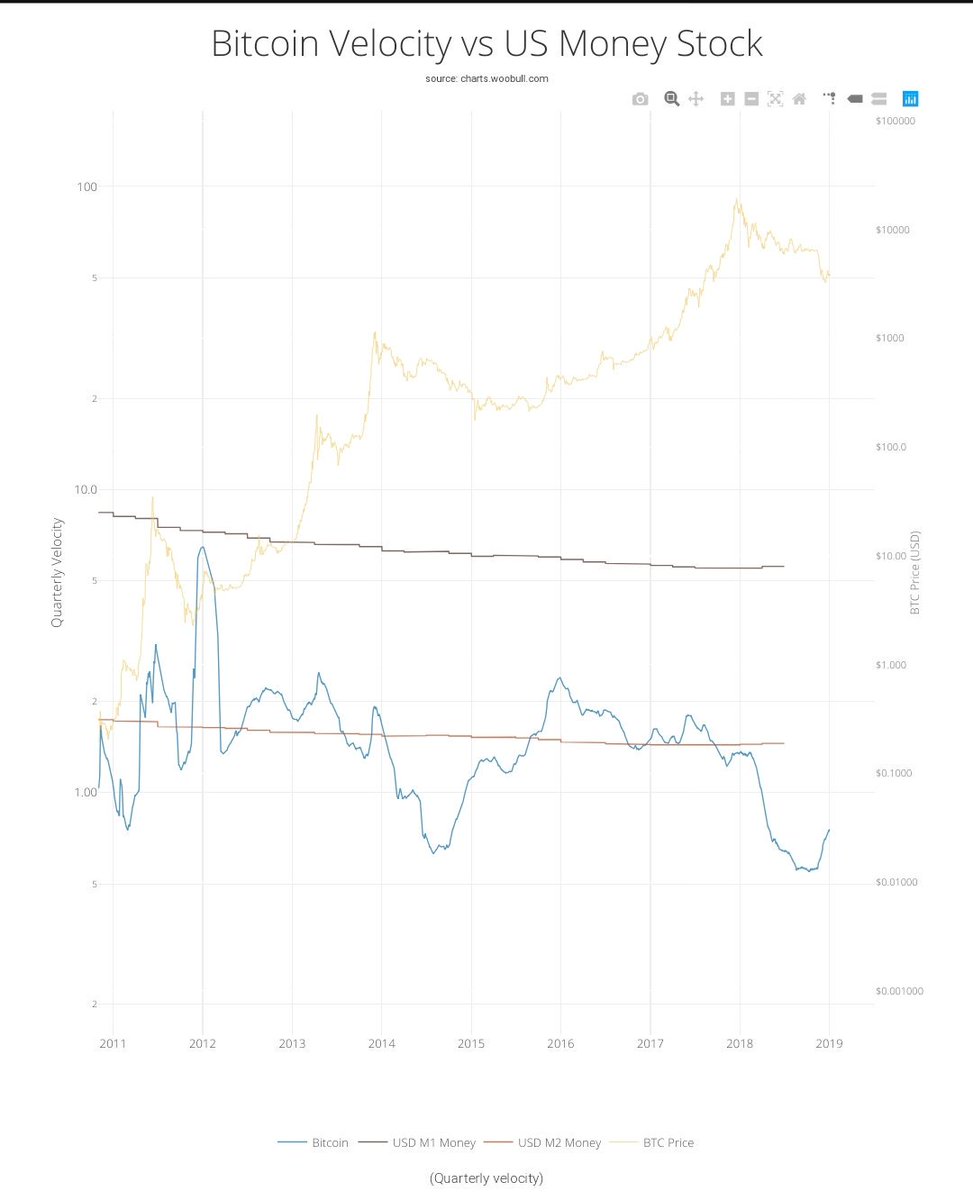

Sticking with historical average velocity, a 70% discount rate and 18,000,000 #bitcoin outstanding we get a current value of:

((1,000,000,000×365)/(4x18,000,000))/1.7)^1

= $2,982 today

Current $BTC price is around $3,800. At the peak in 2017, the Bitcoin network was processing $4 billion per day. Solving for time sees when investors believe the network will process $4 billion daily transactions.

t~=3.1

The market is implying that the Bitcoin network will consistently process what it did in December 2017 in transactions per day in just over 3 years i.e. Q1-2 2022.

Thanks again @cburniske for the thought leadership.

1,000,000 = ((Tusd)/(4 x 18,000,000))/1.7^1

Tusd ~= $42,350,000,000

The Bitcoin network needs to process !!! $42 billion in transactions per day !!! to justify that price

Needed to annualize and adjusted expected supply in Jan 2020.

1,000,000 = ((Tusd x 365)/(4 x 18,250,000))/1.7^1

Tusd ~= $340 Billion PER DAY by NEXT YEAR to justify BTC $1 million today

Today daily tx value is about 1000x less...good luck @officialmcafee