1/ SOME THOUGHTS on #stablecoins & the #crypto selloff, which are probably connected.

HUGE news last week & it matters far more than @elonmusk or @binance news. A long thread 👇:

HUGE news last week & it matters far more than @elonmusk or @binance news. A long thread 👇:

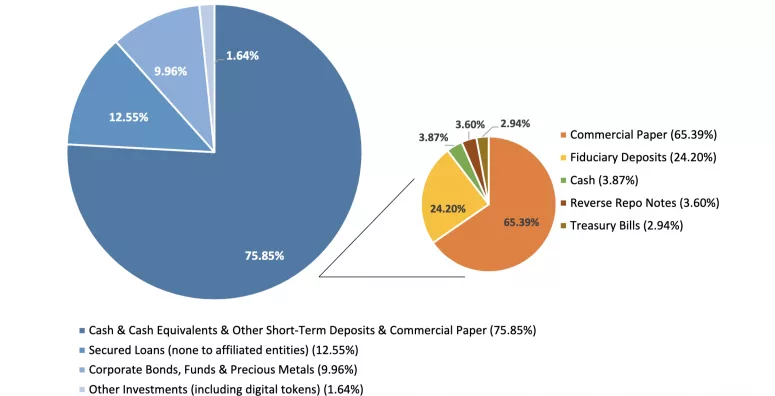

2/ First, #Tether finally disclosed how it invests reserves & it was a big negative surprise (not previously knowable at this level of detail). This news probably contributed a lot to #crypto selloff since Wednesday.

3/ Why? Because now risk managers at #crypto hedge funds almost certainly will require haircuts on #Tether, which means traders had to sell #crypto to reduce their total risk exposure.

4/ Example: if risk managers now apply a 5-10% haircut for #Tether & Tether is in a trader’s portfolio, the trader must bring down total exposure by selling other non-Tether #crypto.

5/ Based on Tether’s new disclosure, both #Tether’s probability of default & loss severity in default just went up. Why? Because CREDIT RISK.

6/ There’s now much bigger risk that #Tether may “break the buck” (trade below par to the US dollar) amid a credit market correction. This would prob bring #crypto markets lower with it if (when) that happens. (#DeFi protocols that already haircut Tether were proven right.)

7/ Markets already had independent confirmation that #Tether had very little bank deposits in its reserves, but now we know its reserves are mostly invested in CREDIT ASSETS of who-knows-what quality, not T-bills or other short-term, lower-risk, liquid securities.

8/ Tether's reserve portfolio looks like a credit hedge fund, with some interest rate risk (corporate bonds) & commodities risk thrown in too. Need LOTS more disclosure now. So many new questions.

9/ Big ? is WHY?? Why choose to take so much risk w/ users’ reserves? Tether's reserve issues used to be partly explainable (banking access) but Tether clearly has securities access now. Doing this was a CHOICE.

#Tether is an IMPORTANT pymt technology. Why add more controversy??

#Tether is an IMPORTANT pymt technology. Why add more controversy??

10/ Plus, if #Tether stays a de facto credit hedge fund by investing reserves this way, markets now can safely predict that #bitcoin & #crypto prices will likely exhibit high correlation w/ credit markets. They will probably correct together.

11/ I’ve always been challenged by the biz model of some #stablecoin issuers: the ones that keep the float, and especially the ones that use the float as a hedge fund "plaything." BUT RESERVES ARE USERS’ MONEY!!!

12/ That biz model is “heads the #stablecoin issuer wins, tails the stablecoin users lose.”

As Warren Buffett likes to say: when tide goes out you see who’s swimming naked.

As Warren Buffett likes to say: when tide goes out you see who’s swimming naked.

13/ #Wyoming law rejects such a biz model. This is why Wyoming law requires #SPDI banks to hold 100% reserves of customer deposits in cash, T-bills etc.

14/ Here’s some math for #Tether’s $58.2bn of reserves. A conservative assumption is that Tether’s reserve portfolio yields at least 1%. That’s $582m of annualized profits(!) going to Tether's issuer.

15/ I can only guess how US regulators reacted to Tether’s announcement. Tread carefully, peeps. I’ve thought for a while that a #stablecoin crackdown is inevitable. Will this trigger it? Dunno

16/ But if/when a crackdown happens, I’ll be shaking my head because some of the fallout will have been ENTIRELY AVOIDABLE had #Tether just invested the reserves in T-bills, for example.

One of basic tenet of US financial regulation is DISCLOSURE of risks.

One of basic tenet of US financial regulation is DISCLOSURE of risks.

17/ I regularly defend #Tether (and will continue to) as very important technology and key industry infrastructure as a bridge to the US dollar, and have relationships w/ some of its team going back years.

18/ But I can’t defend #Tether’s choices on asset allocation & making no risk disclosure. What a missed opportunity! SMH. Not helpful to our industry.

19/ Like it or not, one of the best things for industry at present would be getting #stablecoins to be OK w/ US regulators (esp the Fed & the SEC). #stablecoins are very important bridges between #crypto & the US dollar.

20/ Why? bc EVERY US dollar must clear thru a bank & then the Fed. Like it or not US regulators have big power over #stablecoins.

Yep, @AvantiBT plans to help here (when open). Other #SPDIs may do so too--as industry "utilities" to hold #stablecoin reserves on behalf of issuers

Yep, @AvantiBT plans to help here (when open). Other #SPDIs may do so too--as industry "utilities" to hold #stablecoin reserves on behalf of issuers

21/ #Wyoming #SPDIs by law can’t play shenanigans with reserves backing #stablecoins because SPDIs can’t take risk w/ customer deposits. User money is not an SPDI’s plaything!!

22/ Markets will probably soon have an opportunity to vote w/ their feet & I suspect money will move to #SPDIs, which should become reserve manager "utilities" for the #stablecoin industry.

23/ Folks, balance sheets matter & it's not just whether reserves are 100% or not--it's also RISKS in those reserves (eg, credit, interest rate & other kinds).

#Wyoming #SPDIs were designed as solvency play & this is equally true for #crypto custody as for #stablecoin reserves.

#Wyoming #SPDIs were designed as solvency play & this is equally true for #crypto custody as for #stablecoin reserves.

24/ Speaking of regulators, something pretty big happened this week & it got only little attention: a US bank announced it will issue a #stablecoin.

25/ Facebook announced a pilot for #Diem w/ @Silvergate, where Silvergate will be the issuer & Diem will operate its #smartcontract.

26/ It’s a pilot but it’s significant bc #Diem would be a bank-issued #stablecoin. OK OK, yes yes yes there will be @Facebook blowback (probably lots of that). But it’s BANK-issued.

27/ I have a question tho: how well will it work when the #stablecoin issuer is a different legal entity than the operator of the #smartcontract? I can think of MANY risks w/ that.

28/ Hey #smartcontract developers--can you think of another example where a token issuer is separate from the smart contract manager? Pls reply & discuss the risks.

29/ Another question: Will the “rent-a-bank-charter” model used by #fintech lenders will become a “rent-a-bank-charter” model for #stablecoin issuers?

30/ P.S.--there was a big fight in Congress over the “rent-a-bank-charter” model used by #fintech lenders last wk. Guess who swing vote was: @SenLummis.🤠

31/ Here are 10 predictions about #stablecoins (from a speech just released by @CatoInstitute that I gave last Nov): cato.org/cato-journal/s…

32/ The speech is 6 months old but pls read parts about #stablecoins inside the US banking system. It’s happening. THAT is signal thru all the Elon & Binance noise.

33/ And that’s a very big deal. Like it or not, #stablecoins are important bridges btwn US dollars & #bitcoin, #ether, #DeFi & the rest of #crypto.

34/ Someday #stablecoins will be irrelevant, but today they matter a lot. Again--like it or not, US regulators control what touches US banks--yep, including all USD stablecoins.

35/ P.S.--seems cute that 6 months ago I’d predicted only $100bn of USD #stablecoins outstanding by year-end. Ha! 🤣Missed that by a mile. Probably will hit that amount by July, if no crackdown before then

36/ Enjoy the speech. It’s a little light reading for the weekend. Happy Saturday! 🤠

-END-

-END-

oops -- thread broke -- it continues here:

https://twitter.com/CaitlinLong_/status/1393652013154537473?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh