1) What is #Dow Theory?

• Dow Theory is a trading approach developed by Charles Dow who is also known as the father of Technical Analysis. It is still the basis of technical analysis of financial markets.

• Dow Theory is a trading approach developed by Charles Dow who is also known as the father of Technical Analysis. It is still the basis of technical analysis of financial markets.

• The basic idea of Dow Theory is that market price action reflects all available information and the market price movement is comprised of three main trends.

• Most of technical analysis theory today has an origin from ideas proposed by Dow & Edward Jones back in 19th century

• Most of technical analysis theory today has an origin from ideas proposed by Dow & Edward Jones back in 19th century

Those ideas were published in the Wall Street Journal and are still assimilated by most of the technicians.

• Dow Theory still dominates the far more sophisticated and equipped modern study of technical analysis.

• Dow Theory still dominates the far more sophisticated and equipped modern study of technical analysis.

2) The 6 tenets of Dow Theory

1. Market moves in summation of three trends: Primary, Intermediate & Minor Trend.

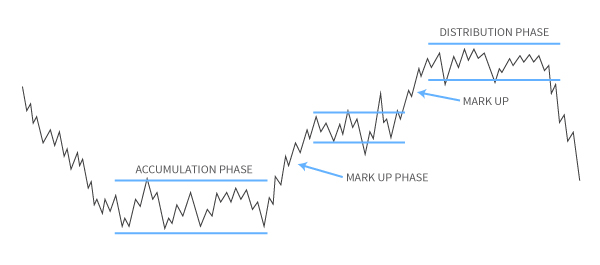

2. Market trends have three phases: For uptrend, the phases are Revival of confidence (accumulation), Response (public participation),Over-confidence (Speculation)

1. Market moves in summation of three trends: Primary, Intermediate & Minor Trend.

2. Market trends have three phases: For uptrend, the phases are Revival of confidence (accumulation), Response (public participation),Over-confidence (Speculation)

The three defined stages of the Primary Bear Trend are Abandonment of hope (Distribution), Selling on decreased earnings (doubting), Panic ( distressed selling ).

3. All news is discounted in the stock market.

3. All news is discounted in the stock market.

4. Averages must confirm: Initially, when the US was a growing industrial power, Dow had formulated the two averages. One would reflect the state of manufacturing and the other, the movement of those products in the economy.

5. Volumes confirm trends: Dow was of the belief that trends in prices could be confirmed by volumes. When the movements in price were accompanied by high volumes, they would depict the ‘true’ movement of the prices.

6. Trends continue, unless definitive reversals come about : Irrespective of the day to day erratic movement and market noise that maybe witnessed in prices,

Dow believed that prices moved in trends. Reversals in trends are hard to predict unless it’s too late due to the nature and difference in magnitude of trends.

Join here for updates regarding investing and trading

#Nifty #banknifty #stocks #BREAKOUTSTOCKS

t.me/vikrafintech

#Nifty #banknifty #stocks #BREAKOUTSTOCKS

t.me/vikrafintech

Join here for updates regarding investing and trading

#Nifty #banknifty #stocks #OptionsTrading

t.me/vikrafintech

#Nifty #banknifty #stocks #OptionsTrading

t.me/vikrafintech

• • •

Missing some Tweet in this thread? You can try to

force a refresh