If we break the D3 support here before reaching into the red zone, buying the dip inside the weekly supports is the better choice.

That means if, at any given moment this week, we take out any of the liquidity pools AND close back above last week’s low, that’s a long.

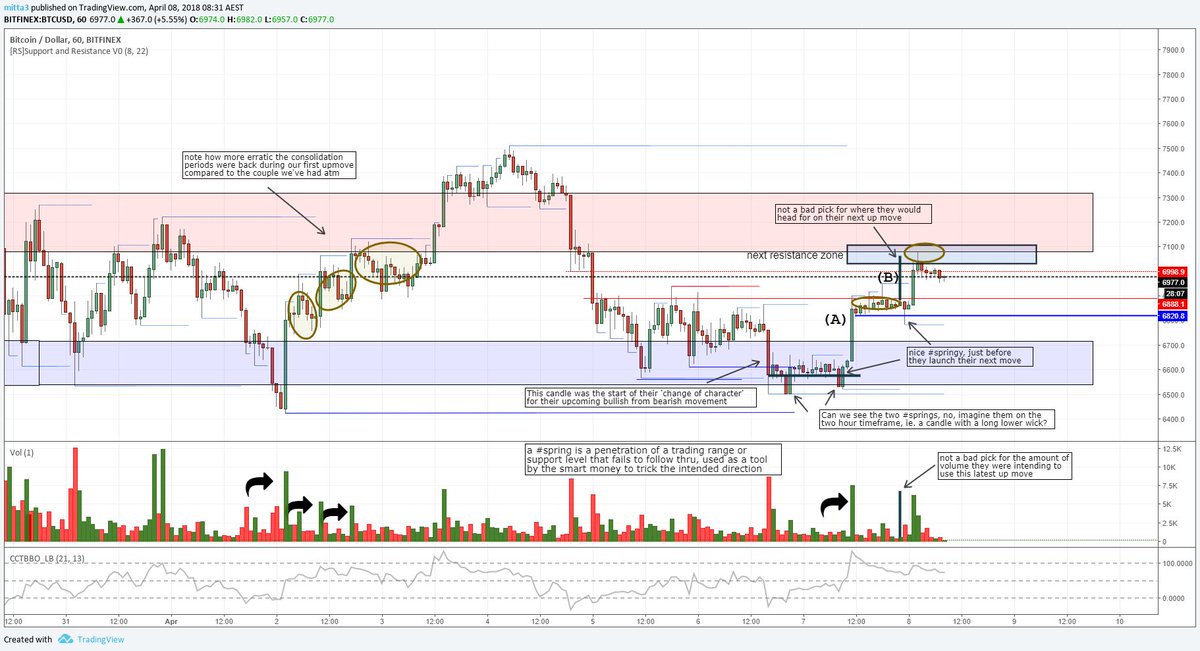

@CryptoCalibur #Bitcoin