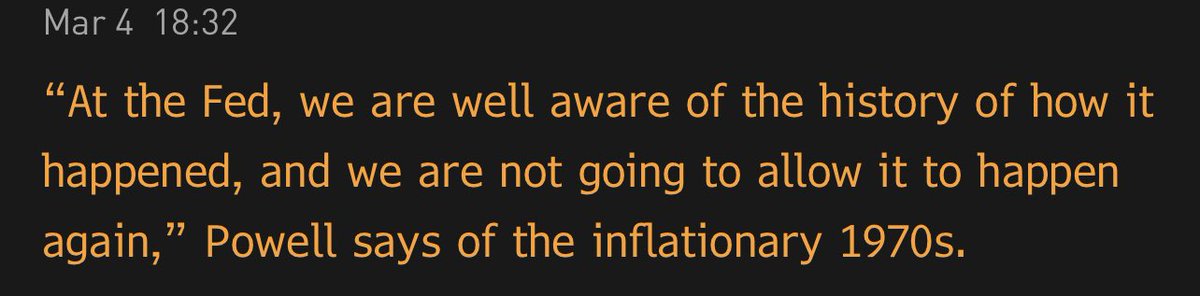

The fact #bitcoin isn‘t getting completely obliterated given Powell just basically said „Yes we still need to print now but before anything happens with inflation we‘ll hit the breaks hard“ is certainly a silver lining.

It will depend a lot on how markets read the Fed‘s communications tomorrow, when the dust settles, but in case they go with „ok it‘s confirmed, the Fed will be less expansive soon to avoid inflation“, I think $40k is totally doable here. #bitcoin $BTC

Not advice.

Not advice.

FWIW the likeliest outcome is investors decide tomorrow not so much changed after all & all those tech stocks seem quite a bit cheaper now.May see a good reaction in $BTC as well. Just definitely a warning:we‘re much closer to the end than the beginning & the end may have started

Fingers crossed it remains a ghost #bitcoin $BTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh