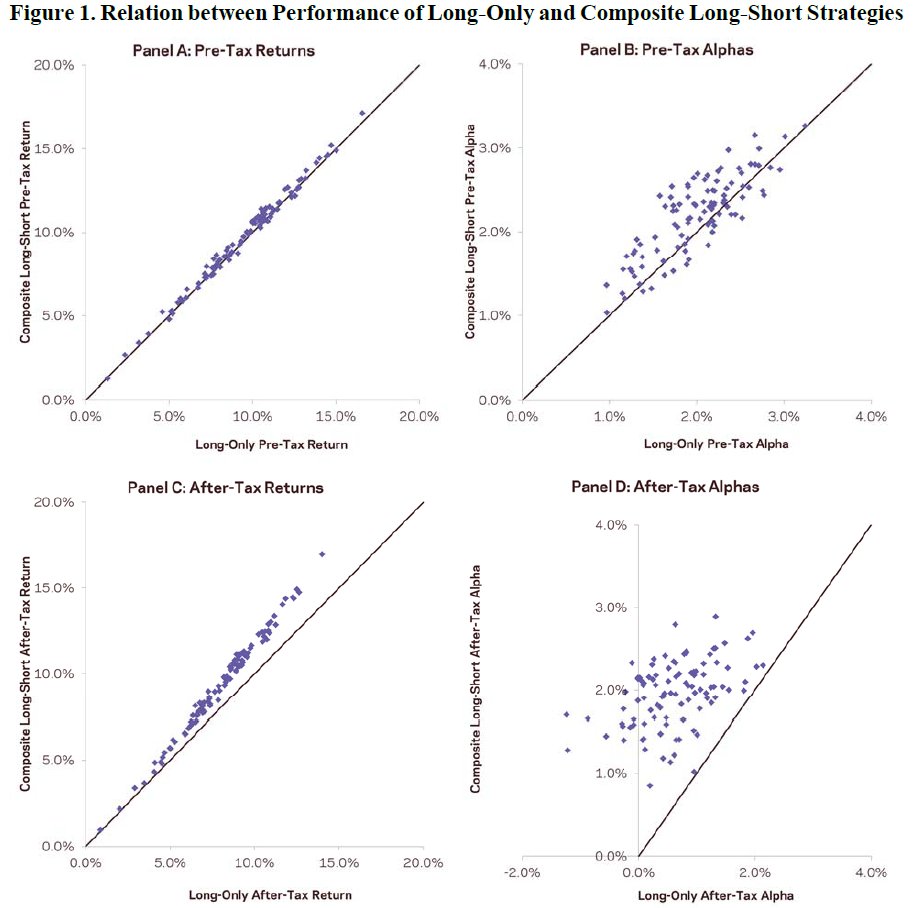

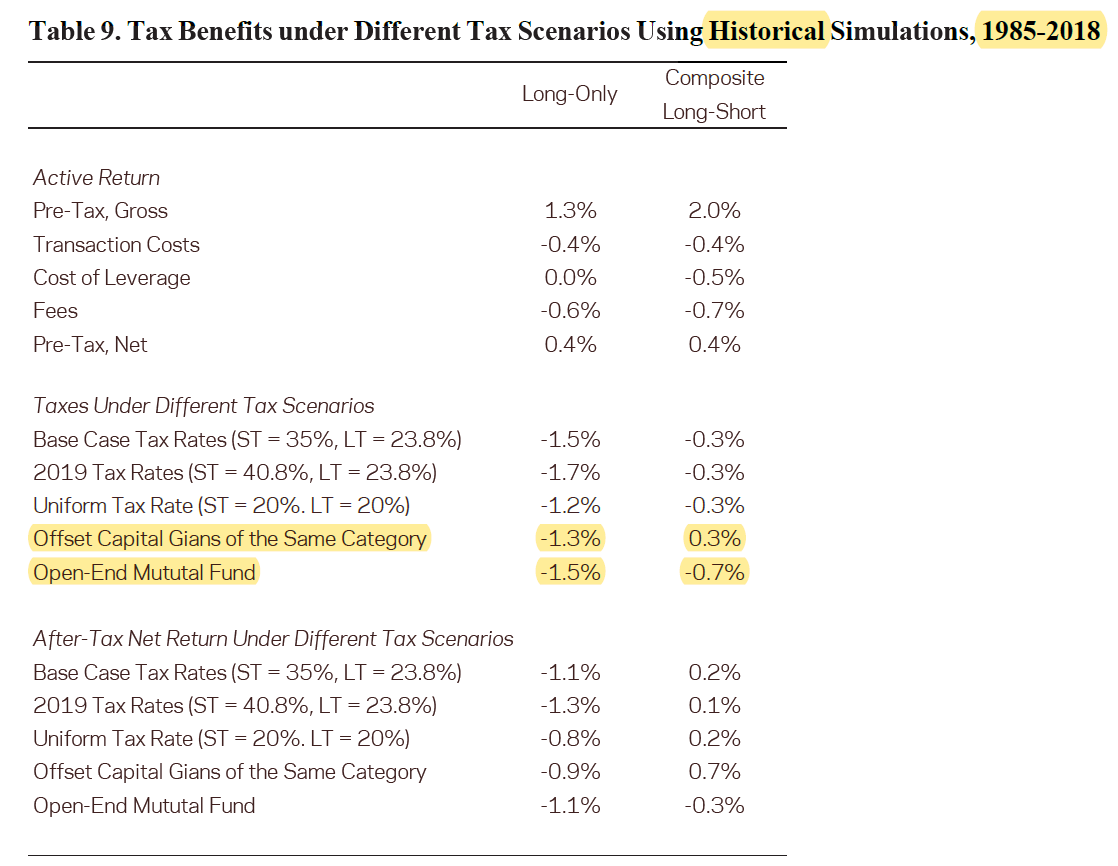

"The turnover of a strategy that separates α from β is concentrated on the long-short component and enables the deferral of capital gains on the passive market component."

papers.ssrn.com/sol3/papers.cf…

Two of the authors find similar results in an earlier paper:

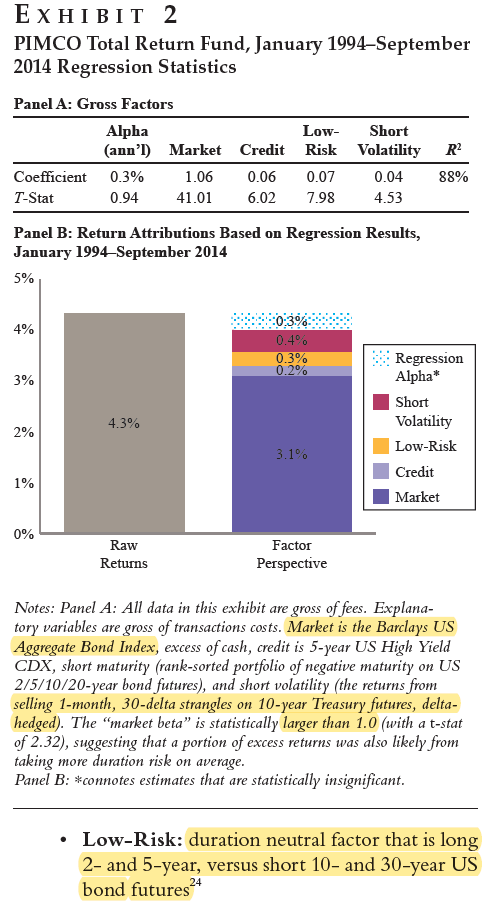

+0.3% tax benefit (tax-agnostic)

+6.1% tax benefit (tax aware)