Chief Strategist https://t.co/pIhX6wyW68, Host: RealInvestment Show, Editor https://t.co/wmWaTk1TpO, PM for https://t.co/lf8aFSFI6i

Newsletter Signup: https://t.co/qxJrsTVRHR

5 subscribers

How to get URL link on X (Twitter) App

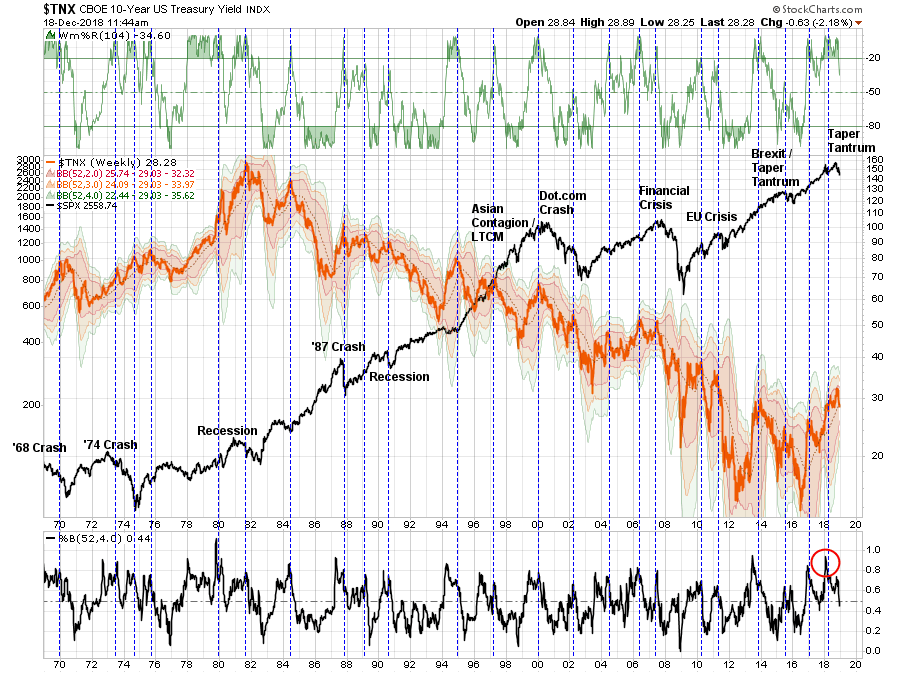

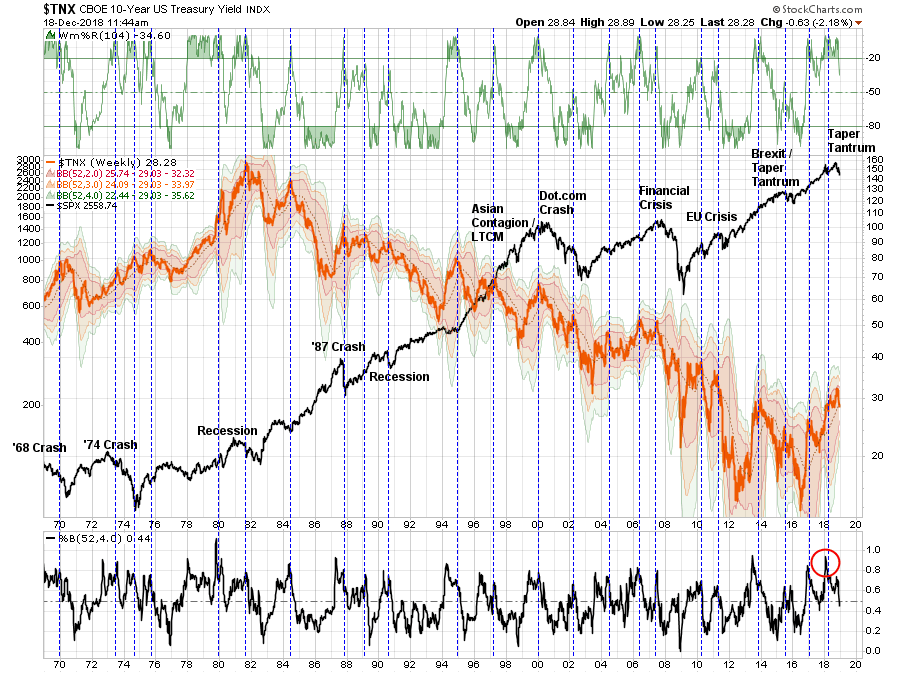

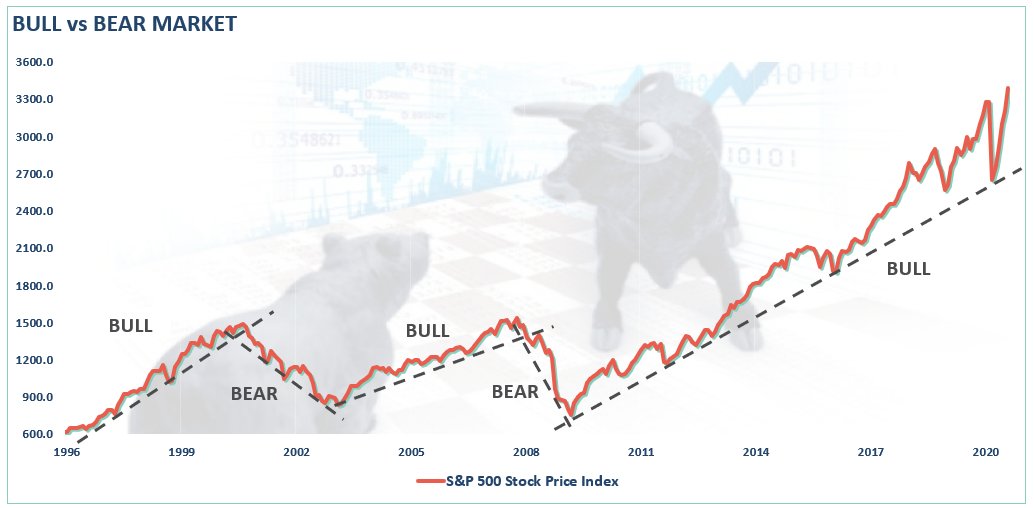

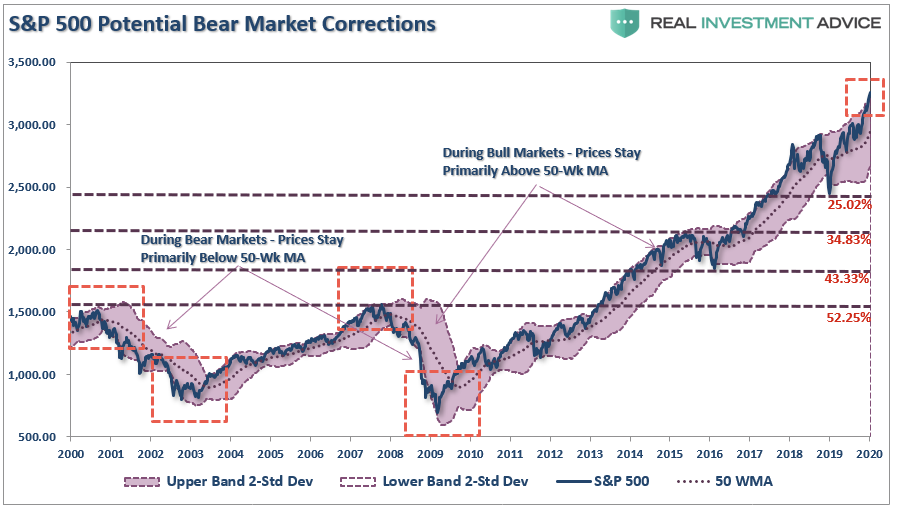

@slangwise Looking at potential retracement levels, to the lows of 2018, or the highs of 2015-2016 would not be out of the ordinary. A mean reversion event would be the lows of 2016 to the highs of 2008.

@slangwise Looking at potential retracement levels, to the lows of 2018, or the highs of 2015-2016 would not be out of the ordinary. A mean reversion event would be the lows of 2016 to the highs of 2008.

Earnings - The Good:

Earnings - The Good:

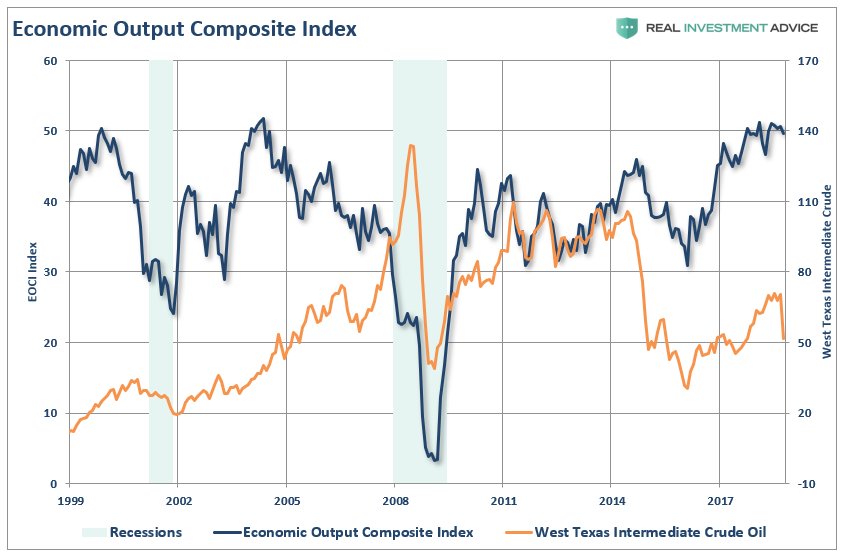

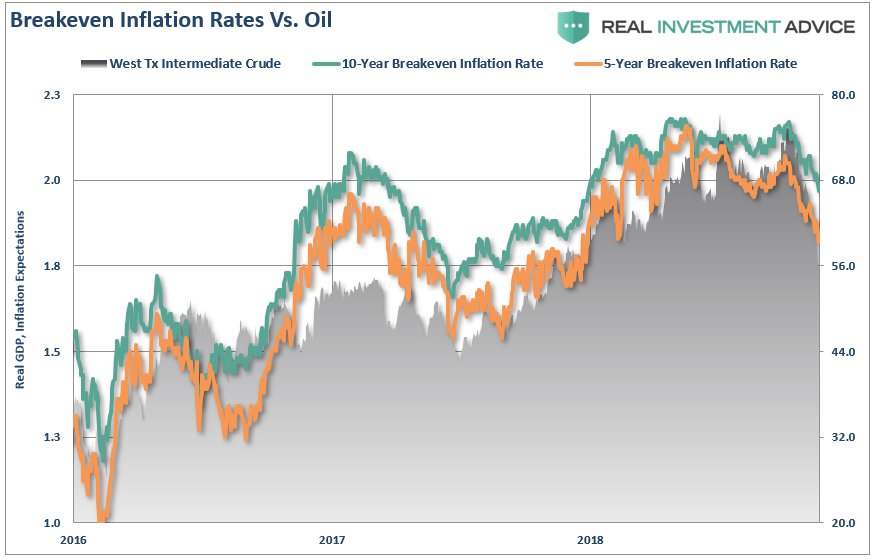

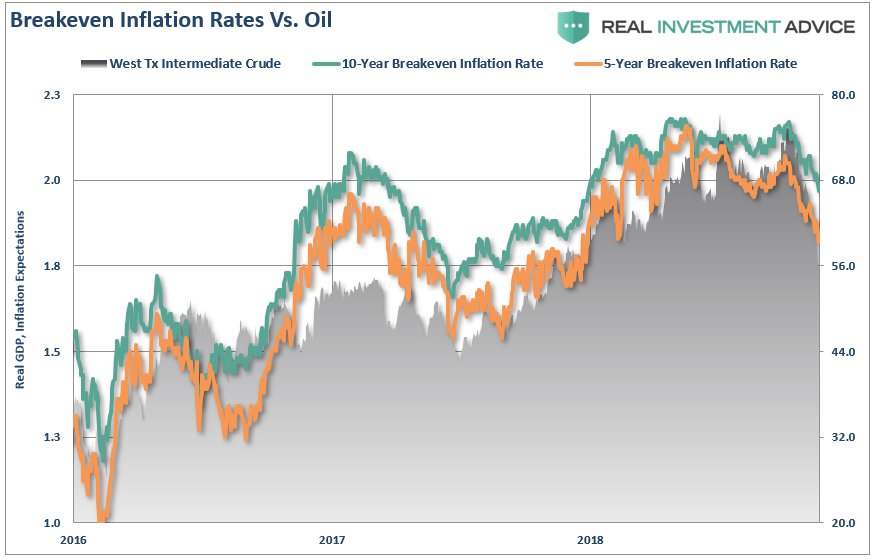

Those suggesting the drop in #oil is only a "supply problem" are looking at economic data which is both lagging and subject to revisions. Oil is telling you the global slowdown is coming home. $SPY $TLT realinvestmentadvice.com/oil-sends-a-cr…

Those suggesting the drop in #oil is only a "supply problem" are looking at economic data which is both lagging and subject to revisions. Oil is telling you the global slowdown is coming home. $SPY $TLT realinvestmentadvice.com/oil-sends-a-cr…