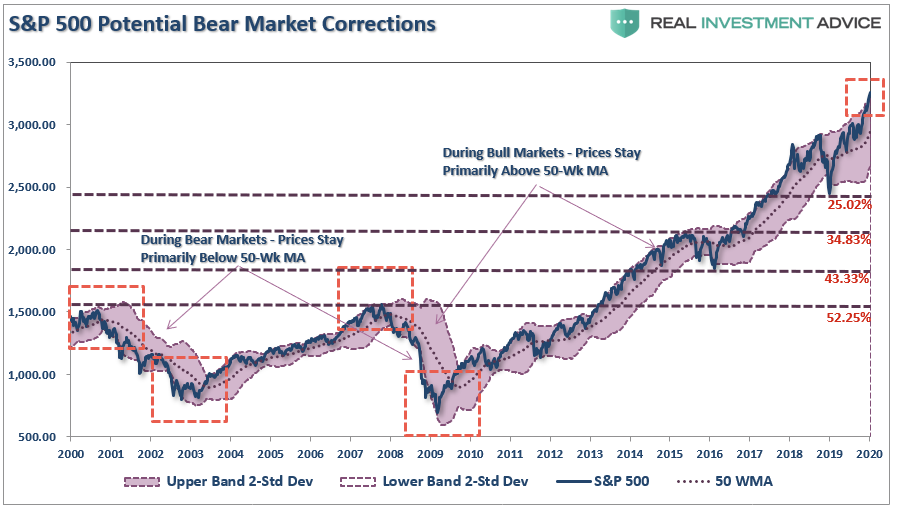

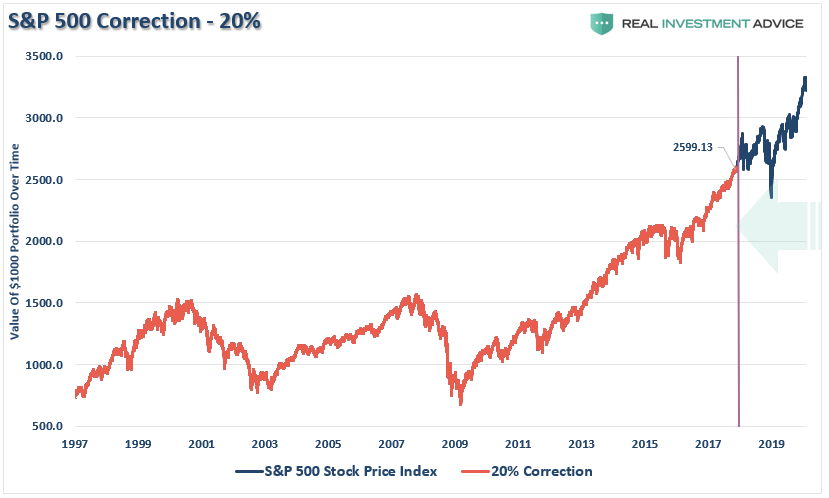

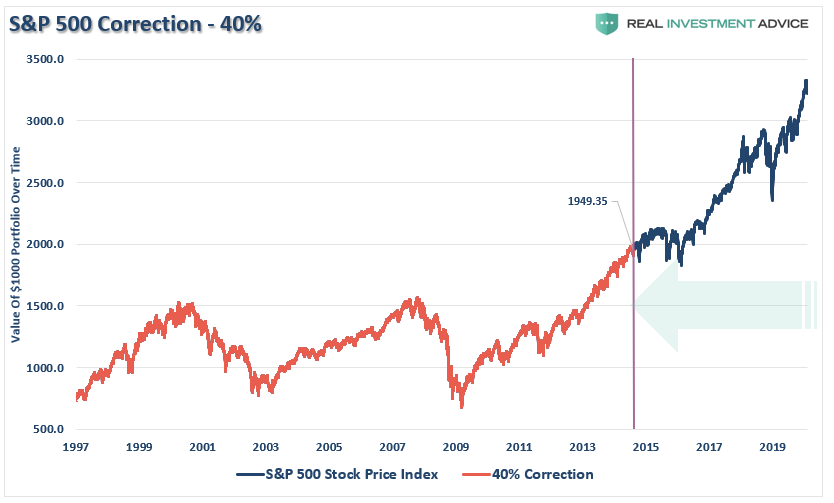

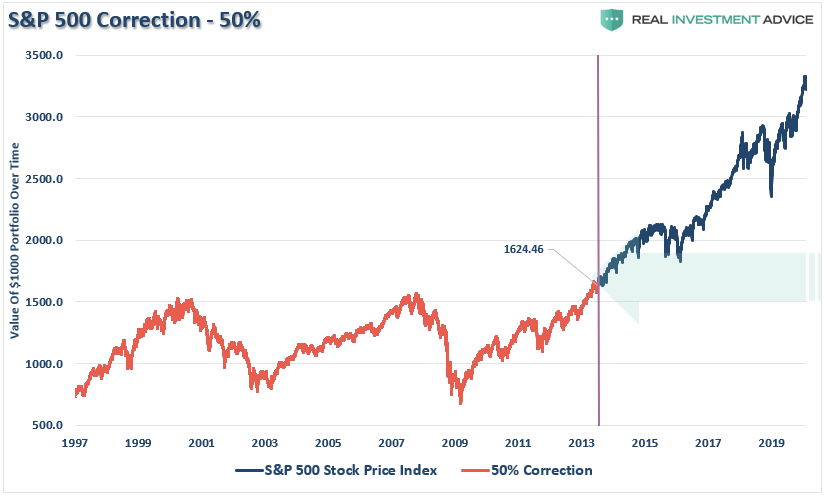

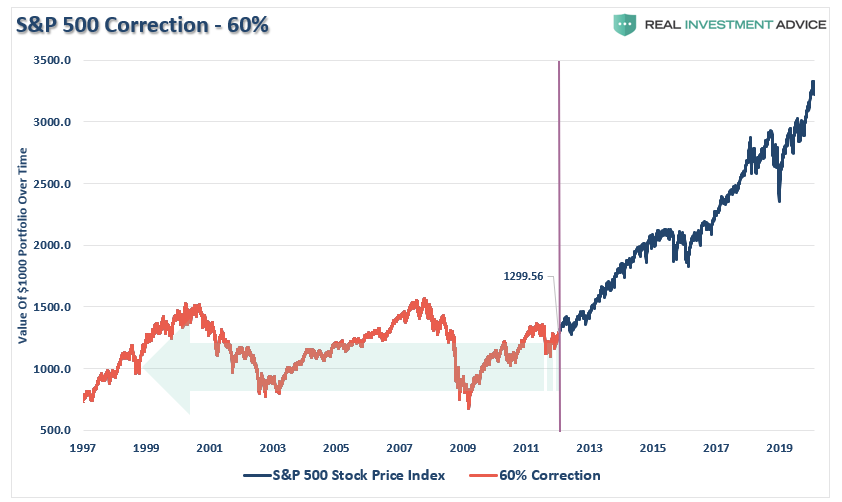

What if? We explore what a 10-60% correction would do to investors and their #retirement. While this #TimeIsNotDifferent, you are.

realinvestmentadvice.com/market-downtur…

realinvestmentadvice.com/market-downtur…

If you need 6% per year to reach your goals, and suffer a 20% correction, it doesn't require JUST 25% to get back to even. You have to ALSO make up the 6%/year lost as well.

realinvestmentadvice.com/market-downtur…

realinvestmentadvice.com/market-downtur…

realinvestmentadvice.com/market-downtur…

realinvestmentadvice.com/market-downtur…

1) Correction begins

2) Decline weakens #confidence, companies stop #buybacks.

3) Further decline triggers $5 T bond problem

4) Bond decline triggers run on #pensions

5) Boomers liquidate.

#Demographics

realinvestmentadvice.com/market-downtur…

If you needed a 6% annual return from the market at the peak in 2007....Congratulations....you are now back to even.