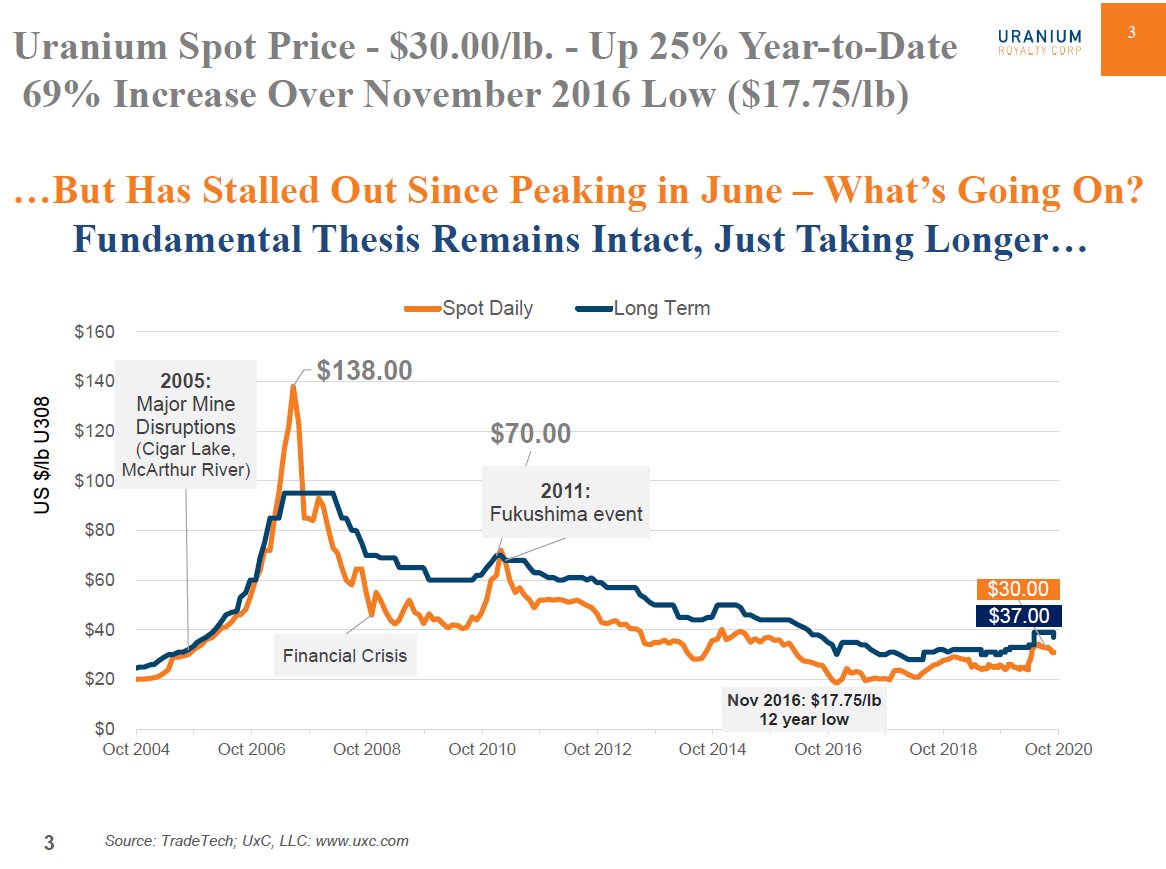

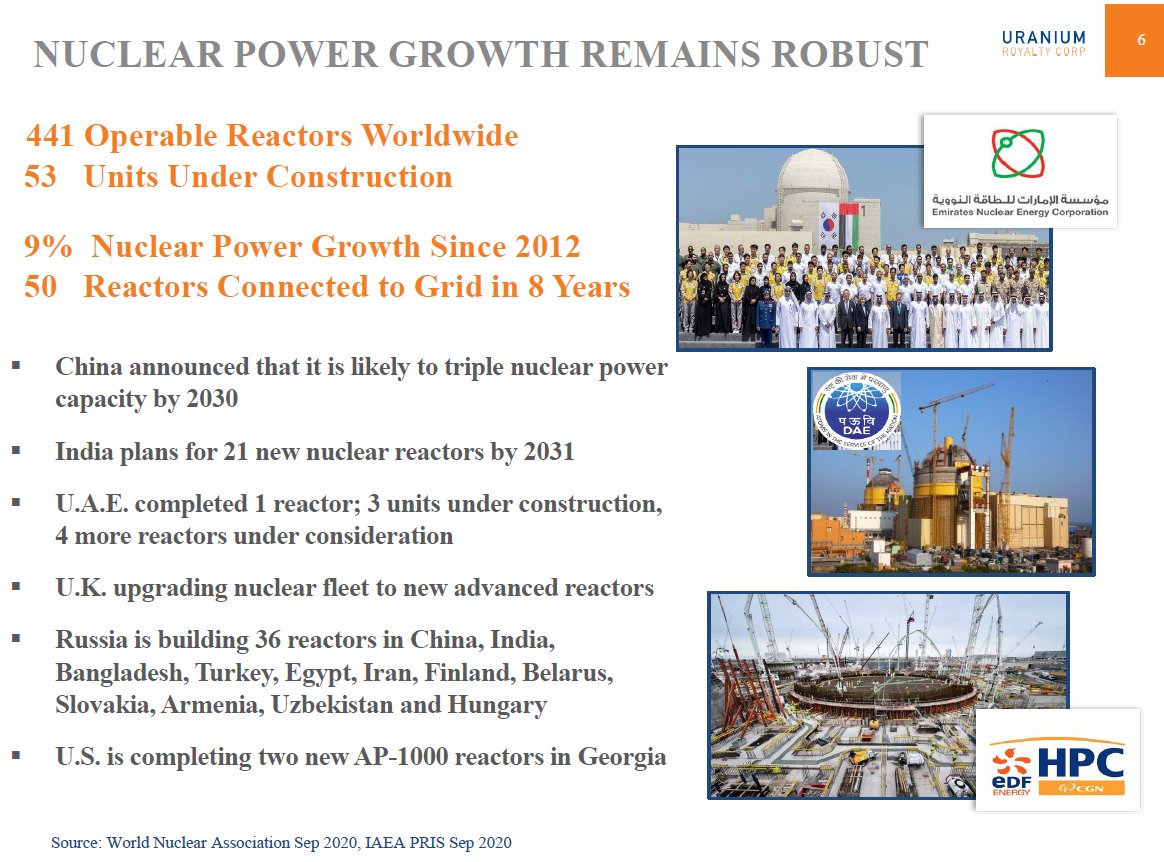

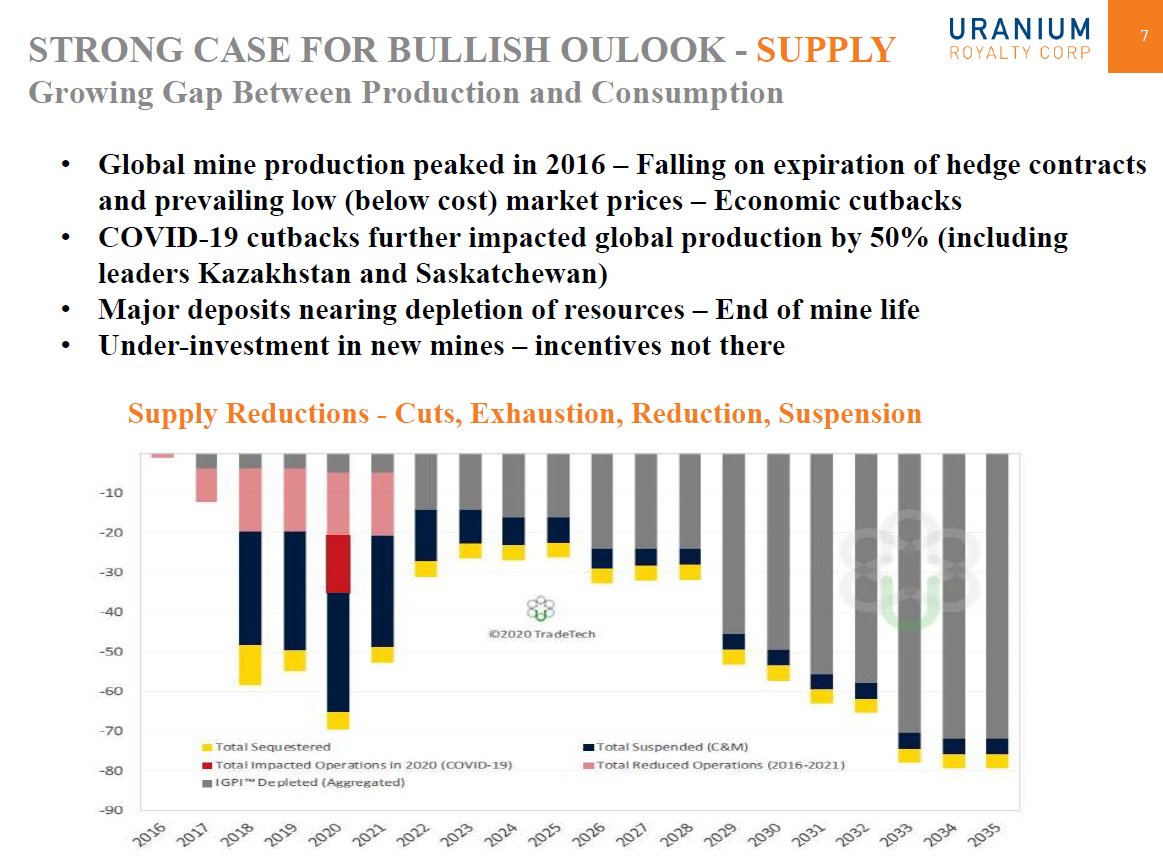

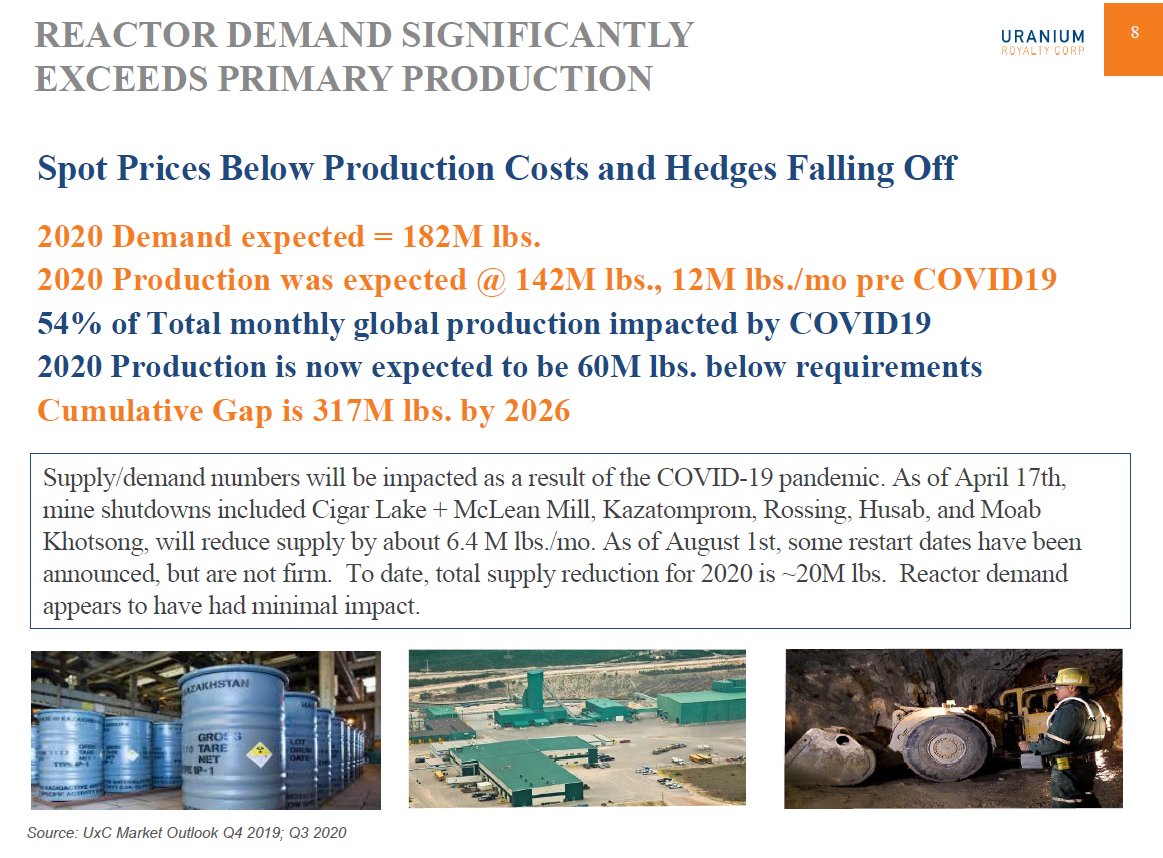

#Uranium Alert!🔔 For 1st time in months, Uranium space was hot topic today in a Wall Street chat group of over 450 institutional portfolio managers & very bullish on $CCJ & $U.🐂 "If the mad-mob trading FCEL and other #ESG names gets a hold of uranium... Watch out." ⤴️👇 1/3...

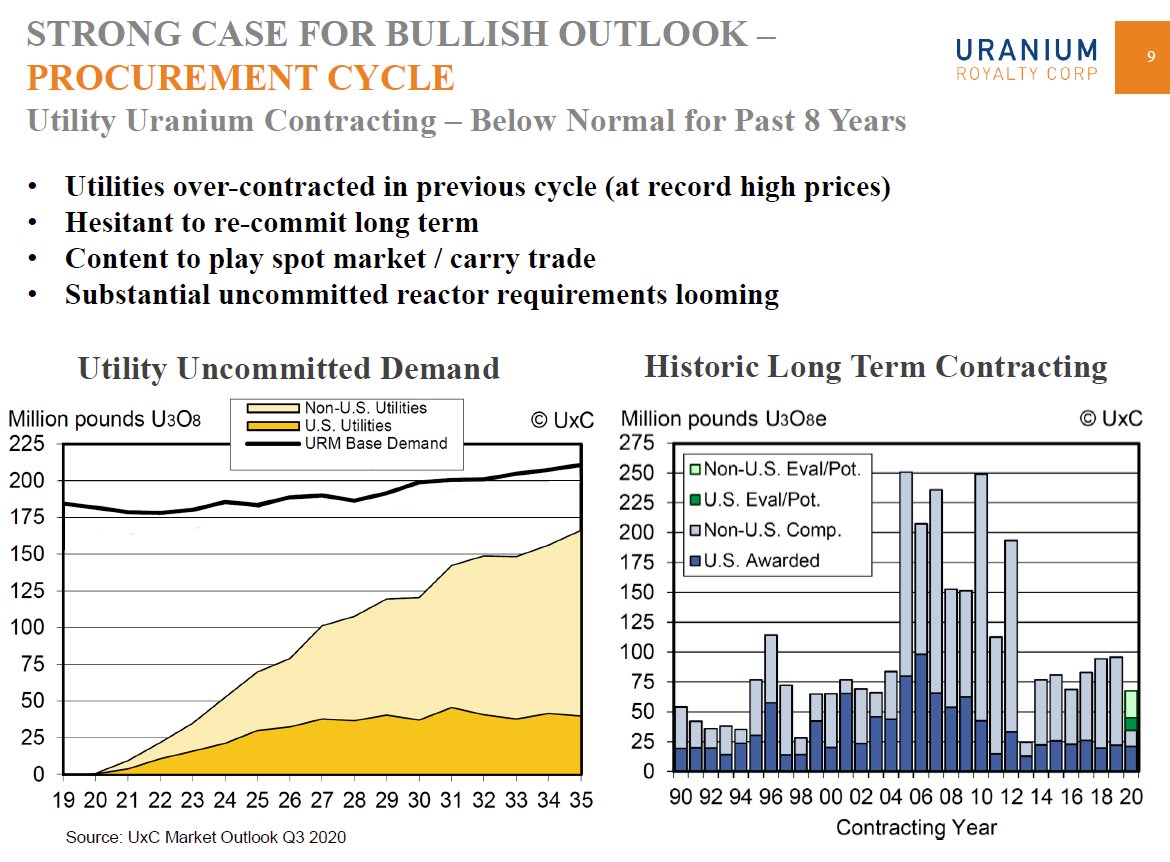

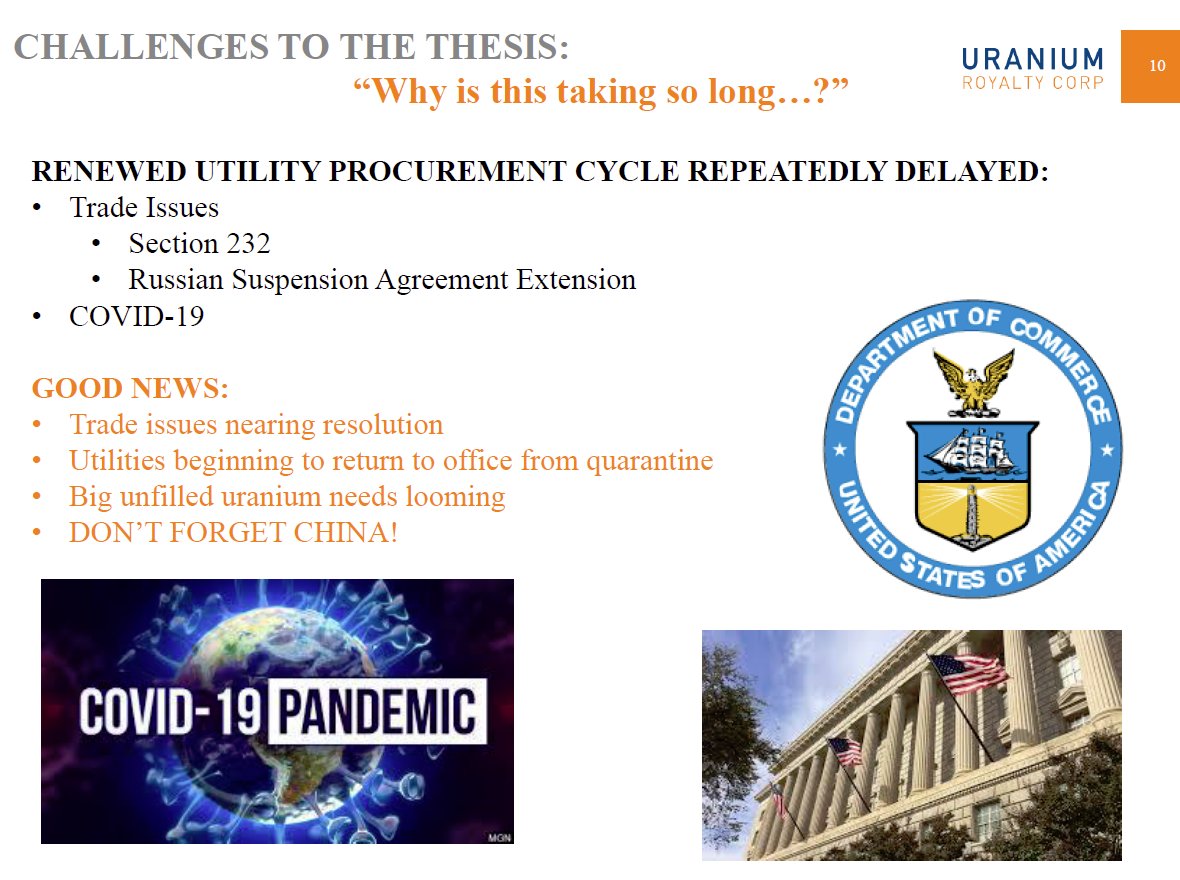

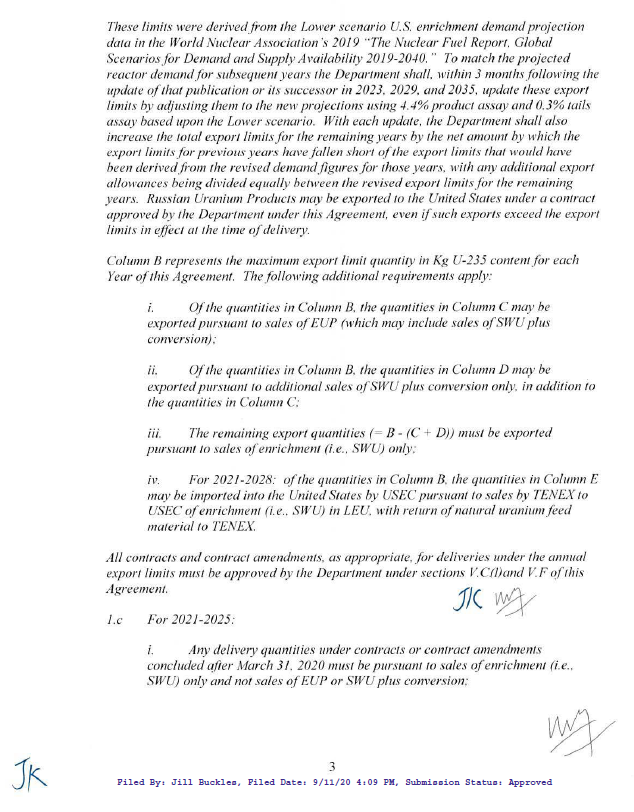

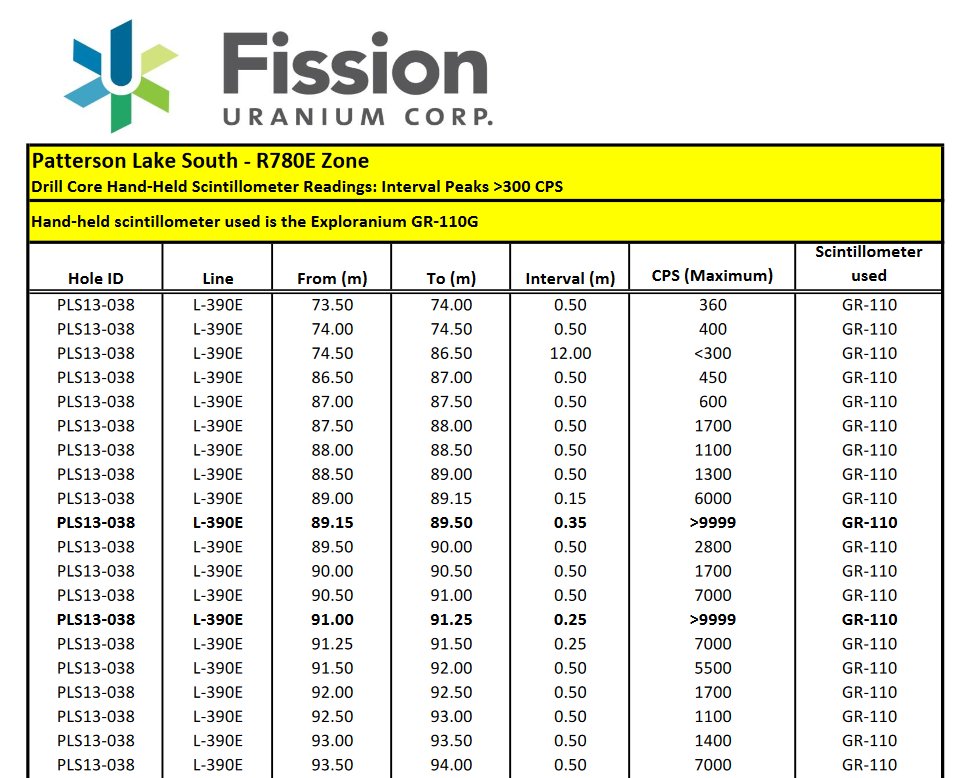

2/3 The January Bull Case for #Uranium... is the U sector about to explode?💣🚀 👇 #U3O8 #mining #stocks #nuclear #CarbonFree #EnergyTransition #NetZero #ESG #SupplyDeficit #NuclearWave 🌊🏄

3/3 #Uranium: "A commodity that hasn't moved right as the world wakes up to inflation with an actual clean energy angle to it. This could well be THE trade for 2021, IMO. I know it's been slow to develop, but it just looks better than ever."🐂 #mining #stocks #nuclear #ESG 🌊🏄

• • •

Missing some Tweet in this thread? You can try to

force a refresh