#Breaking: Treasury has released Interim Regulations for the #PaycheckProtectionProgram

I'm about to review and break them down, but before doing so, I just want to quickly mention how incredible it is that @USTreasury got these out before tomorrow "Opening Day".

So👏

Note these Regs provide an IMMEDIATE INTERIM RULE, which means they are effective right away, despite not having undergone a (normally-required) comment period.

As a result, these are Regs which CAN be immediately relied on, but comments ARE requested for a 30-day period...

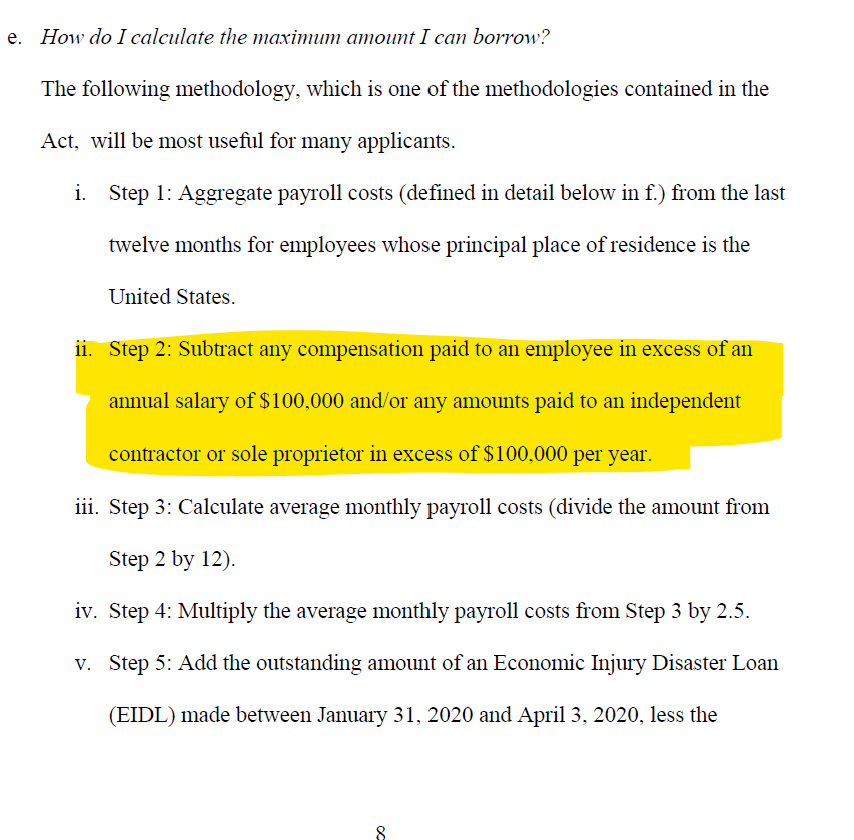

Section 2e provides clarity on employees making more than $100k in compensation/year.

Notably their comp IS included in loan calc, up to $100k. I thought this was clear from #CARESAct, but received feedback from several saying they were flat out ignored in calc. They're NOT!

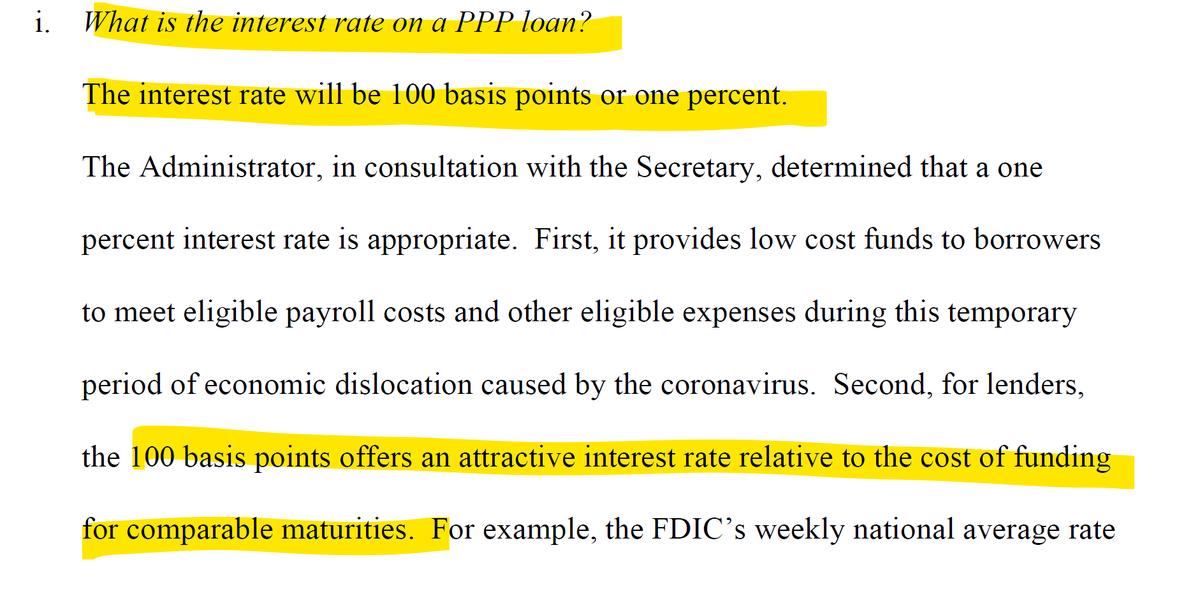

Despite initial statement (+ info sheet) from @USTreasury saying interest rate would be 0.5%, Interim Regs confirm Mnuchin statement earlier today... rate is 1%.

This is a HUGE win for lenders. Half a point on $349 billion/year is a lot of money! That's on top of orig fees!

And only 25% of the amount of the loan that is forgiven can be attributable to non-payroll costs.

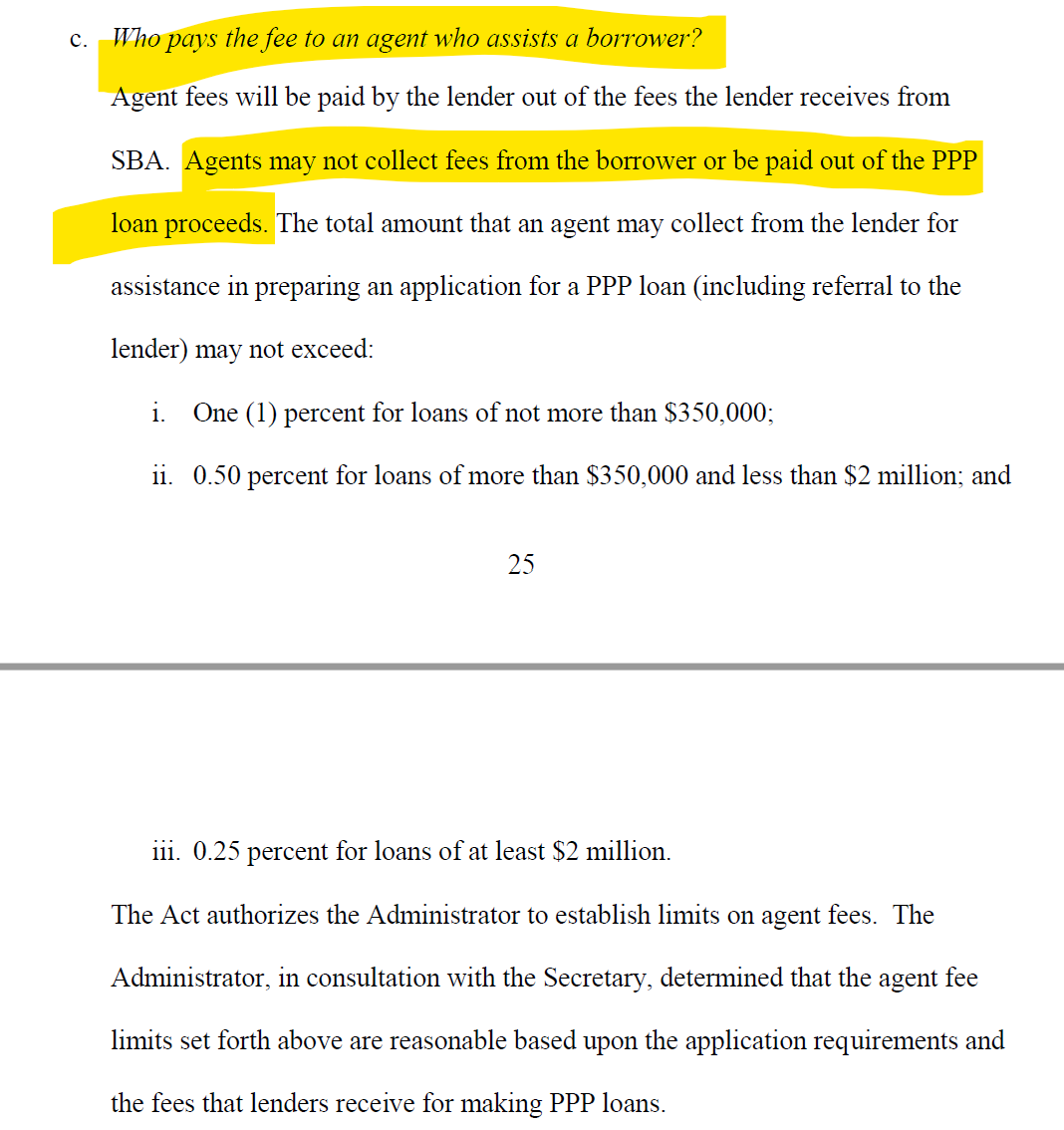

REALLY important point here for CPAs, attorneys, and other persons assisting borrowers with their #PPP loan apps.

🚨YOU CANNOT CHARGE THE BORROWER DIRECTLY!🚨

Your fee will be paid by the lender, and cannot exceed certain amounts.

Def still going to be many Qs about the #PaycheckProtectionProgram for which we don't have answers, but overall, this was good.

Several previously open Qs have been definitively answered, which is helpful b/c, you know... applications beginto be accepted TOMORROW!

End👊