cbinsights.com/research-unico…

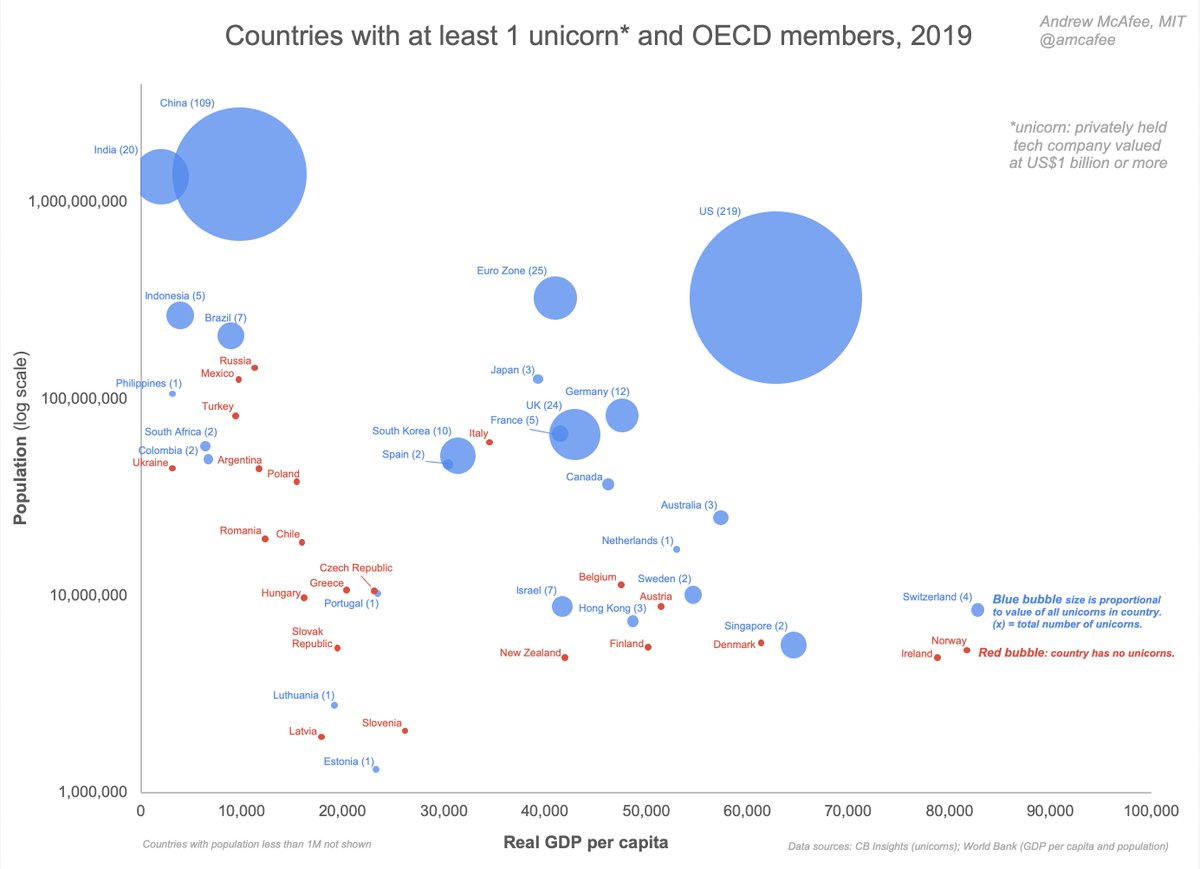

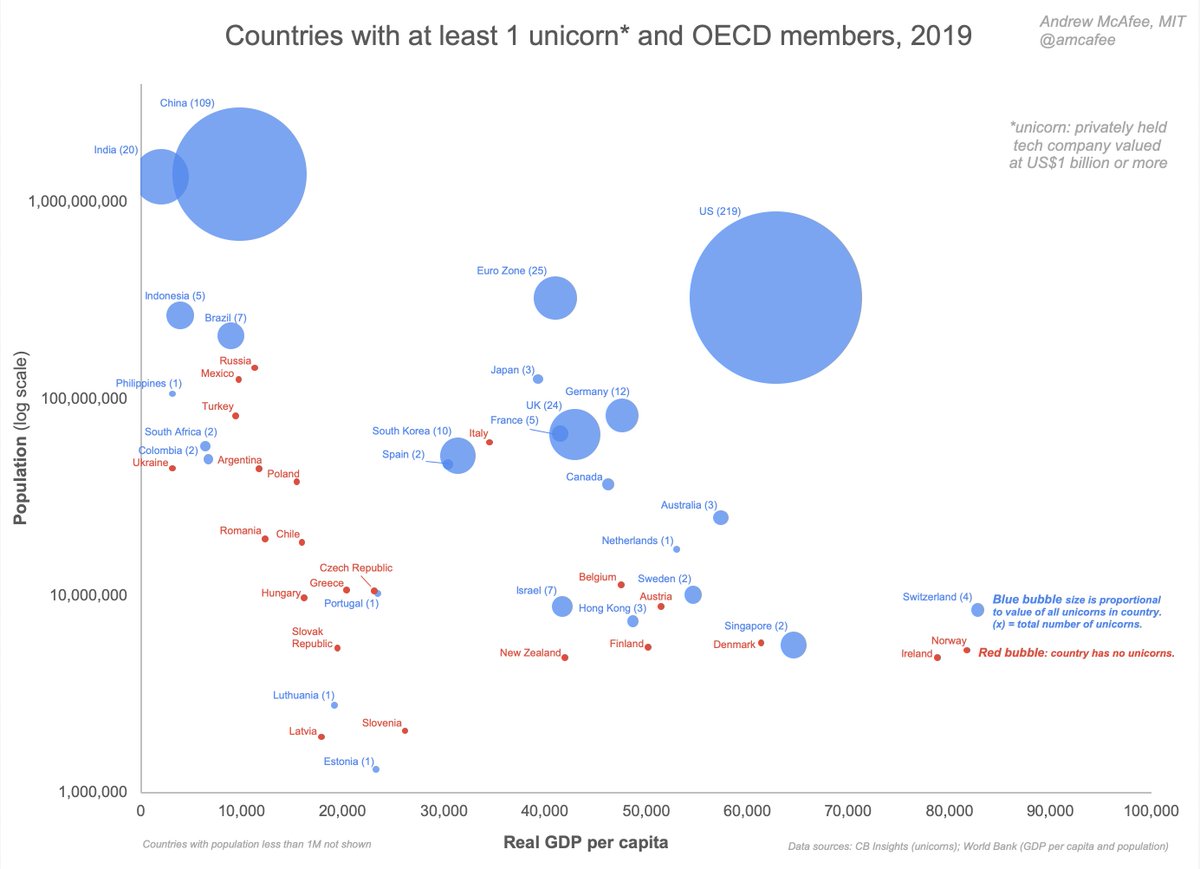

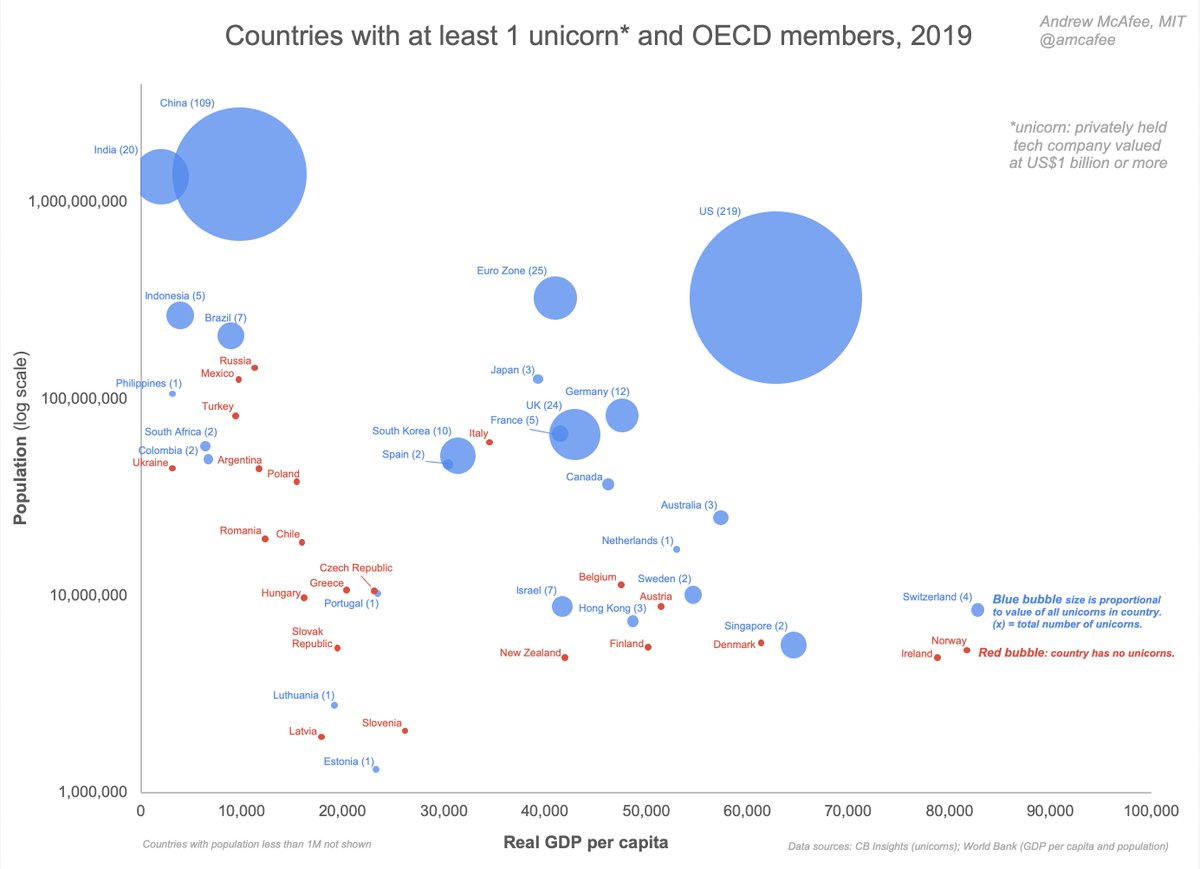

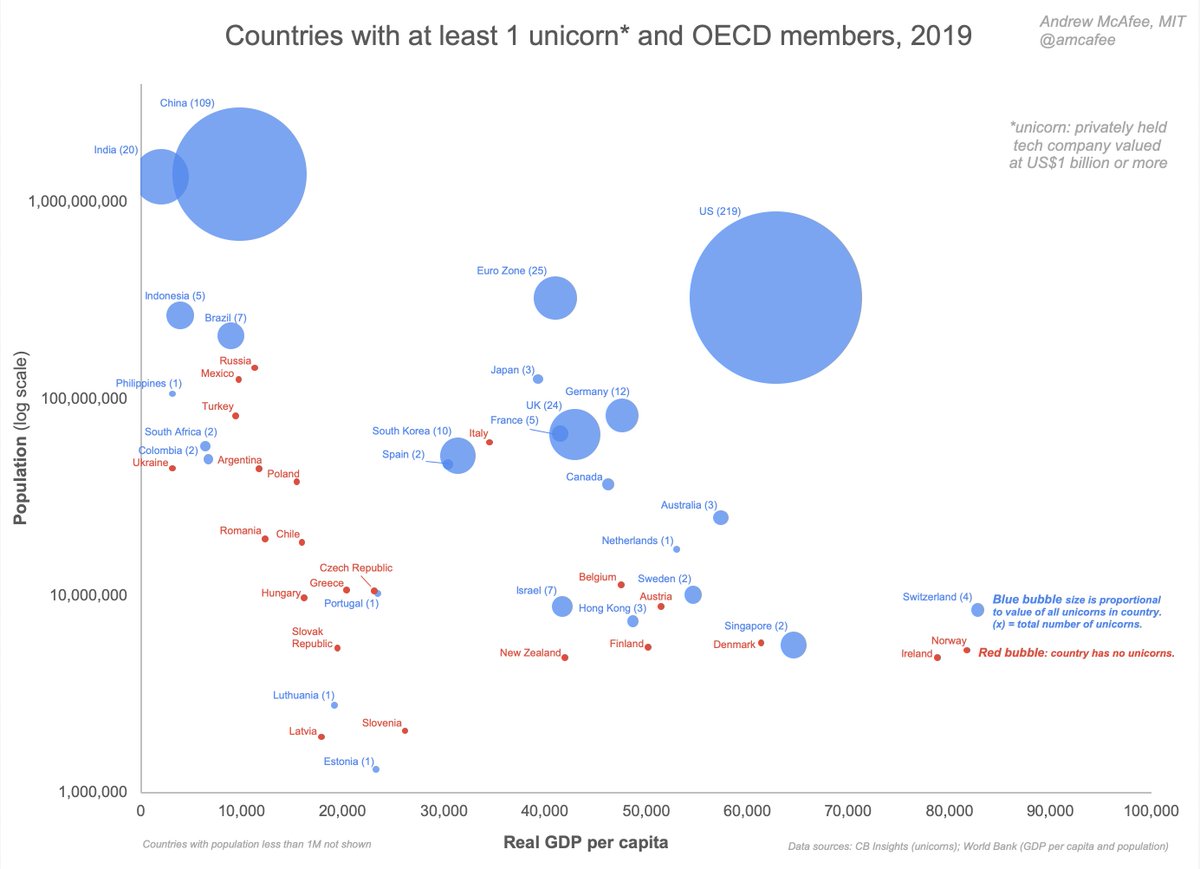

It also has red bubbles; what do they represent? They represent relatively rich countries (i.e. members of the OECD) that don’t have ANY unicorns.

(all data are here: docs.google.com/spreadsheets/d… )

Keep Current with Andrew McAfee

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!

assumption? https://t.co/UPFb4FOgtc

assumption? https://t.co/UPFb4FOgtc