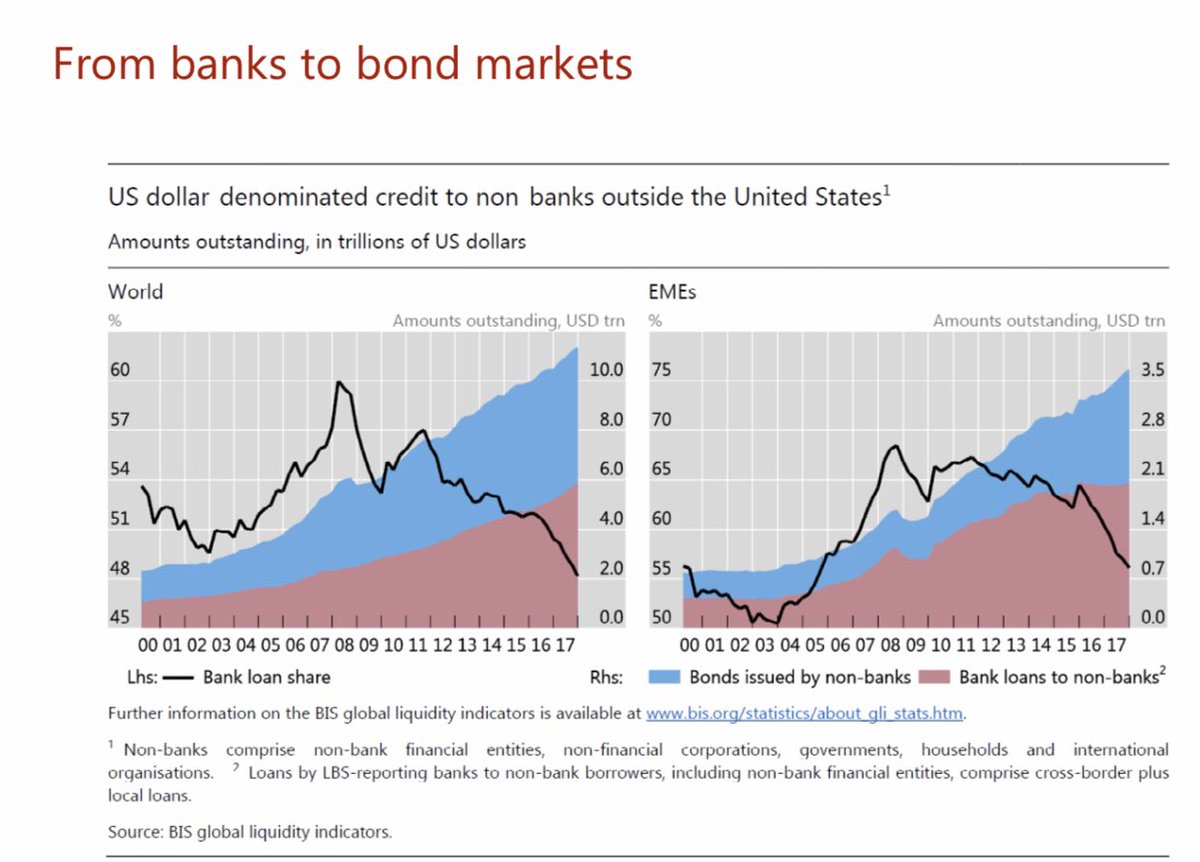

Great presentation by @HyunSongShin

ecb.europa.eu/pub/conference…

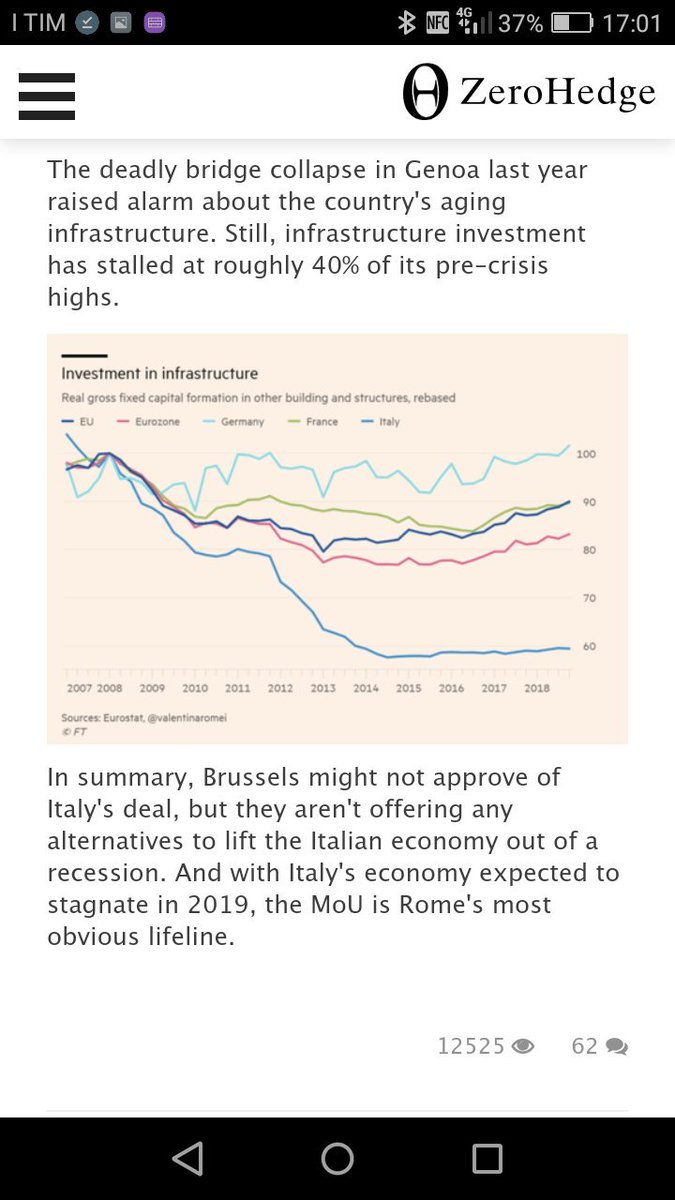

IMF chief: we are rethinking our advice to emerging markets ft.com/content/b53468…

🇦🇷 Mauro Alessandro @BancoCentral_AR

🇦🇪 Arif Amiri @DIFC

🇹🇷 Uğur Namık Küçük @CentralBank_TR

🇿🇦 Chris Loewald @SAReserveBank

🇮🇩 Dody Budi Waluyo @bank_indonesia