Read this thread. All the way through. It is full of claptrap and fear-mongering.

If you want, you can follow along in my thread.

"Why wasn't it evident as it was building? Bc interest rates are mispriced--artificially low"

No.

That's not how markets work. One does not attract investors in ever dodgier debt by lowering the nominal return.

"Because markets misled it."

Whuh?

Business makes plan. Presents plan to investors. Investors believe business plan, invest. All OK so far.

It must have been because "the market" (i.e. investors in business).

No. Investors did not mislead shale business. This is a fundamental misunderstanding of how investors work, how markets work, and how businesses work.

Maybe. Maybe they thought they were special and existed in a vacuum and increasingly competitive production was meaningless to a cmdty price.

But this did not cause business to borrow more.

b) not "backfill"

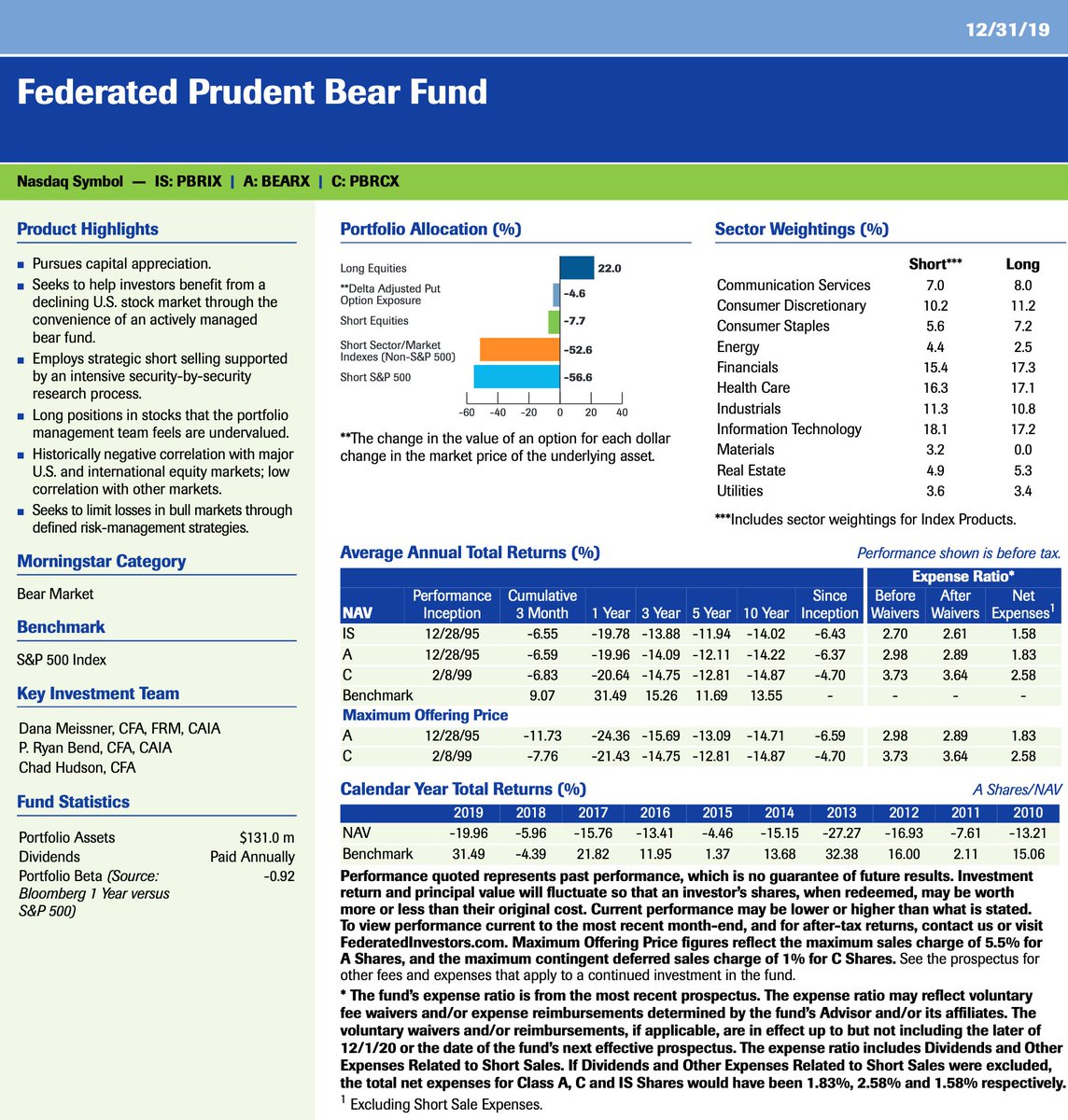

But... "For perspective, debt in US nonfinancial sectors (households, biz, govt) went up 10% in past 2 yrs!!!

"So, to put this week's multi-trillion$ monetary & fiscal stimulus into perspective"

This week did not see "multi-trillion$ monetary" or "fiscal stimulus". It saw the Fed ensure the repo market works. It saw no large number of fiscal action.

Of that $4.7trln in new debt, it was...

Public Debt +$2.5trln

HH +Nonprofit +$1.0trln

Nonfin corp +$1.2trln

So private debt +$2trln, GDP+$2trln.

Meh...

I agree on "bazooka."

Stimulus it was not. Nor even real QE.

Not sure how she says "stimulus hasn't worked". If looking at auction results, no stimulus. If you know WHY repo mkts are wonky, you know it's tough.

Bazookas sometimes miss.

Vol goes from 5% swings to 20% swings to 50% swings intraday, up and down.

Reader: What should we look for?

Cate: Try 20%. In one example, near the end the swings were 50%. YES, 50% INTRADAY SWINGS UP & DOWN!!

Reader: Will that happen here?

Cate: Dunno, but don't be surprised if yes.

Will that happen here? "Dunno"

I assume Cate is all in VIX long at 70.

What none of these crypto shills (I assume anyone making their living off crypto is a shill, not someone who actually believes moving the world from current state to non-fiat limited supply crypto is a) good, b) possible) gets is how their dream is achieved.

It is an extraordinary grift. And when it doesn't "work", those who sold it to you will own the thing they warned you about to convince "you" to buy crypto. And it will be "THEY'RE" fault.

Done.