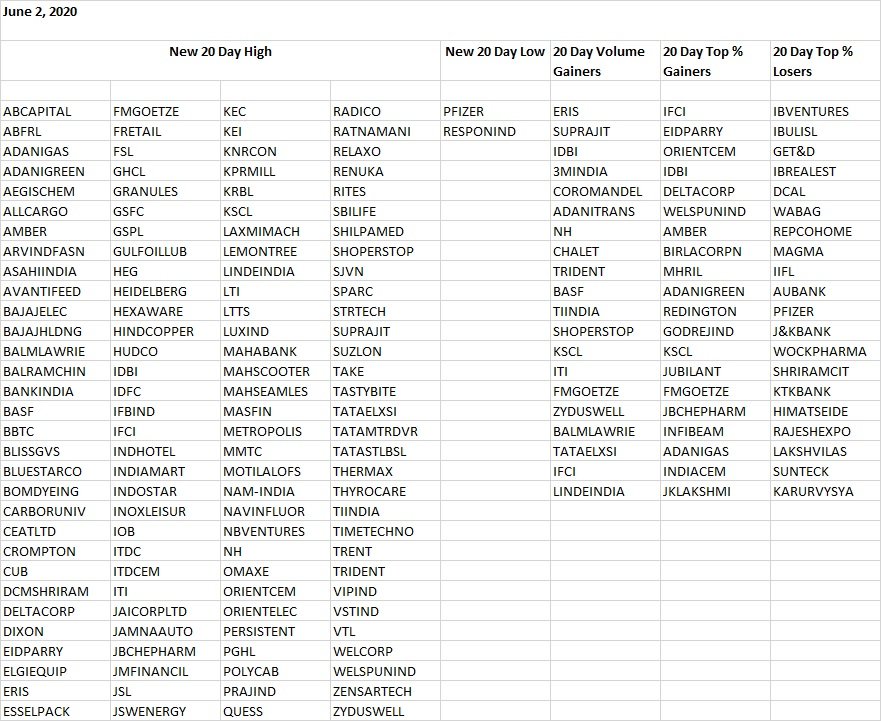

Introducing the #T20list

This list covers #CNX500 stocks but excludes F&O stocks from the study

stocks at new 20Day highs or lows suggest range #breakout

20Day volume gainers indicate #action

top 20Day % gainers & losers suggests #momentum

This list covers #CNX500 stocks but excludes F&O stocks from the study

stocks at new 20Day highs or lows suggest range #breakout

20Day volume gainers indicate #action

top 20Day % gainers & losers suggests #momentum

#Locustsattack could lead to a #bounty for #agrochemical companies

Smaller #cement stocks are gaining interest. Watch out.

#stockstowatch #howtotrade #trading #T20list

Smaller #cement stocks are gaining interest. Watch out.

#stockstowatch #howtotrade #trading #T20list

Agro-chemical and cement stocks continue to dominate the #T20list as most of them gain ground today.

#stockstowatch #howtotrade

#stockstowatch #howtotrade

PSU Stocks Gain Interest

Notice the PSU’s I have marked in bold in today’s #T20list. 3 PSU stocks are featuring in the new 20 day highs and volume gainers list. Several PSU stocks apart from them also gained ground today. Watch out for more action in the days to come.

Notice the PSU’s I have marked in bold in today’s #T20list. 3 PSU stocks are featuring in the new 20 day highs and volume gainers list. Several PSU stocks apart from them also gained ground today. Watch out for more action in the days to come.

Financial services is a theme which is emerging from today’s #T20list. You can notice stocks marked in bold from industries like credit rating agencies, mutual funds, insurance, depositories, commodity and energy exchange. Keep a close eye on them.

Buyers Spoilt for Choice

The highlighted stocks in new 20 day high and top 20 day % gainers list are also in the top 20 day volume gainers list. These stocks have both price action and volume working in their favour.

#T20list

The highlighted stocks in new 20 day high and top 20 day % gainers list are also in the top 20 day volume gainers list. These stocks have both price action and volume working in their favour.

#T20list

124 stocks out of 350 breakout above their 20d highs.

Its a difficult choice but u must go with fundamentally strong stocks. Don’t go too overboard. Markets normally throw surprises when nobody expects it. #T20list

Its a difficult choice but u must go with fundamentally strong stocks. Don’t go too overboard. Markets normally throw surprises when nobody expects it. #T20list

The tally of stocks breaking out is rising consistently. Hope ur enjoying. However, I’d like 2 remind you to practice abundant caution now as many dud stocks have also started moving higher. So don’t fall for it. Choose only the best ones to trade and enjoy until the party is on.

• • •

Missing some Tweet in this thread? You can try to

force a refresh