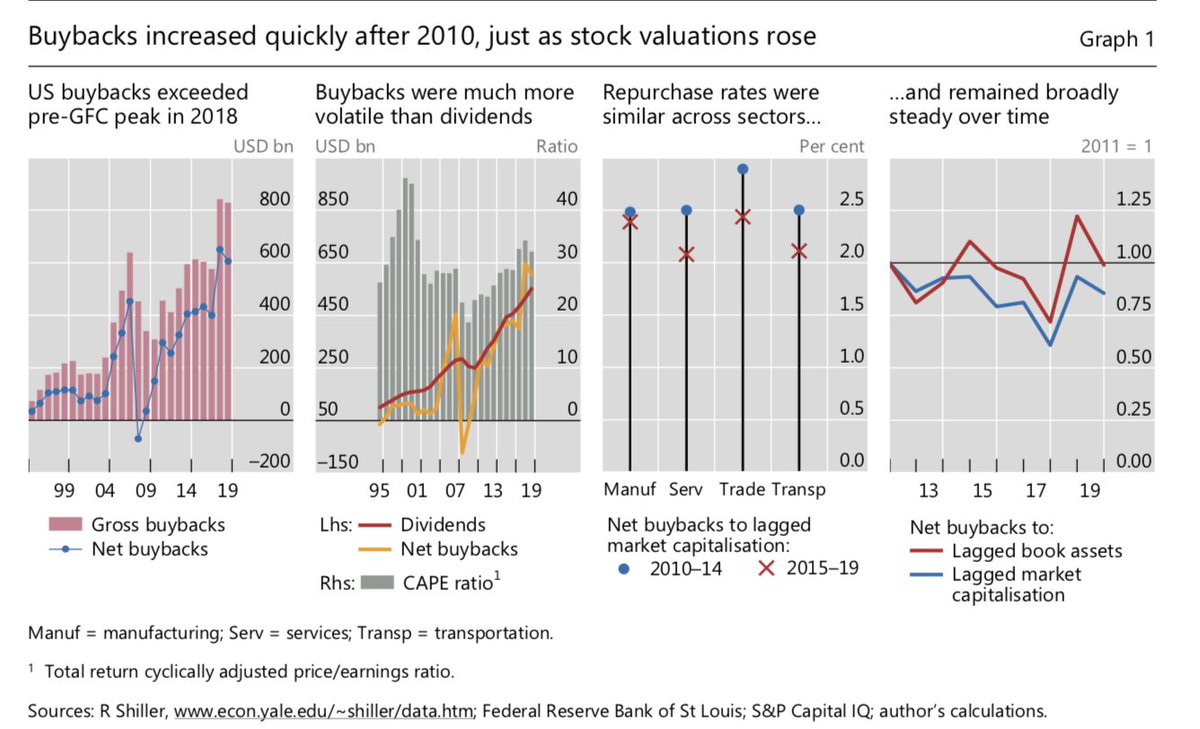

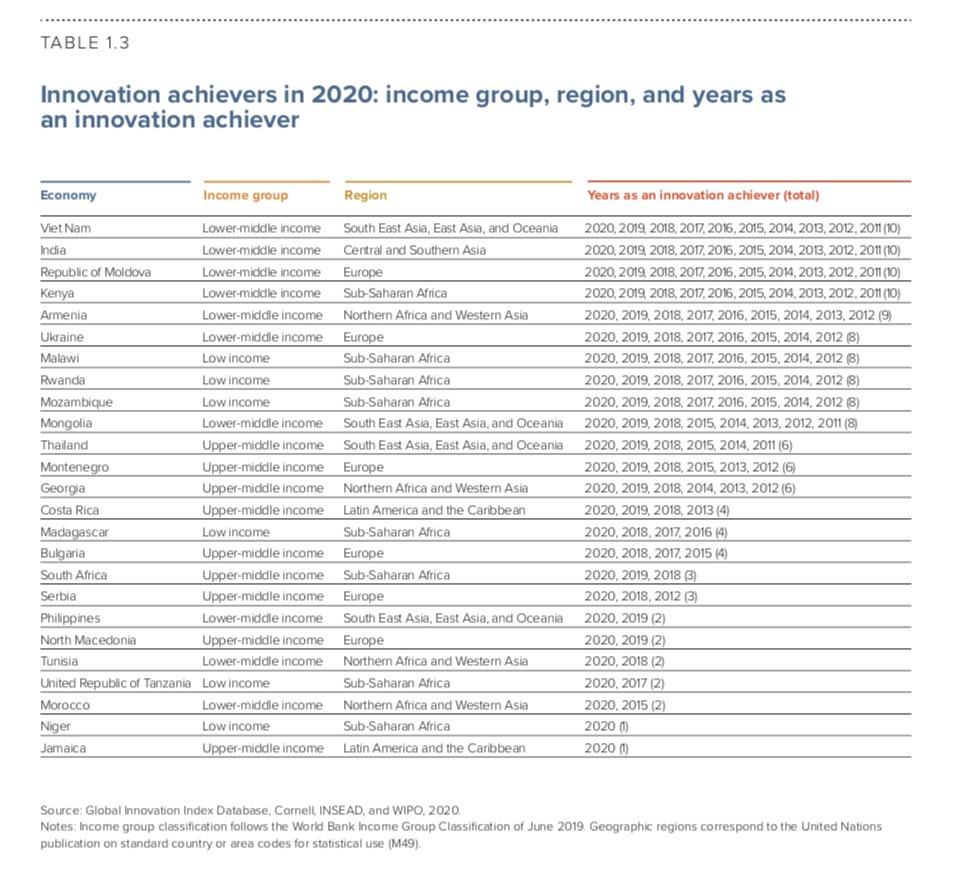

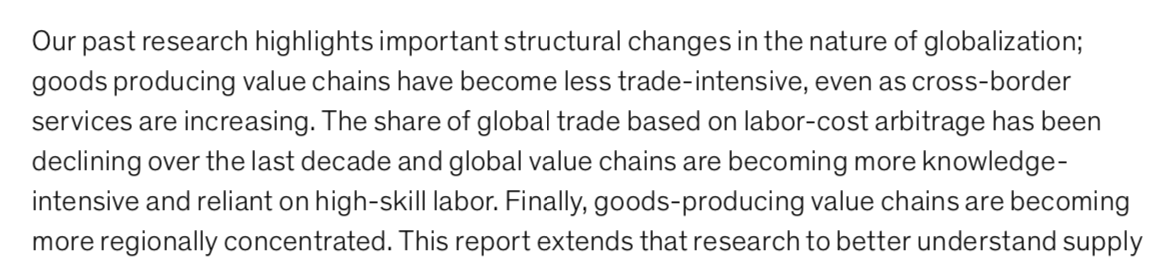

Somewhat muted 90th birthday celebrations at the 'Tower of Basel' comes along with their 'Annual Economic Report' plenty of insights & illustrations of the economic & financial fallout from the #Covid19 crisis: bis.org/publ/arpdf/ar2… Some takeaways (1/4)

3/4 #Covid19 crisis unfoldes... #Oil prices drag down econ activity in key econs...Ratings agencies, awake for this one, downgrades corporates, investors pull back...Banks come under pressure...Investors position as if they anticipate large losses in global #CRE/#RE...#Macro

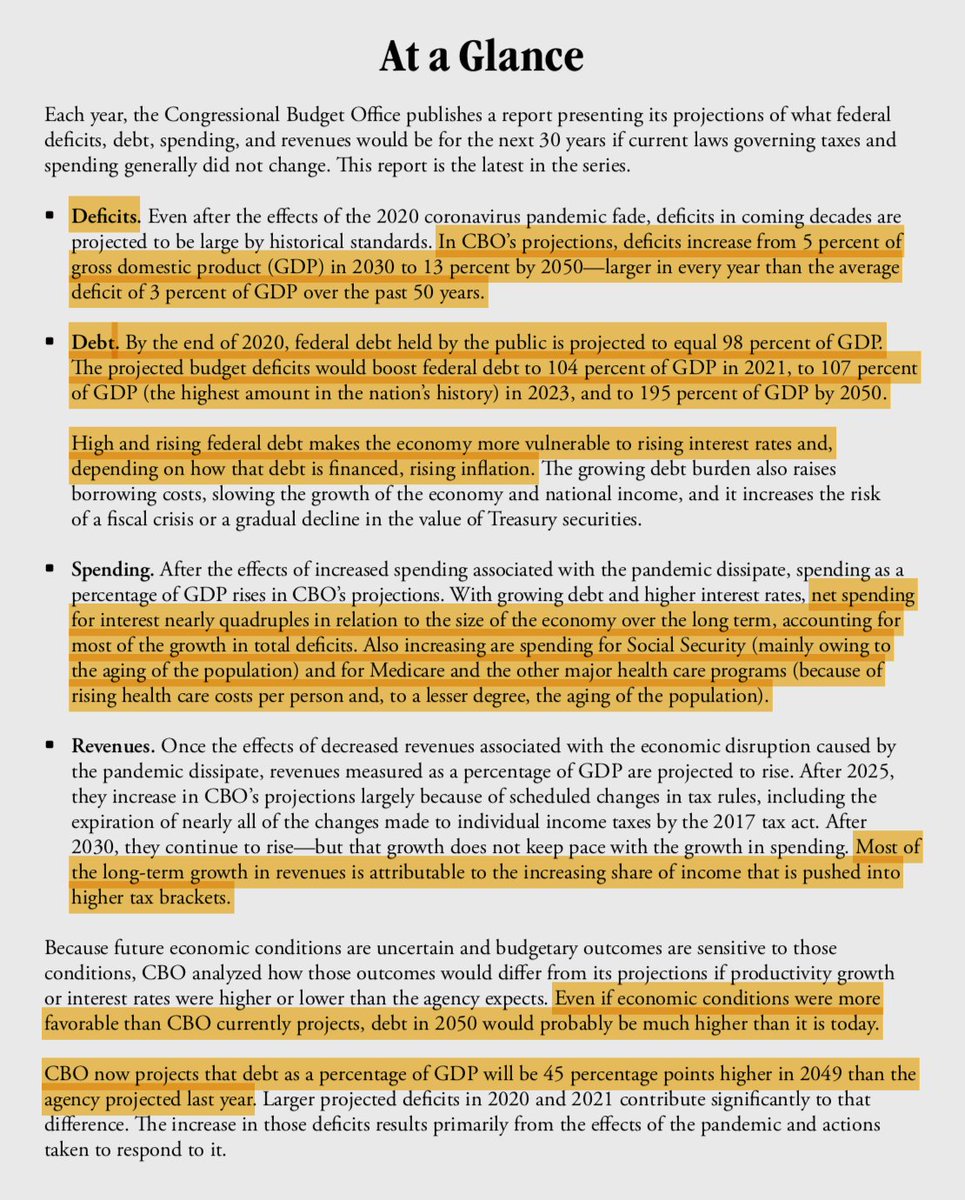

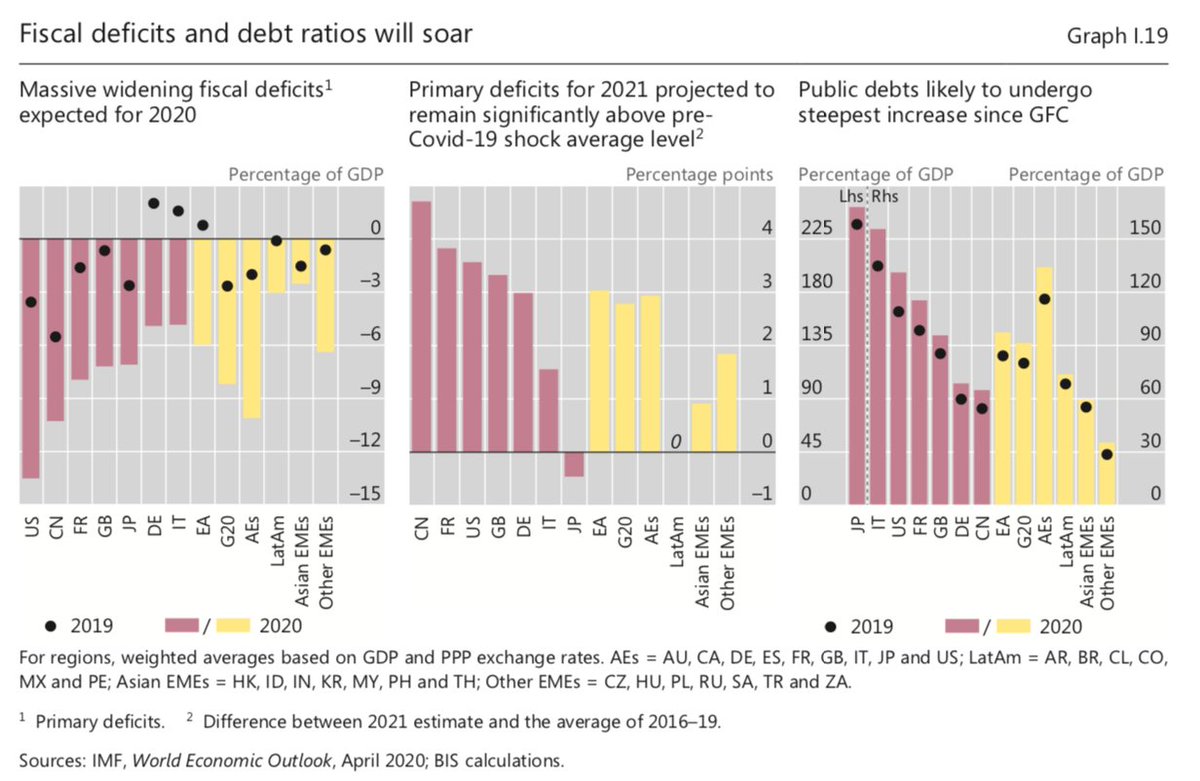

4/4 BIS perspectives on the actions of their Central Banks & the path ahead in lieu of the #Covid19 crisis..."A swift & forceful response"..."Fiscal deficits & debt ratios will soar"...Fed Swap lines overview...& a dry take on "Monetary financing"...#CentralBanks #MonetaryPolicy

• • •

Missing some Tweet in this thread? You can try to

force a refresh