Recently, Dr. Shiller suggested that #valuations really aren't that high once you fall in the #Fed trap of using #earnings #yields and #low #rates to justify it. The problem is it is a #rationalization to justify overpaying for #assets.

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

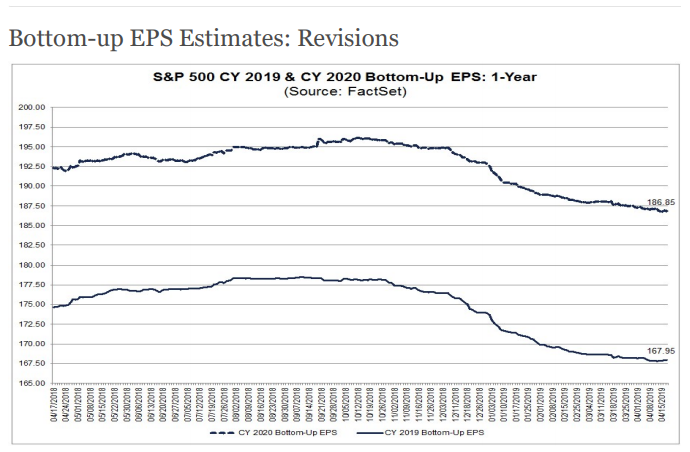

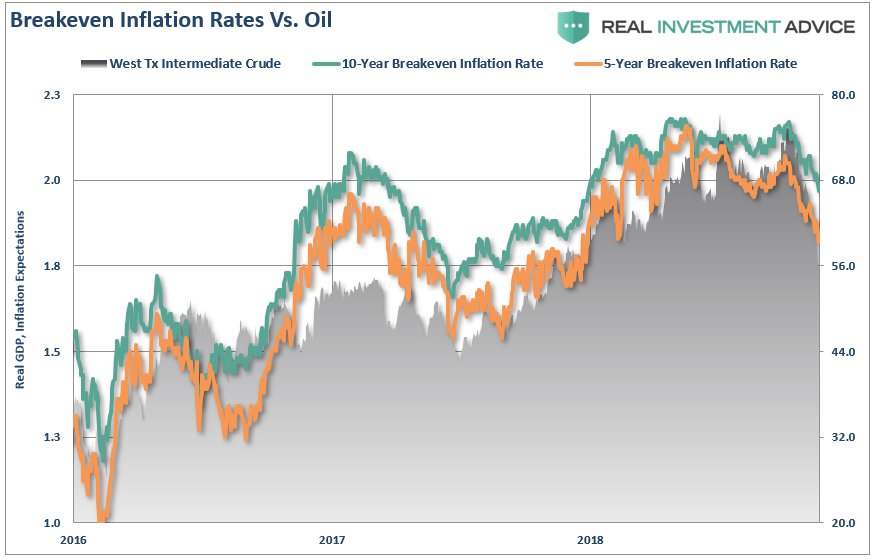

The main problem in using low-interest rates as a rationalization to overpay for assets is that you have to also discount #future #cashflows for lower inflation and rates as well.

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

"As low-interest rates went lower, the dynamic changed from using debt productively to using debt for non-productive purposes such as dividend issuance, share buybacks, and, in some cases, offsetting negative cash flows."

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

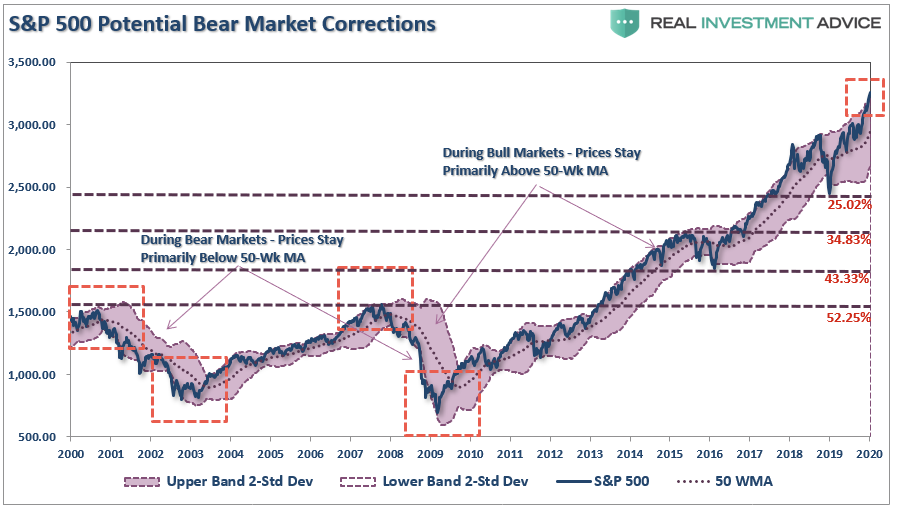

Historically, when interest rates or inflation are low, the stock market’s E/P is also low. There are just two times when interest rates were low. The first was in the 1940s, and currently. In the 1940s, stock valuations were low, along with rates.

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

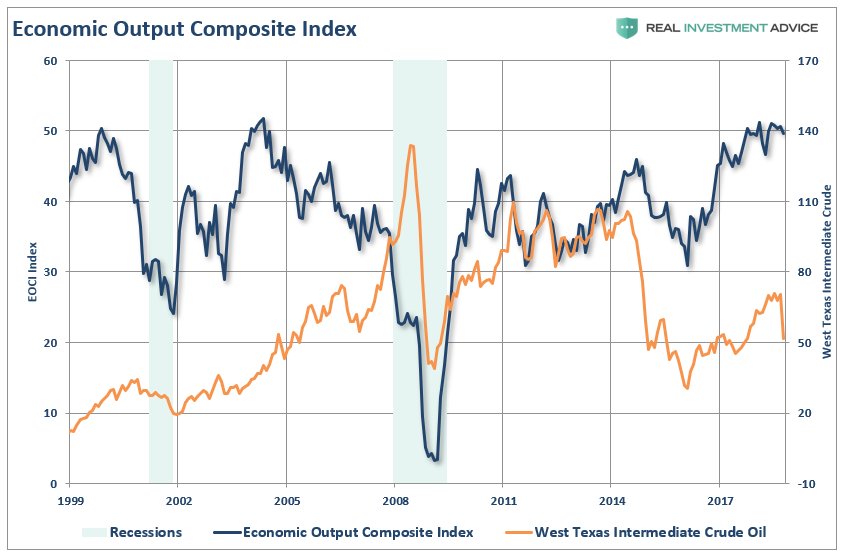

"Usually, interest rates are #low because #growth is bad, and when growth is bad that tends to be bad for #equities. That leads to a curved relationship between rates and equities over time."

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

As noted in “Why This Isn’t 1920,” the highest #correlation between #stock prices and future #returns comes from #valuations.

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

• • •

Missing some Tweet in this thread? You can try to

force a refresh