Here on #EconTwitter, it has recently been discussed how forecasters could have been so wrong about #inflation. A 🧵 on the drivers of inflation in #Germany (with similarities in other €-countries). 1/

While in the US, several factors seem to be at play and inflation seems to be increasingly broad based, in Germany (and most of the €-area), inflation is still relatively limited to some components. Especially, one key factor is not always fully appreciated:Natural gas prices.2/

The recent increase in natural gas prices (the border prices of which have increased by 270 % over the past year) has not been seen by analysts in advance. The reason is that much of it has to do with recent fear about supply constraints from Russia, 3/

which in turn have a geo-political background (#Ukraine/#Russia) and therefore have been difficult to be predicted by economists. 4/

To make this point: In August and September, natural gas prices were “only” 170 % above last year’s prices. This increased to a plus of 270 % until November. 5/

Just to put those 270 % in perspective: In the 1973 oil crisis, for the US, at its peak the increase in monthly imported oil prices was about 300 % year-on-year. In the 1979/80 oil crisis, prices never increased by more than 110 % year-on-year. 6/

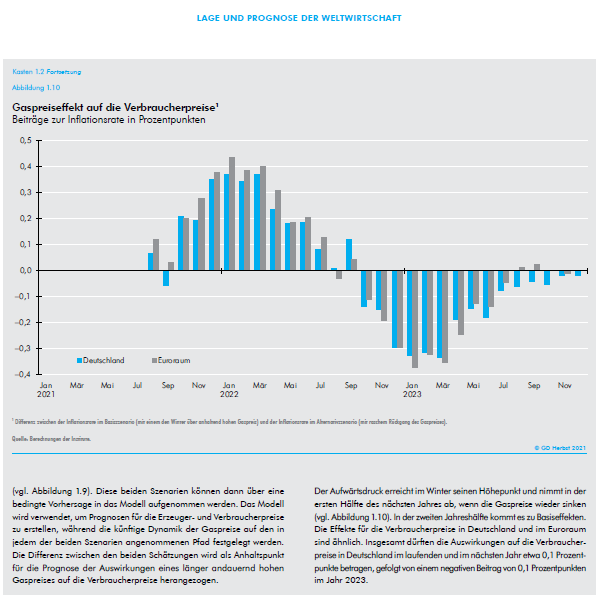

When making their autumn forecast, the leading German economic research institutes calculated with a gas price of 80 €/MWh and simulated a FALL in gas prices as their “alternative scenario”. The new increase just was not seen (actual peak was ~180 €). gemeinschaftsdiagnose.de/wp-content/upl… 7/

Getting natural gas prices wrong has a huge impact on the inflation forecast.

Natural gas is not only a key source of energy for Germany (covering about one fourth of the country’s primary energy needs), it is also the key MARGINAL energy supply. 8/

Natural gas is not only a key source of energy for Germany (covering about one fourth of the country’s primary energy needs), it is also the key MARGINAL energy supply. 8/

As gas is used in power plants to provide the electricity that more sluggish energy sources cannot, its price has a disproportionate influence in other energy markets, too. The rise in wholesale prices in electricity can be linked to the increased natural gas prices. 9/

Moreover, for private households, natural gas is the most important source of heating energy. While natural gas retailers have not yet fully passed on the price rise to customers, the impact on CPI inflation is disproportionate 10/

as natural gas’ weight in the basket is 2.5 % (for comparison, car fuels together are ~ 3,5 %) and, given low tax rates on natural gas relative to car fuels, any price change in net gas prices has a larger impact on CPI than a change in car fuels. 11/

destatis.de/DE/Themen/Wirt…

destatis.de/DE/Themen/Wirt…

What is more, natural gas enters a number of industrial processes in which it cannot be quickly or easily substituted. A sustained and strong increase in prices as we have seen is thus a significant cost push for firms, 12/

and as we see in goods price inflation, this is passed on to customers. Hence, the impact of energy on CPI inflation is not only direct (about half of the latest increase in German CPI is a direct increase in energy prices), 13/

but also indirect and turns up in other prices. Still, these indirect effects are not yet a proper inflationary process in which wage and prices increases lead to permanently higher inflation. Especially, there is no sign of wage pick-up yet. 14/

What does this all mean for the @ecb? The situation in the €-area is different from that in the US. The @ecb needs to be vigilant, but so far, not hiking rates soon seems a plausible reaction. At the moment, we are seeing a one-off price shock, 15/

combined with some temporary supply disturbances in certain sectors (car production).

While it will take some more time for gas prices to work through into consumer prices, and thus measured inflation might remain above 2 % for some months 16/

While it will take some more time for gas prices to work through into consumer prices, and thus measured inflation might remain above 2 % for some months 16/

(and longer if a war in #Ukraine would lead to gas supply disruptions), the proper reaction to this is yet to hold tight, not to react in panic. 17/

CC @jasonfurman @peterehrlich @peterbofinger @isabel_schnabel @BachmannRudi @schieritz @achimtruger @VMRConstancio @wolfgangproissl @sveajunge @Chulverscheidt @Clausmichelsen @Mfratzscher @GrimmVeronika @monikaschnitzer /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh