#RealInvestmentReport is out!

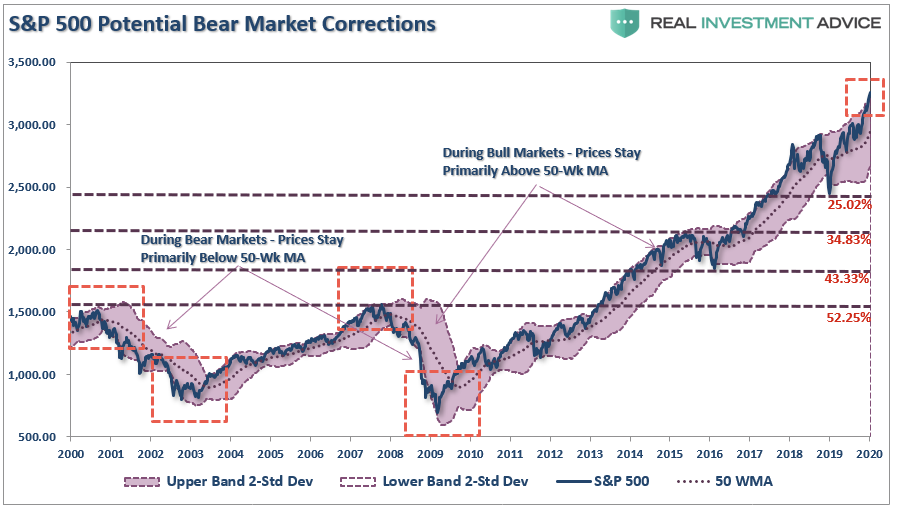

The #bullish #bias kept #market holding above recent #breakout levels, but extensions and deviations from means remain extreme. We could see further weakness next week before the year-end "#WindowDressing" #rally.

realinvestmentadvice.com/irrational-exu…

The #bullish #bias kept #market holding above recent #breakout levels, but extensions and deviations from means remain extreme. We could see further weakness next week before the year-end "#WindowDressing" #rally.

realinvestmentadvice.com/irrational-exu…

While markets did weaken slightly over the last few sessions, the #market remained above recent breakout levels. However, with a short-term #MACD #sellsignal, and #options #expiration next Friday, we could see further weakness next week.

realinvestmentadvice.com/irrational-exu…

realinvestmentadvice.com/irrational-exu…

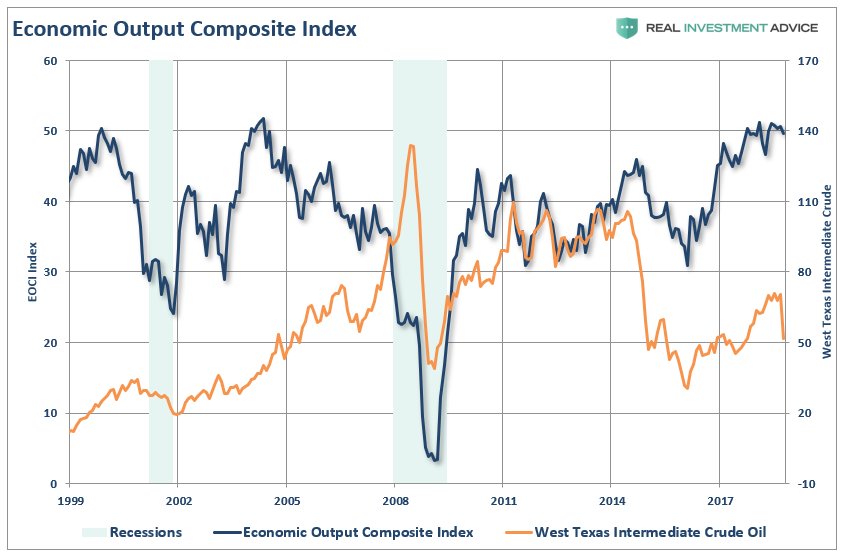

In August we laid out our year-end #target of 3750. With the #SantaClaus rally ahead, (in reality it is #WindowDressing week) we are close to our mark. 2021 will likely prove to be disappointing as we lay out the #risks.

realinvestmentadvice.com/irrational-exu…

realinvestmentadvice.com/irrational-exu…

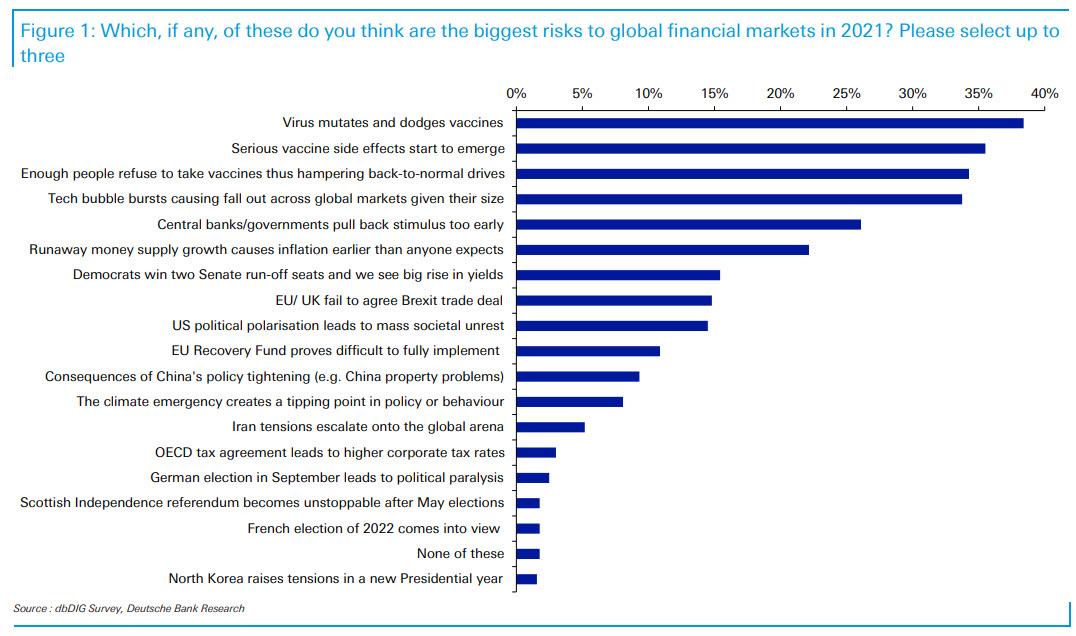

"No One Could Have Seen It Coming."

Such will be the excuse of the #media when the unexpected occurs. We walk through the #risks and identify that #Number12 on our list is the most probable.

Don't like ours, we also provide #BofA's list.

realinvestmentadvice.com/irrational-exu…

Such will be the excuse of the #media when the unexpected occurs. We walk through the #risks and identify that #Number12 on our list is the most probable.

Don't like ours, we also provide #BofA's list.

realinvestmentadvice.com/irrational-exu…

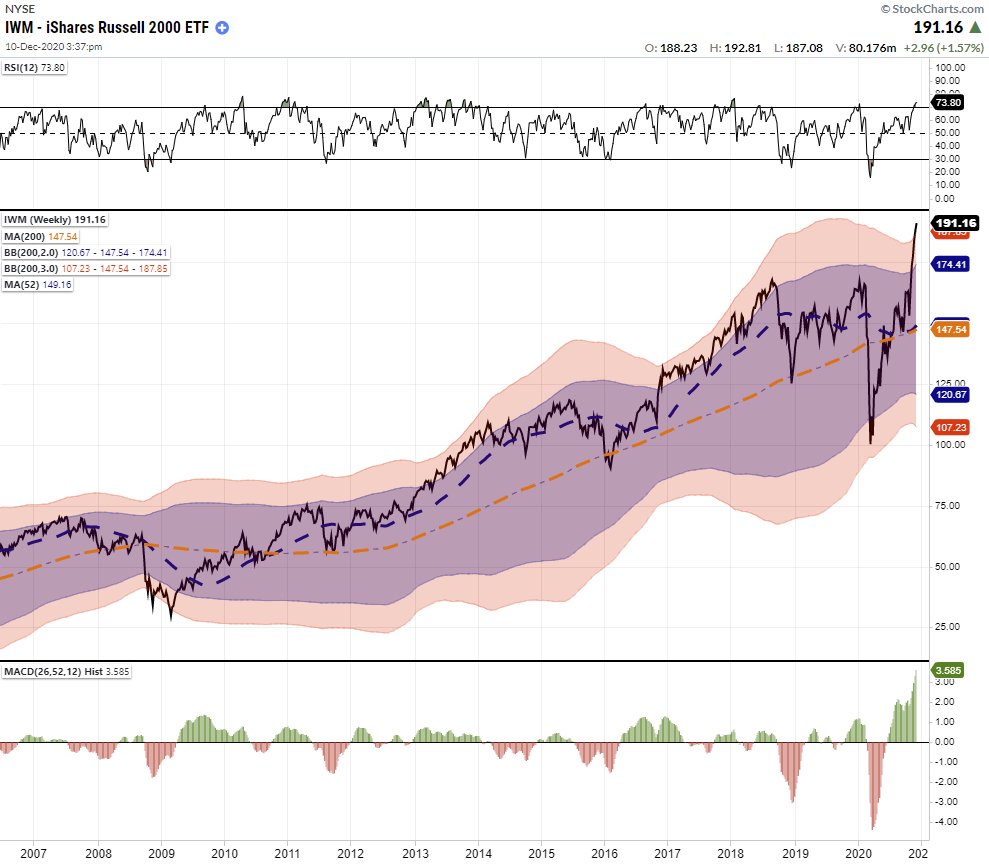

#MidCap #Moonshot.

"Over the past 15-years, there is no point where IWM was more than 3-standard deviations above its 200-week (4-year) moving average, overbought, and trading above 3.5 on its MACD."

realinvestmentadvice.com/irrational-exu…

"Over the past 15-years, there is no point where IWM was more than 3-standard deviations above its 200-week (4-year) moving average, overbought, and trading above 3.5 on its MACD."

realinvestmentadvice.com/irrational-exu…

"1. Despite the rally since 2018, markets continue to exhibit a negative divergence in RSI.

2. Is well into 3-standard deviations above the 4-year (200-week) moving average.

3. Now 13.37% above the 4-year moving average, which matches previous highs."

realinvestmentadvice.com/irrational-exu…

2. Is well into 3-standard deviations above the 4-year (200-week) moving average.

3. Now 13.37% above the 4-year moving average, which matches previous highs."

realinvestmentadvice.com/irrational-exu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh