I help investors and traders by bringing actionable insights and strategies to take the right decisions in market.

How to get URL link on X (Twitter) App

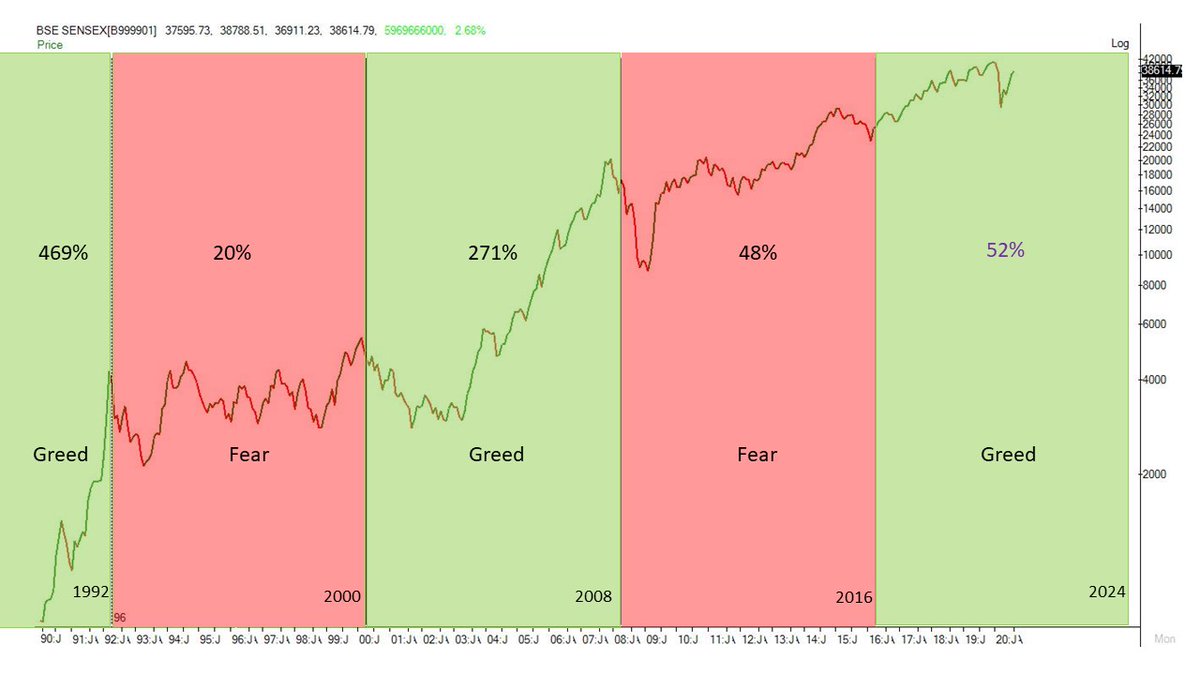

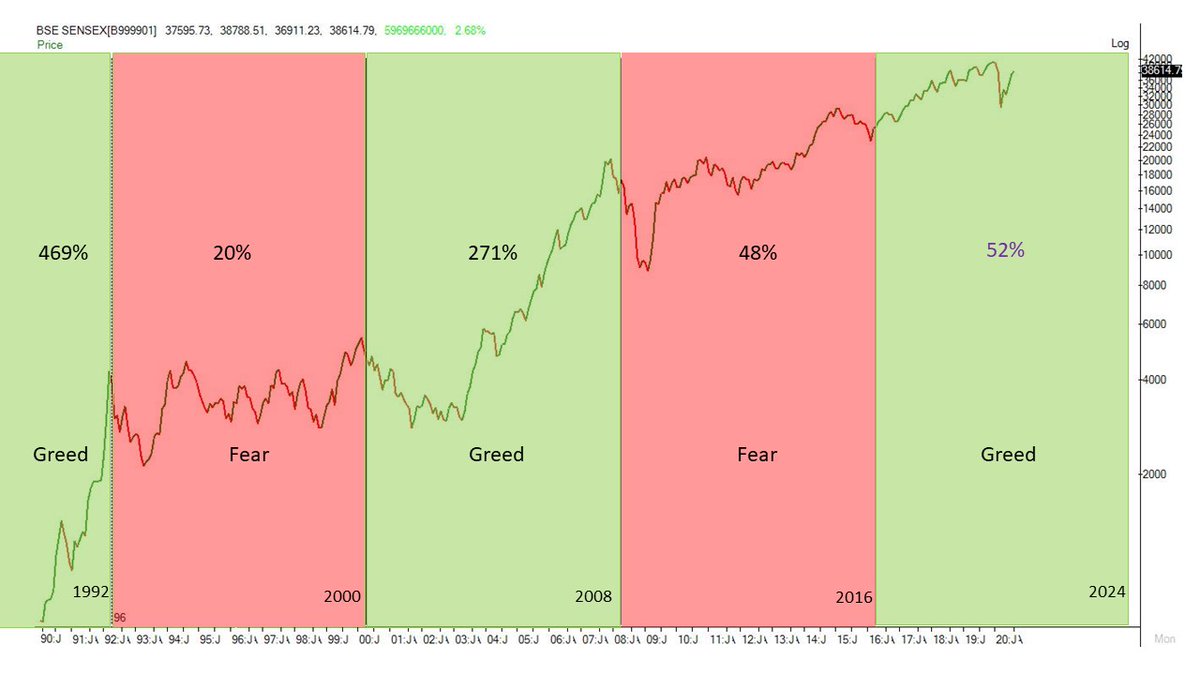

Above is a monthly chart of #Sensex. It goes through an alternating #greedandfear cycle of 8 years. Sensex moves up in greed phase and consolidates in fear phase. It was up 469% in greed phase of 1992. was up only 20% from 1992 to 2000. From 2000 to 2008 it was up 271%.

Above is a monthly chart of #Sensex. It goes through an alternating #greedandfear cycle of 8 years. Sensex moves up in greed phase and consolidates in fear phase. It was up 469% in greed phase of 1992. was up only 20% from 1992 to 2000. From 2000 to 2008 it was up 271%.

https://twitter.com/heartwon/status/1279702080999927808?s=20

1. You've got a superb #tradingsystem...so why are you losing?

1. You've got a superb #tradingsystem...so why are you losing?

#Locustsattack could lead to a #bounty for #agrochemical companies

#Locustsattack could lead to a #bounty for #agrochemical companies

1. The 1992 crash was the first one for Indian stock markets. It took just 36 sessions for the Sensex to fall by 40% from all-time highs.

1. The 1992 crash was the first one for Indian stock markets. It took just 36 sessions for the Sensex to fall by 40% from all-time highs.

(2/2)

(2/2)