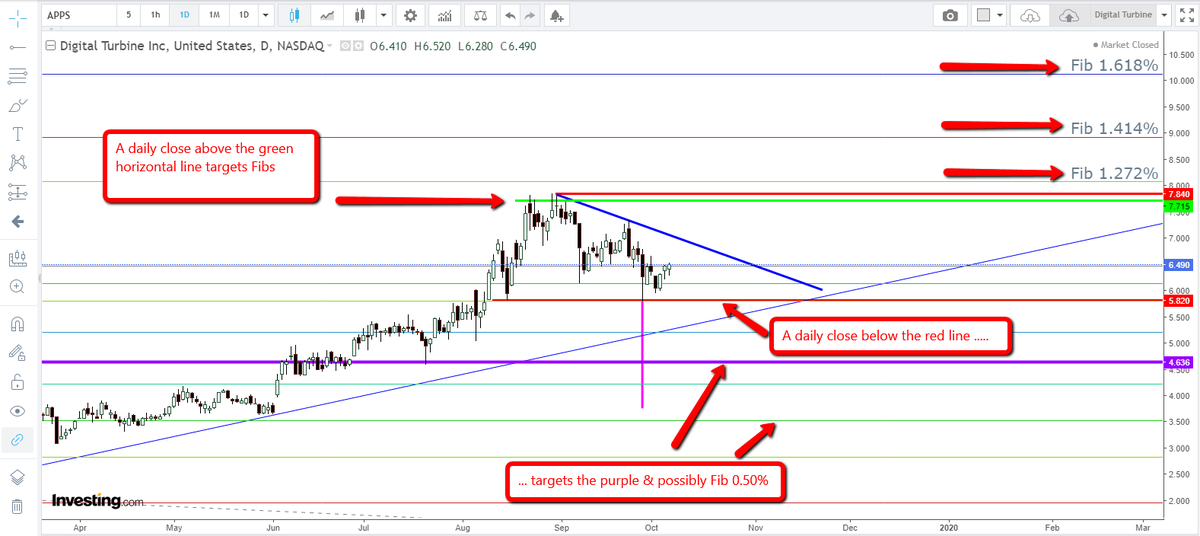

Sellers dominate the market, a base is formed and price rallies upwards. Inverted #Fibs are drawn catch resistance.

3/16

Buyers enter at purple pivot line as failed stop hunt is soaked up, another stop hunt creating a short squeeze higher. Sellers take control of pivot and new rising #trendline fails & turns into trendline pivot. Price reacts for 8 months until sellers take control.

5/16

The magenta vertical line is equal to the space between the 2 red horizontal lines. A daily close below the bottom red horizontal line will target stale buyers (adding to positions) ....

14/16