scmp.com/news/hong-kong…

scmp.com/news/hong-kong…

Okay, u say, well, so what?👇🏻

caixinglobal.com/2020-02-28/dil…

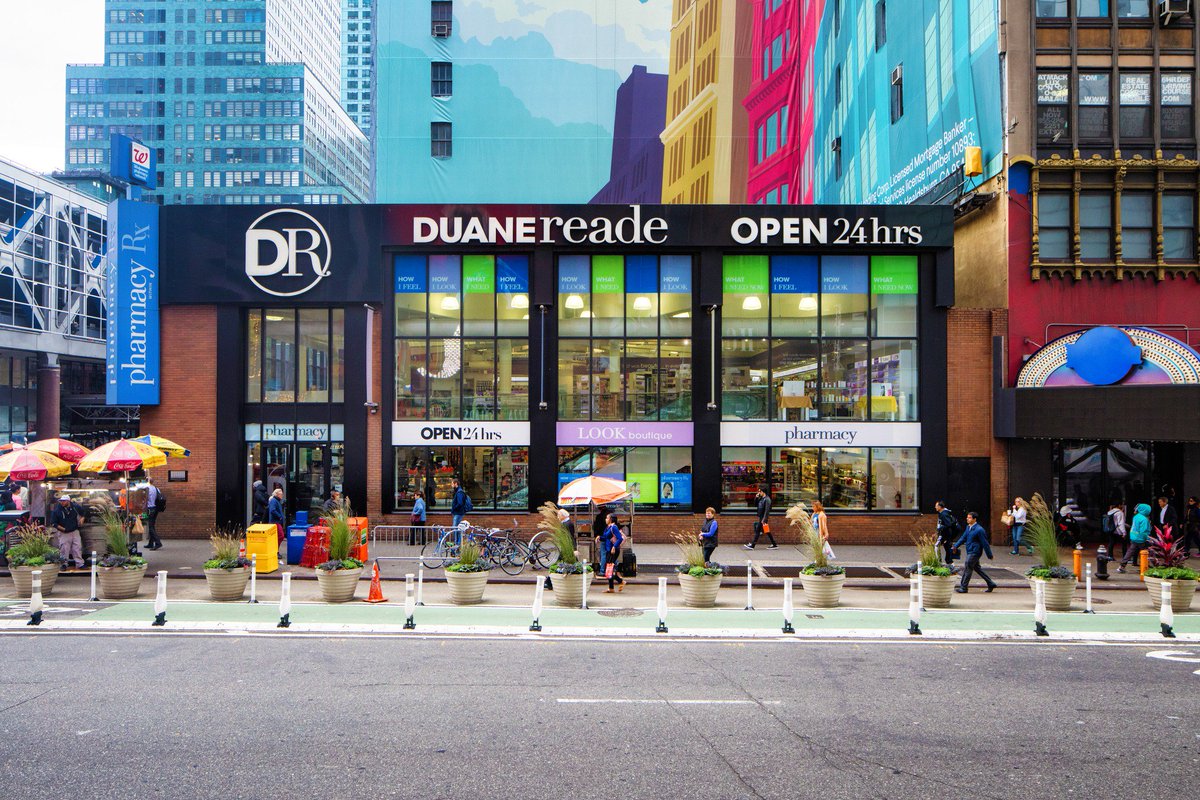

They are key to ANY economy, including Hong Kong & mainland China. These are the people that buy goods from big publicly listed firms. They matter.

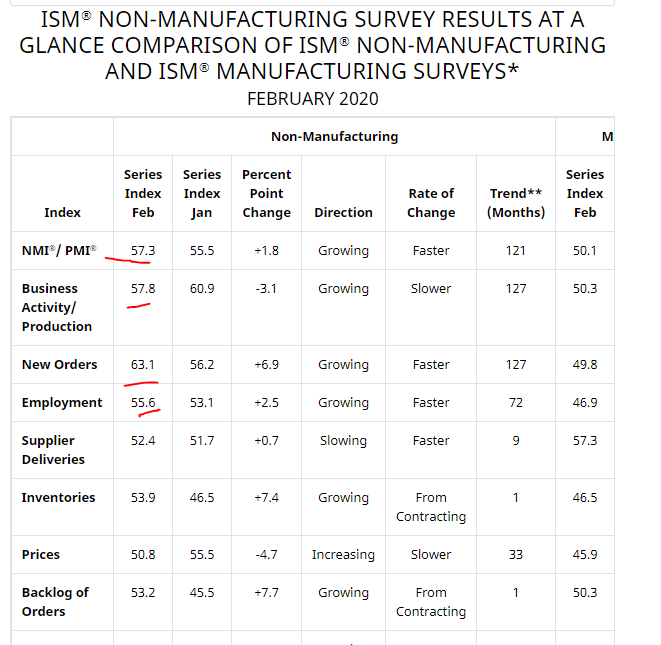

What has happened? Only 1/3 OPEN in China.

Rent + utilities = 15-20% costs of restaurants, 30% for small retailers & 50% for small grocery stores. They can say get rid of variable costs but still got sticky costs.

About 85% of them will run out of cash in 3m

Btw, it makes sense as smaller ones are riskier. So what? Well, help totally needed for small firms. Can't makeup for service income losses. Don't forget

Bigger firms = HIGHER COSTS

Smaller firms = No labor, no business

So however u slice & dice this, u can't square the missing of people in the output equation.

So what u say? Well, China is supposed to be efficient & cheap!

a) Higher costs of production for electronics = either erosion of profit margins for producer or higher costs for consumer (erosion of purchasing power)

b) CEOs have to consider, is it prudent to put all the supply chain eggs in 1 basket?

So?

a) We need to have some packages for the smaller guys & totally targeted b/c they don't benefit & if they get hurt then we got a major DEMAND problem as they are KEY

b) Once everything normalizes, risk assessment changes & that means change of investment 👈🏻👈🏻