Record low interest rates & QE caused a "tsunami of liquidity" to flow into EM bonds, pushing yields to record lows.

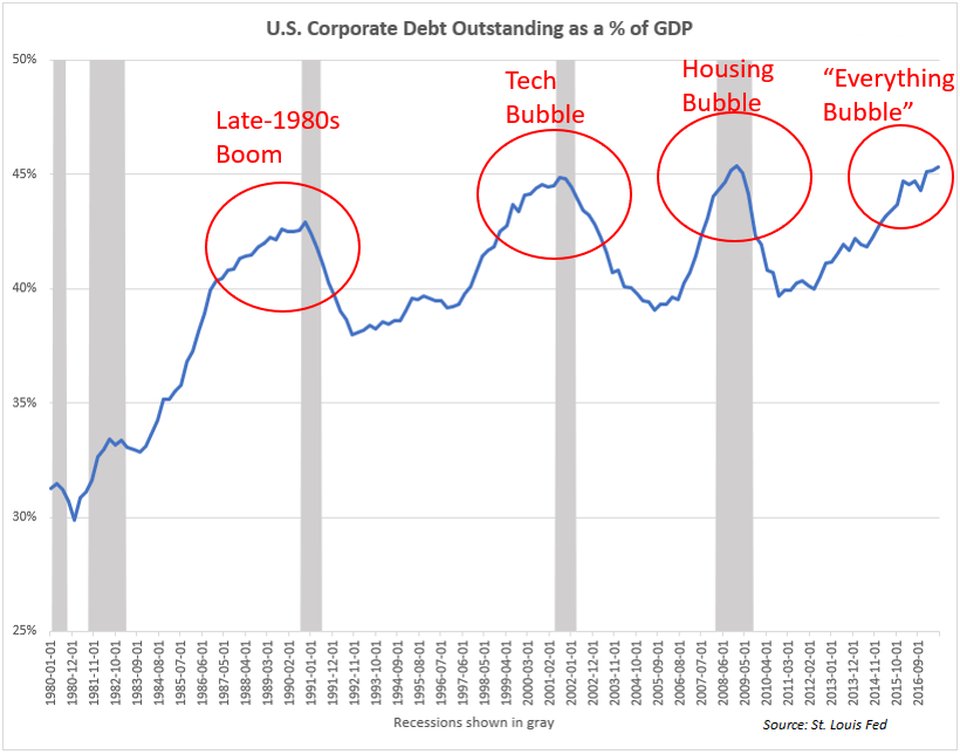

That created property & credit bubbles in EMs.

Those institutions were basically "shorting" Dollars, but are now forced to scramble & pay back loans as the EM bubble bursts.

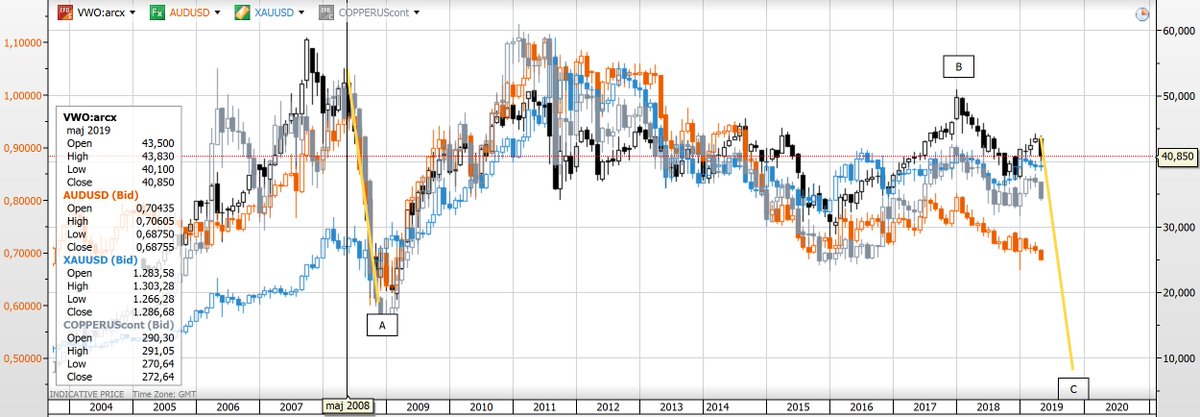

They are also jettisoning EM assets, which is causing the crash in EM currencies/assets.

That's exactly what is happening, unfortunately...

forbes.com/sites/jessecol…

There were also carry trades in Canadian and Australian assets (which had higher yields like EMs).

That's why those currencies/assets are sinking so hard too.

That carry trade was behind MANY bubbles.