So the Fed has to make the call on US Q2 2020 GDP on mid Q1 data before the virus hits. Mr. Markets wants moooore!!!

Btw...

Next wk: CPI & PPI + trade (or lack there of)

Feb monetary data

and most importantly: Feb IP, retail sales, FAI.

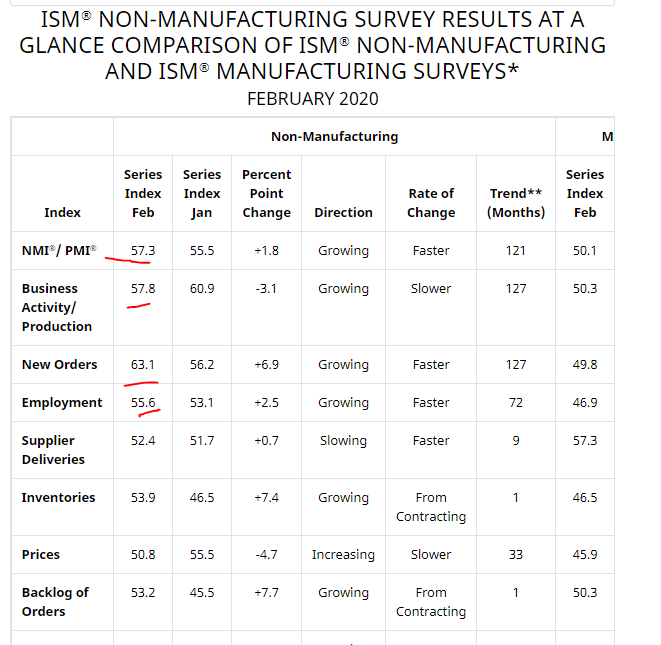

All to be weak given worst than ever PMIs.

USA (increasingly infected growth wise although strong before the virus hits)

Japan contracted before the virus so won't be better after

China slowed before & gonna hurt in Q1

Korea slowed before & will defo slow.

China: 53.3% (note Feb PMIs show that services collapsed & will recover in March & April, like slow & can't recover & income losses gone). Don't forget manu lowest ever too

Japan: 70% (note that it already contracted in Q4 & don't get excited about 2020)