"I'm bullish" said Treva Klingbiel, President of leading #Nuclear fuel consultants TradeTech, who gave a very bullish #Uranium Market update at today's PI Financial Uranium Day webinar.👨💻 I'll try to cover her main points in this thread (apologies if I get anything wrong) .../2

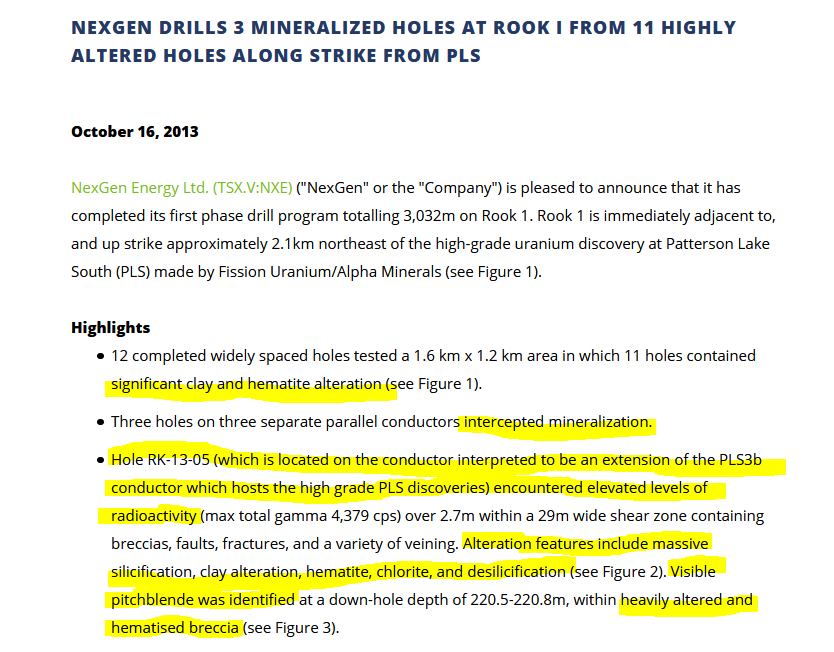

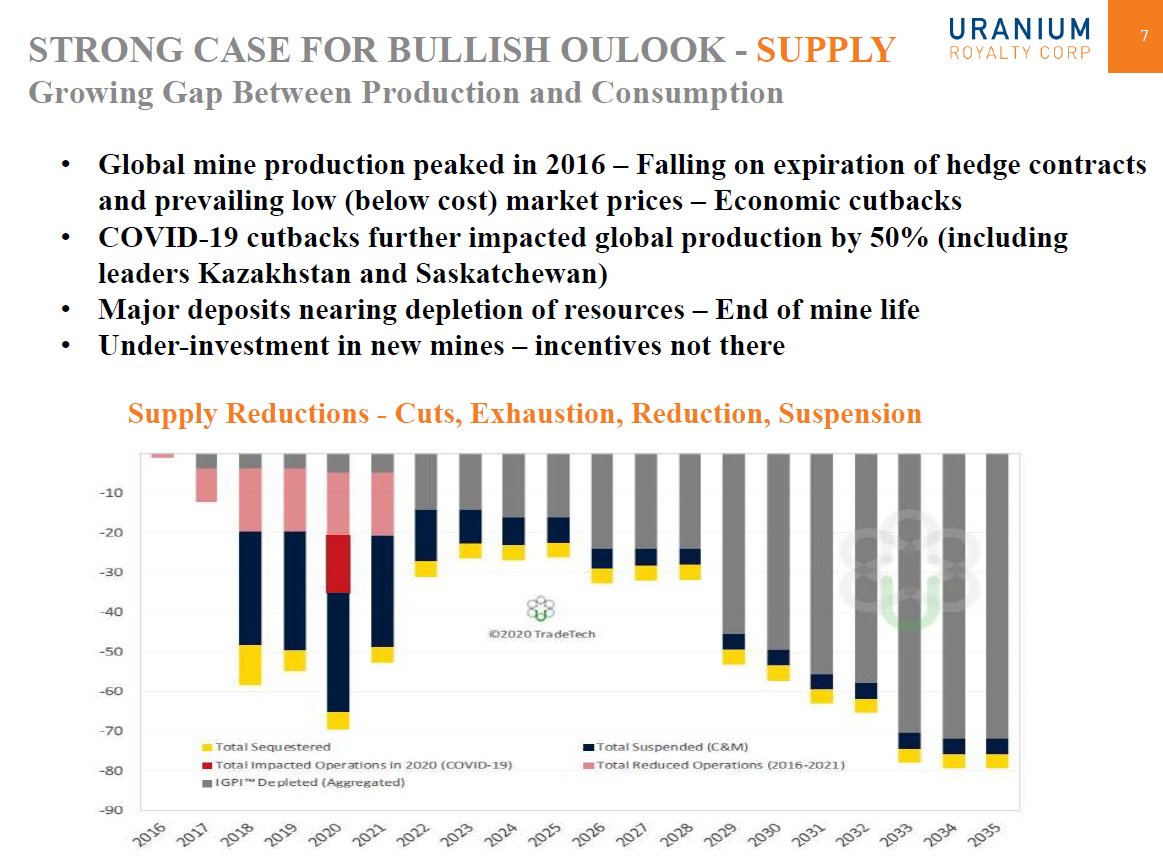

2/ Bottom line: New #Uranium mines needed, especially in back half of this decade after idled mines restarted. #U3O8 price tailwinds are depleted reserves, lack of investment, increasingly restricted supply, mounting uncertainty over timely arrival & cost of new mined supply../3

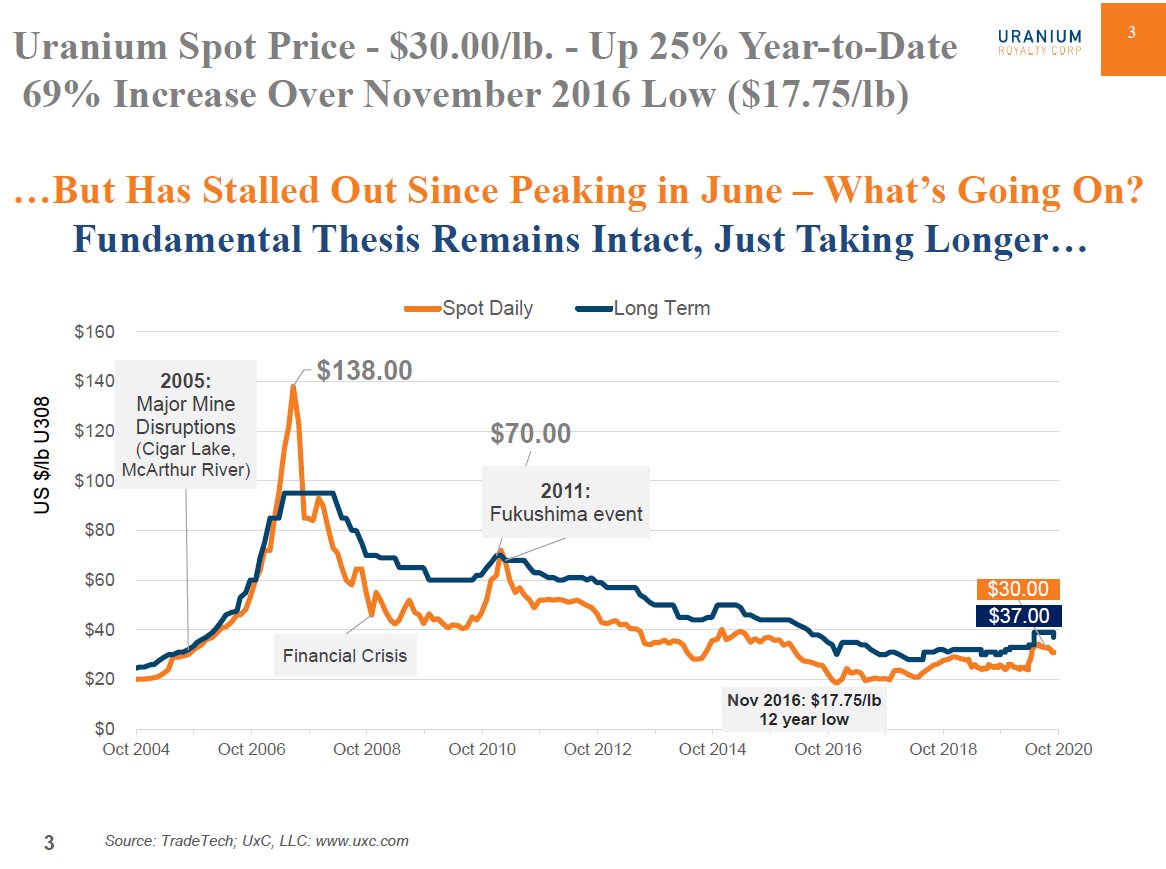

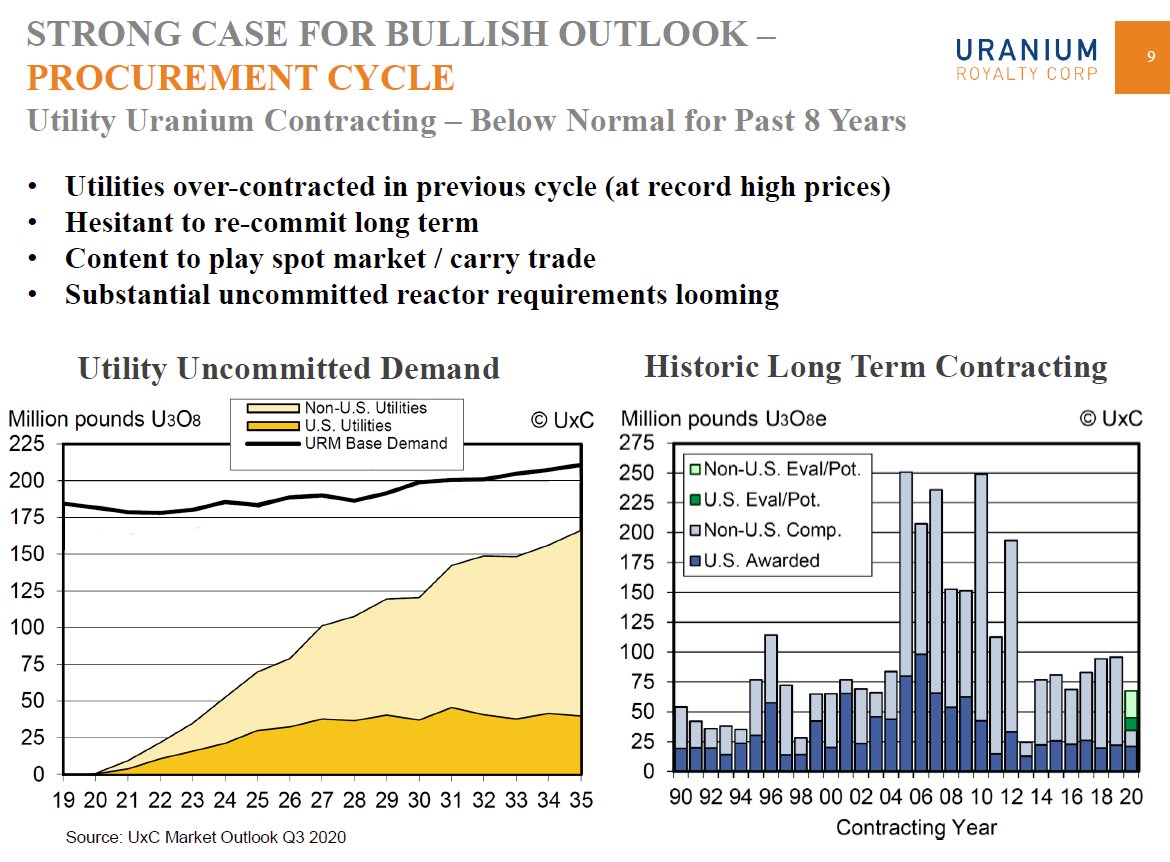

3/ #Uranium Price headwinds are reduced #nuclear demand from potential early reactor retirements, lower costs for (re)emerging mines, stalled utility buying due to market uncertainties, competition from other energy sources. Utility concerns continue to delay procurement .../4

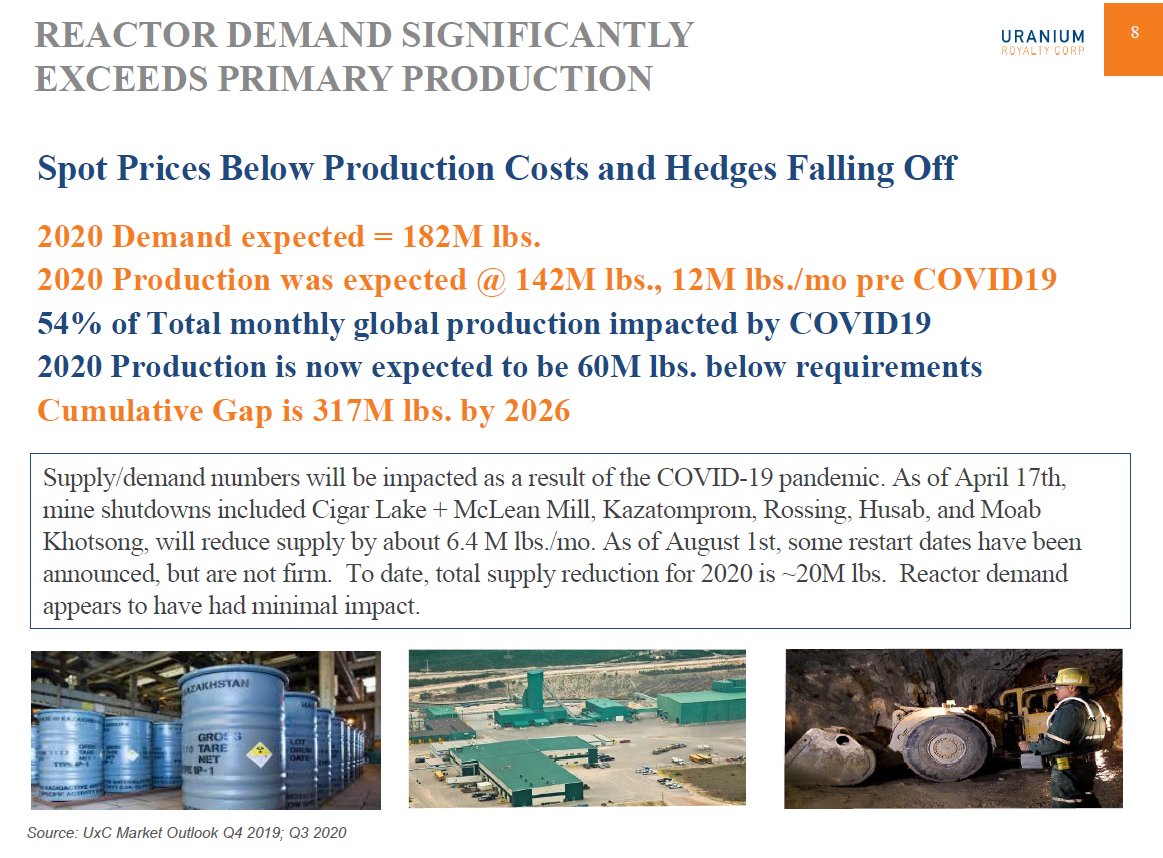

4/ Recent developments: rising concerns over increasingly restricted supply base, #COVID19 took out -19M lbs in 2020 on top of -50M lbs already removed; rising importance of #nuclear as US rejoins Paris Accord; lower cost mine projects emerging, reduced global inventories .../5

5/ #Uranium #stocks have risen on average +125% in past year on strengthening fundamentals, institutions investing in #ESG #CleanEnergy theme via uranium equities on expectations of rising #Nuclear fuel demand in global energy transition, positioning for rising U price .../6

6/ The #Uranium market landscape has changed since the last bull market with different dynamics, catalysts, and rise in ISR production share vs conventional #mining, both of which are needed to meet future demand in an era of increased competition fostering new innovation... /7

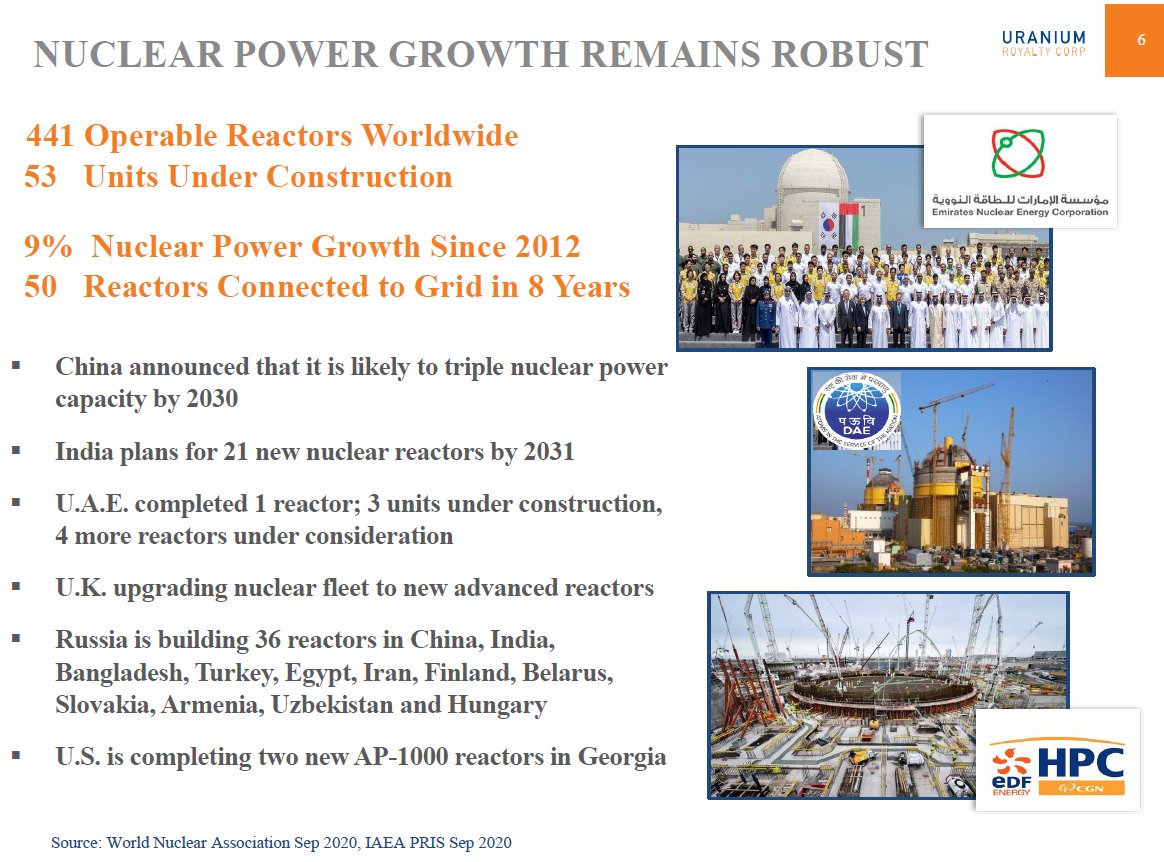

7/ The World Needs New #Uranium Mines! By 2035 -75M lbs/yr supply depleted while #Nuclear demand expected to rise by 20M lbs/yr, creating a 100M lbs/yr #U3O8 primary mined deficit in just 14 years. Large new major mines needed to begin production in last half of this decade... /8

8/ An emerging #nuclear renaissance could drive demand even higher as new scenarios unfold, ie. more Japanese reactor restarts, delayed retirements, SMR roll-outs, accelerated reactor builds in China & other nations to meet #NetZero goals= increasing appetite for even more U.../9

9/ #Nuclear utilities must recognize that higher #Uranium prices are necessary to get new mine projects into development to meet demand. Developers expect an average of US$57/lb & shareholders/investors will not support new mine construction unless price expectations are met../10

10/ To attract #nuclear utility customers, #Uranium mine developers must also be innovative at finding new ways to reduce costs and increase their competitiveness, while demonstrating they can deliver new production to meet demand that is timely, low risk and cost effective.../11

11/ Given risks involved in getting new #uranium mine projects into production & mounting uncertainty concerning the timely arrival and cost of ready-to-produce primary supply, Realized Price must adequately support future production to sustain #nuclear fuel supply .../12

12/ In conclusion, the #uranium market is in perpetual annual deficit which reached -40 Million lbs #U3O8 in 2020. The global #nuclear fleet is growing, new mines must be built and the commodity price must respond to address mine production costs in order to meet future demand.🐂

• • •

Missing some Tweet in this thread? You can try to

force a refresh